2020 Becomes the Year of Realization of Digital Bank Indonesia

Some banks are preparing strategies with separate entities and new branding

We have witnessed various digital banking innovations in the last almost a decade. Mobile and internet banking can be an example of banking digitalization that is most closely related to daily life. Thanks to this innovation, it is easier for customers to make financial transactions.

Indonesian banking has also begun to embrace service connectivity through the development of Open API. The growth of digital business in the country, driven by e-commerce and fintech platforms, can be said to be driven factors for banks to develop these innovations. Now, cross-platform transactions are very possible.

In recent years, fintech has played a significant role in providing efficient and practical access to financial services. Fintech has succeeded in disrupting the traditional banking business model with fast.

Based on Fintech Report 2019, it was recorded that 79,9% of 747 respondents in Indonesia used the service digital wallets, followed by investment (31,5%), paylater (30,9%), online finance (12%), insurtech (11,8%), through crowdfunding (8,2%), P2P lending (6,2%), and remittances (2,4%).

The role of fintech in the financial ecosystem has actually become a momentum for banks to innovate. Out of service mobile banking owned, a number of banks in Indonesia are increasingly aggressive in developing digital financial products, both independently and in collaboration. Customers can now even open savings accounts through the application mobile banking and digital platforms.

In the context of digitalization, the efforts above are certainly relevant to current user needs. However, these efforts are not enough if we want to achieve broader financial inclusion. The population of people who are not touched by financial services (unbanked) is still big. Limited ATMs and branch offices are one of the obstacles for banking.

A Google, Temasek, Bain & Company report in October 2019 noted that as many as 92 million Indonesians fell into the segment unbanked (50,83%), followed by segment banked as many as 42 million people (23,20%), and the segment underbanked 47 million (25,97%).

The banking industry in Indonesia is aware of this phenomenon that financial products are now not only monopolized by banks. This situation also indicates that banks have not been able to close gap between financially literate people and those who are not, with traditional business models.

Digital banks in Indonesia

After the digitalization of banking, it is now a trend digital bank in Indonesia is slowly starting to grow. This effort shows how bank transformation no longer relies on digitizing services, but also becomes a separate institution.

Definitively, digital banks are different from banking digitization. Borrowing a popular term, the concept of digital banking is generally referred to as neobanks which has been popular since 2017. While quoting the article "Neo Bank and the Future of Retail Banking in Indonesia", term digital banking is often defined as challenger bank.

Challenger banks in the world it has even received millions of customers. Some of them are Nubank (Brazil), Monzo (UK), N26 (Germany), and Chime (United States).

Returning to the initial definition, digital bank or neobanks is defined as a bank that operates online without a physical branch office. Bank in digital offers easy access with user-friendly UI/UX. With an internet connection and a smartphone, anyone can open an account and access other financial services.

digital bank also have the opportunity toleverage journey customers through developing supporting financial services and making their products into customers' everyday products.

Of course the concept above is inversely proportional to traditional banks where financial services - even though there is internet and... mobile banking—still requires face to face and physical branch offices. This is understandable considering that banks are a business of trust so physical contact is still required.

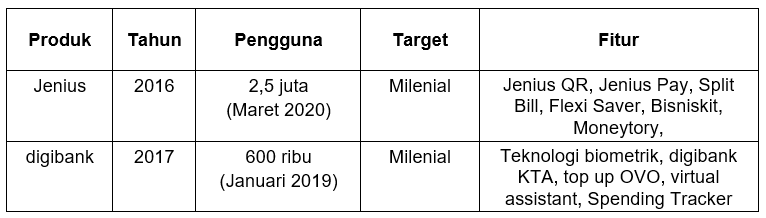

In Indonesia, digital banks are mostly linked to services Jenius (2016) and digibank (2017). Both are often referred to as pioneers of the first digital bank. However, there are also those who call it a product spin-off considering that both of them are still under the auspices of BTPN and DBS Bank as the main entities.

Jenius and digibank are application-based services that offer basic banking products, namely savings and online account opening. Both also offer other supporting services, such as financial management.

If the root is the expansion of financial inclusion, it can be said that Jenius and digibank cannot yet be labeled as such. This is because both of them are targeting segments of society that are already digitally literate (digital savvy). Meanwhile, segment unbanked tend not to understand financial literacy.

Realization of the next digital bank

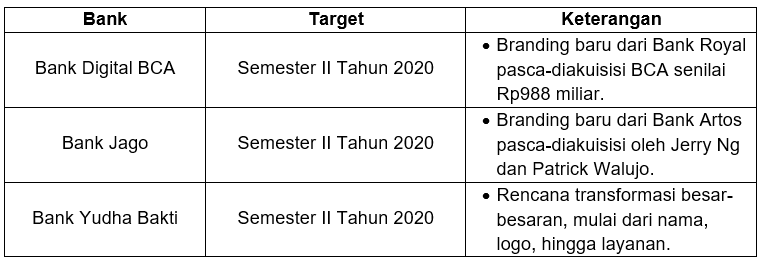

As the ecosystem and technology mature, 2020 looks like it will be the year when the launch of digital banks in Indonesia is realized. Some of the plans we have summarized include BCA Digital Bank, Jago Bank, and Yudha Bakti Bank (BYB). Efforts to become a digital bank as a new entity were all passed through an acquisition process.

Quoting Cash, BCA annexed Bank Royal for IDR 988 billion in 2019. Bank Royal will change its name to BCA Digital Bank with a realization target in the second semester of 2020. The target market is the retail and MSME segments, different from its parent's main portfolio which plays in corporate. BCA Digital Bank has obtained permission from the OJK and is infrastructure ready.

It is known that the company is also said to be preparing P2P lending for BCA Digital Bank. However, BCA President Director Jahja Setiaatmadja revealed that he was reluctant to launch this service in the near future. "We don't dare to enter P2P yet because the risks are very big, we are preparing first," he said as quoted from Dataword.

Furthermore, Bank Artos officially changed its name to Bank Jago after being acquired by senior bankers Jerry Ng and Patrick Walujo. According to Bank Jago President Director Kharim Siregar, his party is finalizing the business model and perfecting the application which is targeted to launch before the fourth quarter of 2020. Quoting Bisnis.com, Bank Jago will target the middle and middle segments mass market as the main target. Apart from that, Bank Jago will also collaborate with digital platforms in various business verticals, such as e-commerce, ride hailing, and P2P lending.

DailySocial have contacted BCA and Bank Jago representatives regarding the realization of this digital bank, but they are still reluctant to reveal information. "Our board of directors cannot convey information to the media because they are currently focused on preparing the application and everything," said Bank Jago Senior Manager Nurul Kolbi in a short message to DailySocial.

In contrast to the two, Bank Yudha Bakti (BYB) began to be controlled by PT Akulaku Silvrr Indonesia which oversees fintech services Akulaku in 2019. Entry Akulaku It is hoped that it can accelerate BYB's digital transformation process, namely becoming a digital bank without branch offices and developing mobile applications to increase market penetration.

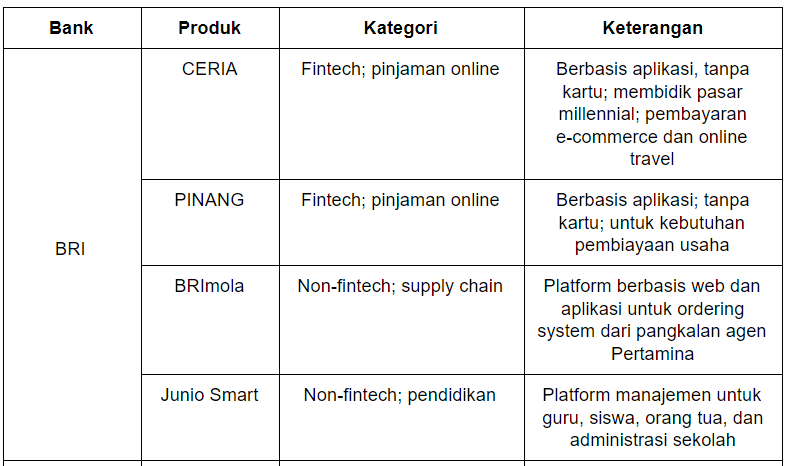

DailySocial contact BRI's Director of Digital, Information Technology and Operations Indra Utoyo regarding this matter. According to Indra, BRI does not carry out a similar strategy to the banks above. However, BRI is considered to have carried out a major transformation to become a digital bank.

To become a digital bank, Indra believes that BRI must maximize the advantages of its physical network. "The winner is the one who can combine physical and digital advantages. Whatever the entity, both BRI and its subsidiaries, it must be digital company. "There is no need for a dichotomy between digital banks and non-digital banks," he said.

Without this dichotomy, he said, BRI has provided something value from the concept of a digital bank with digital-based banking services. BRI is the first bank to launch digital products lending PINANG and Cheerful. Then, the first bank to provide account opening services with a completely digital-based KYC process.

Indra emphasized that digital cannot replace trust, service and brand. However, without digital, we cannot get all three. This means that banks with the 'digital' label are not necessarily more trustworthy than large banks that have undergone digital transformation.

"Until now I haven't seen any digital banks or neobanks who is successful in the world. For me, the winner is the one who combines physical superiority or human touch and digital. The term phygital," he said.

Contacted separately, BTPN Head of Digital Banking Irwan Sutjipto Tisnabudi admitted that the emergence of a new digital bank would help create a digital financial ecosystem and encourage education on better financial literacy. In fact, this trend will give rise to collaboration opportunities.

Regarding the possibility of Jenius becoming a separate entity, Irwan emphasized that Jenius currently continues to support BTPN's business to expand the market segments it previously had. He also emphasized the main strategy through co-creation and collaboration with like-minded partner to develop products that are relevant to customers.

"In carrying out digital transformation, BTPN believes that digital is the core of its business and value proposition, not additional channels. Our priority is building a supportive ecosystem life finance with wider coverage so that the benefits can be felt by digitally literate people," he explained.

Jenius is the result of BTPN's transformation which was developed through a process of co-creation and collaboration with thousands digitally savvy for 18 months. As of March 2020, Jenius had more than 2,5 million users. The company also recently introduced the Bisniskit feature for new business owners and Moneytory to help with financial management.

Regulations and challenges

Currently the operation of digital banks is still under the legal umbrella of conventional banks. This is regulated in OJK Regulation Number 12 concerning the Implementation of Digital Banking Services by Commercial Banks. There is no separate legal umbrella to regulate opening virtual accounts.

The regulations clearly state that digital banks are different from digital banking services (m-banking, SMS banking, e-banking, etc). The difference is clear that all digital banking services can be accessed via smartphone.

Meanwhile, apart from that, digital banks cover all banking services from account administration, transaction authorization, financial management, and/or opening/closing accounts, digital transactions, and other financial product services based on OJK approval.

According to Institute for Development of Economics (Indef) observer Bhima Yudistira, there is no need to design new regulations to accommodate the legal umbrella for digital banks. Moreover, the existing regulations were only published in 2018. However, Bhima underlined that the government needs to pay attention to security aspects and the use of data for third parties so that it can be regulated more strictly.

On the other hand, he also sees that the digital banking trend is driving a new competitive landscape in the banking sector. According to him, banks that invest in digitalization will gain a larger market share than banks that continue to operate conventionally.

"The need for digital banking getting bigger along with the growth in the number of active internet users in 2020 which reached 175,4 million people. "This means that banks are expected to provide faster services at affordable costs, and access anywhere and anytime," he said.

If digital banking is realized, the impact will be very big, especially for millennials. However, it is not without obstacles that banks are also deemed to need to provide education for other market segments, such as MSMEs and rural areas. "Here the importance of developing digital banks must be accompanied by increasing internet network access to remote and outermost areas," said Bhima.

Sign up for our

newsletter

Premium

Premium