Modalku Announces Obtaining Debt Funding of 414 Billion Rupiah

Modalku has distributed IDR 52 trillion in funding through 5,1 million transactions to 100 thousand MSMEs in a number of Southeast Asian countries

Startups My capital announces earnings debt funding worth $27 million or around IDR 414 billion led by AlteriQ Global, Aument Capital Partners, and Orange Bloom. This facility will be channeled through various funding solutions specifically designed to support MSMEs that do not yet have access to funding in Indonesia, Singapore, Malaysia, Thailand and Vietnam.

"In the midst of uncertain macroeconomic conditions, we will continue to increase funding activities for more unserved MSMEs in the five markets Modalku operates in, both together with businesses old or new," said Modalku Country Head Arthur Adisusanto.

Previously, in February 2022 at the same time as series C round announcement, Modalku group also announced facilities debt worth $150 million from a number of financial institutions in Europe, the United States and Asia. One year earlier they also received a similar facility with a value of $120 million from Helicap Investments, Social Impact Debt Fund, and an institution from Japan.

Triodos Microfinance Fund and Triodos Fair Share Fund have also provided debt funding in 2019.

Gap MSME funding is still $300 billion

The presence of institutional funders or often referred to "super lender" This gives the perpetrator more freedom to innovate to present loan products that are more relevant to its market share. Since its inception, Modalku's focus has been on MSMEs in Southeast Asia with the largest market share currently in Indonesia.

In general, in Southeast Asia, there are more than 70 million MSMEs recorded, which cover 99% of total businesses and contribute to 44,8% of GDP. However, according to the United Nation Capital Development Fund, more than 39 million MSMEs still struggle to gain access to formal credit, with a funding gap of $300 billion; This gap is what players are trying to work on fintech like my capital.

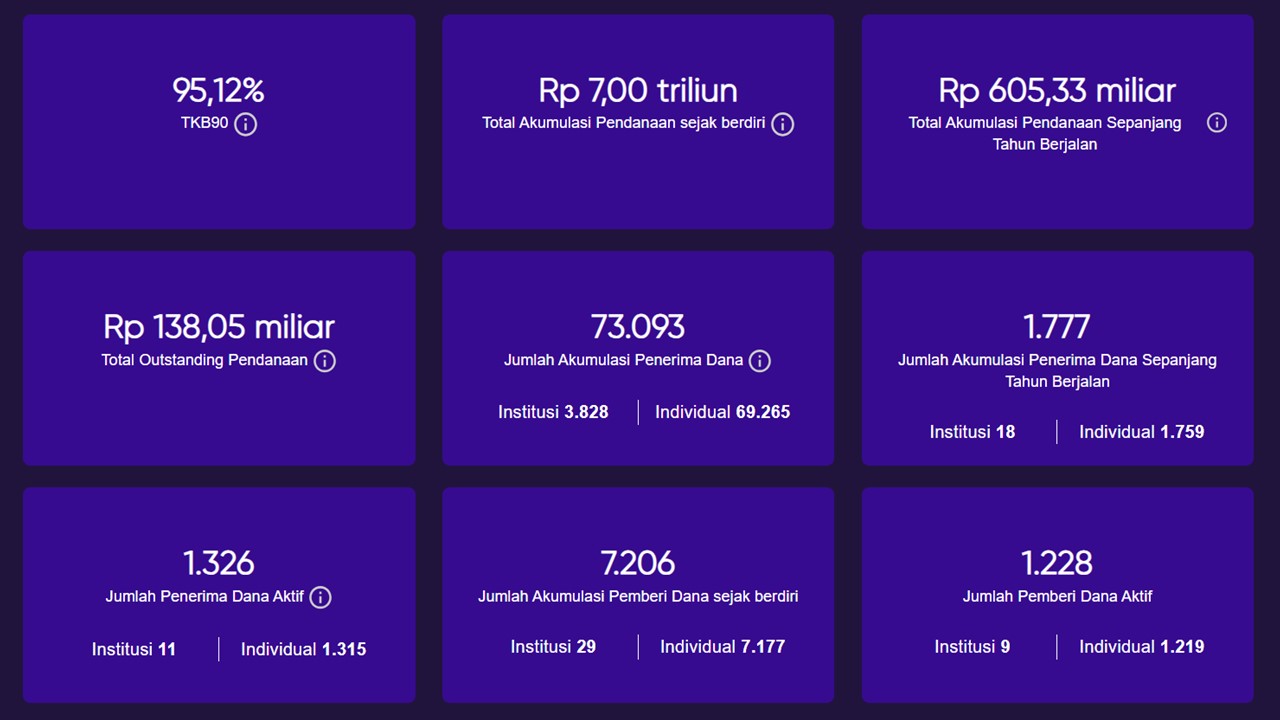

From the statistics presented, to date the Modalku group has distributed funding of more than IDR 52 trillion through more than 5,1 million transactions, and served around 100 thousand MSMEs in Indonesia, Singapore, Malaysia, Thailand and Vietnam.

Modalku business focus

Currently there are dozens which serves MSMEs with different focuses. Modalku has also taken different steps to strengthen their value proposition. In Q2 this year, they just launched the product "Project Capital" for procurement in the government sector. The concept is similar invoice financing, with adjustments accordingly workflow spending in the government sector.

Then, at the end of last year, Modalku also started to go into business finance through its acquisition of PT Buana Sejahtera Multidana, thenrebranding Becomes "Modalku Finance". Modalku Finance offers various financing functions, including Working Capital Financing, Investment Financing and Multipurpose Financing.

Previously, Modalku also carried out co-investment together with Carro to Bank Index, giving the company a signal to enter the digital banking segment. The other products that are also in focus are B2Bpaylater, collaborating with a number of parties such as Bukalapak, Paper.id, and BukuWarung.

More Coverage:

The Modalku Group also had time to improve efficiency with Layoffs of around 38 employees in Indonesia. This business streamlining is in line with the company's focus on continuing growth and achieving profitability.

Funding has an impact

One of Modalku's investors is Orange Bloom. Their goal in joining Modalku is because they are expanding their reach and transitioning to become a pioneer in sustainable issues. The sustainable funding provided aims to provide support in the form of access to funding for MSMEs, including individuals, to overcome climate change and transition to more sustainable practices towards a low-carbon economy.

This is considered to be in line with how Modalku has started implementing an environmental and social management system since the beginning of the year in 5 operating countries. This system is an ESG (environmental, social, governance) risk assessment framework designed with technical assistance from the Dutch Good Growth Fund as part of the credit assessment in the MSME funding application process.

Sign up for our

newsletter