East Ventures Reportedly Leads Moladin's Series A Funding

Since 2018, Moladin has managed to make transactions of more than Rp. 290 billion and embraced 8 thousand agents

Startups marketplace automotive Moladin reportedly pocketed series A funding led by investors in the previous stage, namely East Ventures. According to the information obtained DailySocial, the nominal fund in this round when combined with the previous round reached $4,5 million (approximately 65 billion Rupiah). The company's last announced round occurred on January 2020.

DailySocial tried to confirm to the relevant parties, but until this news was revealed no information had been provided.

In this latest round, investors from the previous round of CyberAgent Capital also participated, as well as a number of angel investors from Singapore also enliven the ranks shareholders.

Moladin was captained by Jovin Hoon and Mario Tanamas since November 2017. Initially the platform focused on purchasing new motorbikes, now it is expanding its services to used motorbikes and new cars which were launched this year. The company collaborates with Dealer and institutions lease to facilitate the purchasing process. Location Dealer It is said to be spread across Jabodetabek, Bandung, Solo, Yogyakarta and Semarang.

The company also provides cash services for consumers, partnering with companies lease, for loans starting from IDR 3 million with a motorbike BPKB guarantee for the year of release starting 2012, up to IDR 20 million with a BPKB guarantee for a car for the year of release starting 2004.

"Since 2018, Moladin has succeeded in making transactions of more than IDR 290 billion. "We also have 8 thousand Moladin agents spread across various big cities to help increase sales," Jovin was quoted as saying Kompas.com.

Automotive industry

2020 was a period full of challenges for many sectors, including the automotive industry. This is reflected in data released by the Indonesian Automotive Industry Association (Gaikindo), car sell Wholesale (sales from factory to Dealer) fell 48,35% YOY, while retail car sales fell 44,55%.

Then conditions began to improve this year, marked by total national car sales increasing 33,5% to 393.469 units in the first semester of 2021. The same fate also occurred in motorbike sales. Quoting from Indonesian Motorcycle Industry Association (AISI), more than 2,45 million motorbike units were delivered to the market.

Compared to the same period in the previous year, motorbike sales were only 1,88 million units. Contributors to motorbike sales came from automatic scooters (86,61%), mopeds (6,95%), and motorbikes. sports (6,24%).

In the startup realm, this automotive marketplace vertical is inhabited by many players. They are OLX Autos, Carro, Carsome, Garasi.id, Otoasia, Mobil123, Carmudi, Rajamobil, Oto.com, and many more.

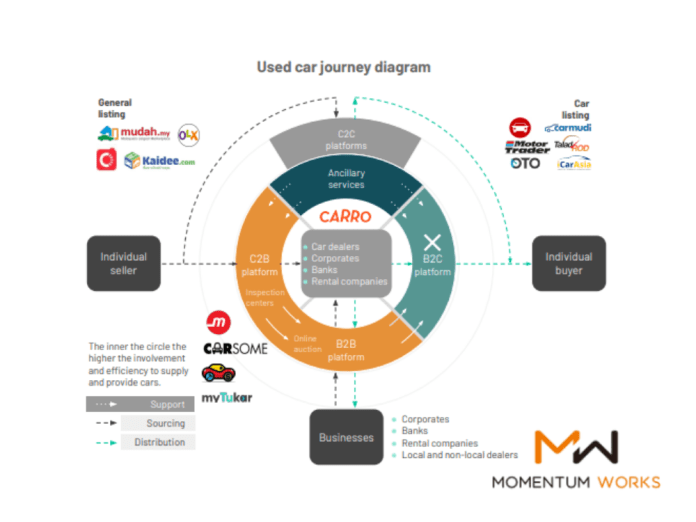

In the buying (C2B) and selling (B2C) used car segments, Carro competes directly with Carsome — both are regional players who also have business bases in Indonesia and a number of countries.

The business model is almost similar, for C2B they buy consumer cars instantly by carrying out a thorough inspection. The company provides checkpoints at strategic locations — purchase requests can be made via the website. The cars purchased are then sold to the owners Dealer car to return to market.

As for the B2C model, the cars that were successfully purchased and inspected were re-sold through their digital platform. The unique value that is trying to be presented is the result of inspection, considering that the goods being sold are used. They also work with financial institutions to peddle credit schemes.

Sign up for our

newsletter

Premium

Premium