Ride-Hailing Platform inDrive Receives Additional Funding of IDR 2,3 Trillion

In Indonesia, inDrive is under PT Ind Mobitech Service, present in Jabodetabek in 2021

Platform ride hailing inDrive again received additional funding of $150 million (around Rp. 2,3 trillion). With funding received last year, inDrive now has a total of $300 million from General Catalyst.

Launch Tech Funding News, this additional funding follows the realization of inDrive's net revenue growth of 54% in 2023. This achievement is said to show the success of this California-based company in being on the right growth path and financial strategy in driving sustainable operations.

This new funding will be used to pursue business growth this year through product development, service expansion and expansion into new markets.

"With this funding, we can continue significant growth and innovation while maintaining a financial position prepared to support our ambitious plans without adding risk to the company's operations," said inDrive CFO Dmitry Sedov.

inDrive, previously named inDriver, was founded by Arsen Tomsky in 2013. As of March 2022, inDrive has regional operational hubs in America, Asia, Middle East, Africa to support its business expansion. inDrive now operates in 749 cities in 46 countries.

inDrive in Indonesia

In Indonesia, inDrive is under PT Ind Mobitech Service, present in Jabodetabek in 2021 by offering intra-city, inter-city travel, delivery of goods by courier, and cargo.

The service is designed so that users can determine their own rates--a concept that differs in different markets ride hailing online generally set a fixed rate. Users have no control over the travel fares charged. This concept is also used by Maxim, its competitor operating in Indonesia.

Both inDrive and Maxim are challengers Grab and Gojek who currently still dominates the market ride hailing Indonesia. Quoteinitiation report issued by Maybank Sekuritas Indonesia in 2023, Gojek controls 52% share ride hailing homeland, meanwhile Grab controls 48% of the market.

More Coverage:

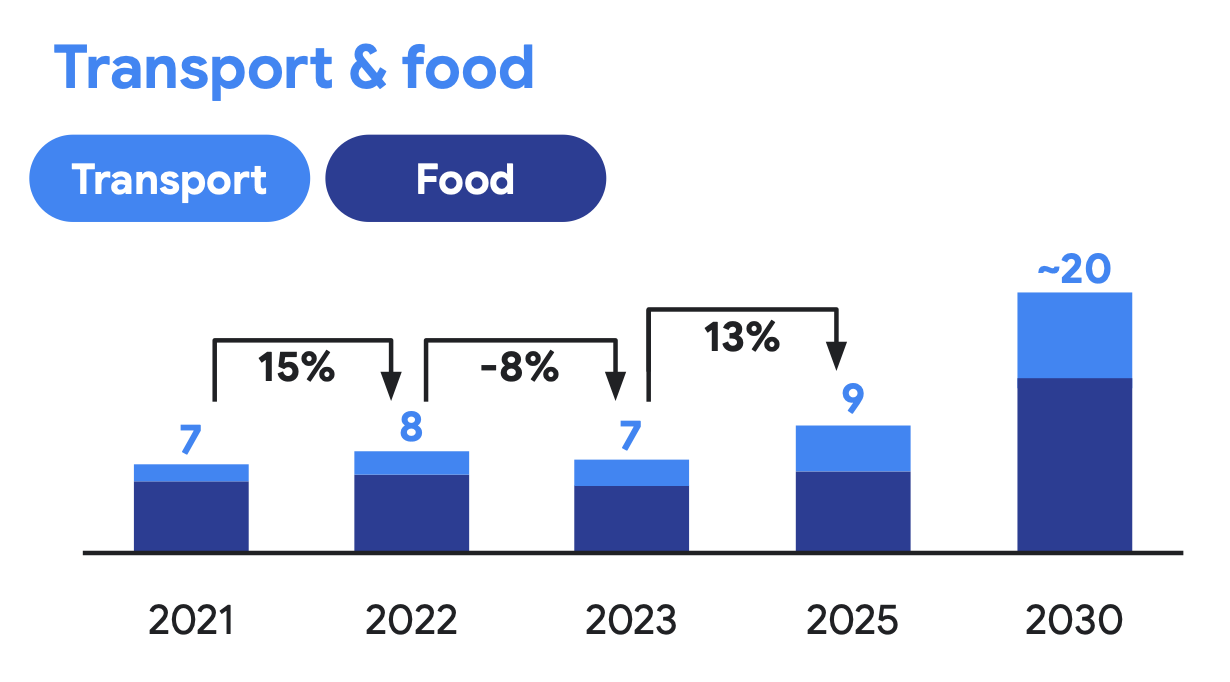

Meanwhile, the total GMV of online-based food transportation and delivery services in Indonesia is estimated to reach $9 billion with a CAGR of 13% (2023-2025).

One of inDrive's value propositions is that it allows driver partners and consumers to negotiate prices. Apart from that, they also provide modes of transportation for traveling outside the city. However, since 2023 Gojek also adopted the same feature capabilities in several cities. Users are presented with the GoRide Nego feature, which allows bargaining between drivers and consumers.

Sign up for our

newsletter