After Receiving Funding, "inDrive" Will Expand On-Demand Services in Indonesia

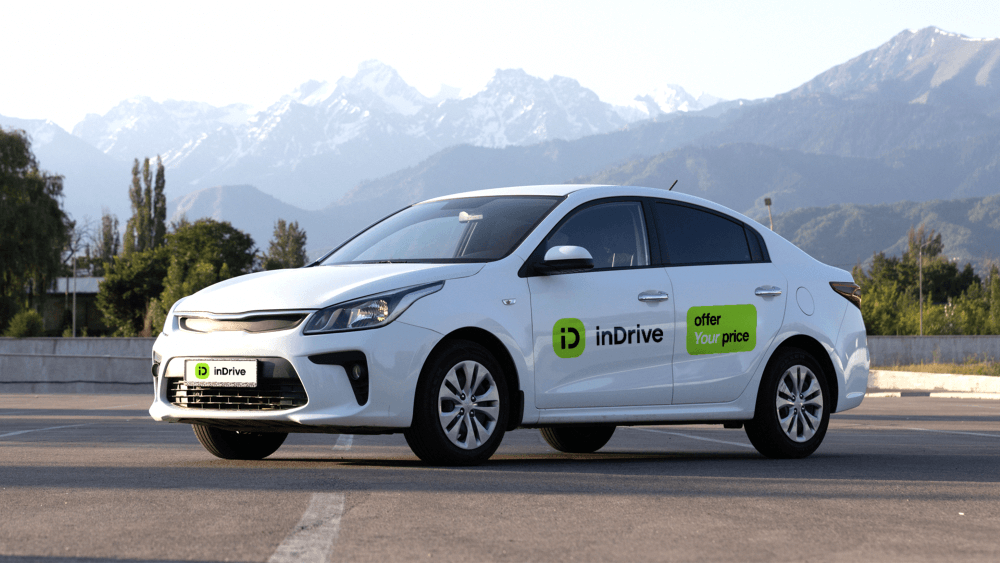

inDrive is an online transportation platform from Russia which has been operating in Indonesia since 2019

Indonesia is one such market ride hailing the largest in the world supported by the rapid growth of internet users and the middle class segment. Currently, market ride hailing Indonesia is dominated by two main players, viz Gojek and Grab.

This time, platforms ride hailing from Russia based in Mountain View, California, USA, inDrive, is trying its luck in the Indonesian market. The company recently changed its name to Inner Drive from previously Independent Drivers. To DailySocial.id, Business Development Manager inDrive Indonesia Georgy Malkov revealed inDrive's plan to expand new services and verticals in Indonesia following a fundraising of IDR 2,28 trillion from General Catalyst.

Negotiation process and cash payment

Operating since 2019, inDrive has served major cities in Indonesia, such as Jakarta, Bandung, Medan and Makassar. inDrive is also present in 47 countries and more than 700 cities with a total of 2 billion trips. Like service ride hailing generally, inDrive utilizes vehicles owned by driver partners for rent as a mode of transportation.

"What differentiates inDrive from other players is P2P ride-hailing service. So, we empower the community to get the best service. The commission we charge the driver is only 10%," said Georgy.

Meanwhile, inDrive provides negotiating options and prices that are affordable and transparent to passengers and drivers. The negotiation process can be carried out to obtain an appropriate price by emphasizing the freedom that can be exercised by passengers and drivers. Passengers can order via the inDrive application from one location to another.

Price recommendations will appear in the application later. Both parties can refuse if the price offered is not appropriate, and can immediately accept if it is in accordance with the agreement between the two parties. This model is the flagship of inDrive, and is claimed to be of sufficient interest to most users in Indonesia.

Currently, inDrive has not yet entered the corporate segment as a target user and is still focused on individual users. Payment methods are also in the cash option, while digital payments are through e-wallet nor credit card is not yet available. However, it claims to have received feedback positive from users ride hailing inDrive.

Pocket new funding

Earlier this year, inDrive raised $150 million (Rp 2,28 trillion) in instruments hybrid innovation from General Catalyst. The fresh funds will be used to fund marketing, including user acquisition and retention costs. General Catalyst previously participated in a $150 million Series C investment round led by Insight Partners in 2021.

In the midst of challenging global macro conditions, inDrive claims to record rapid growth throughout 2022. inDrive's gross revenue increased by 88% (YoY). Its operational area will increase from 37 countries in 2021 to 47 countries. The number of its team is also recorded at 2.700 employees spread across 17 offices around the world with 1.000 new employees.

In the same year, the company launched several new business lines, expanding its offerings from previously limited to passenger and cargo transportation, delivery, and handyman services, now inDrive offers job search advertising and group buying services.

Currently, inDrive already has a team stationed in Indonesia. Especially for the Indonesian market, inDrive has several plans to encourage business growth to double. The company will also add quality and service security to users. Not only available in big cities, inDrive also wants to expand its services in rural areas.

Service tough competition on-demand

apart Gojek and Grab, in Indonesia at this time the service ride hailing also filled by a new player, namely Maxim. However, get into business on-demand in Indonesia is not easy. To survive, service providers need to diversify services, focus on customer experience, build strong partnerships, innovate and adapt.

At the same time, companies also need to be aware of the challenges facing the market, including regulatory hurdles, intense competition, driver retention and economic uncertainty.

While AirAsia Group is currently actively presenting new services in an effort to grow its non-airline revenue. One of them is service ride hailing which has officially launched in Malaysia in 2020. Indonesia is the third country to launch the service ride-hailing in Bali, after Thailand and the Philippines for the regional expansion of the airasia Super App.

Sign up for our

newsletter