Monit.id Presents Virtual Credit Card Service for Business

Has secured seed funding from Init 6 and 1982 Ventures

It is still difficult for new companies with micro-medium scale to get approval for corporate credit cards from banks, which is one of the reasons for the platform fintechmonit.id present. Specifically they are payment software for businesses. Monit.id is officially active in early 2022.

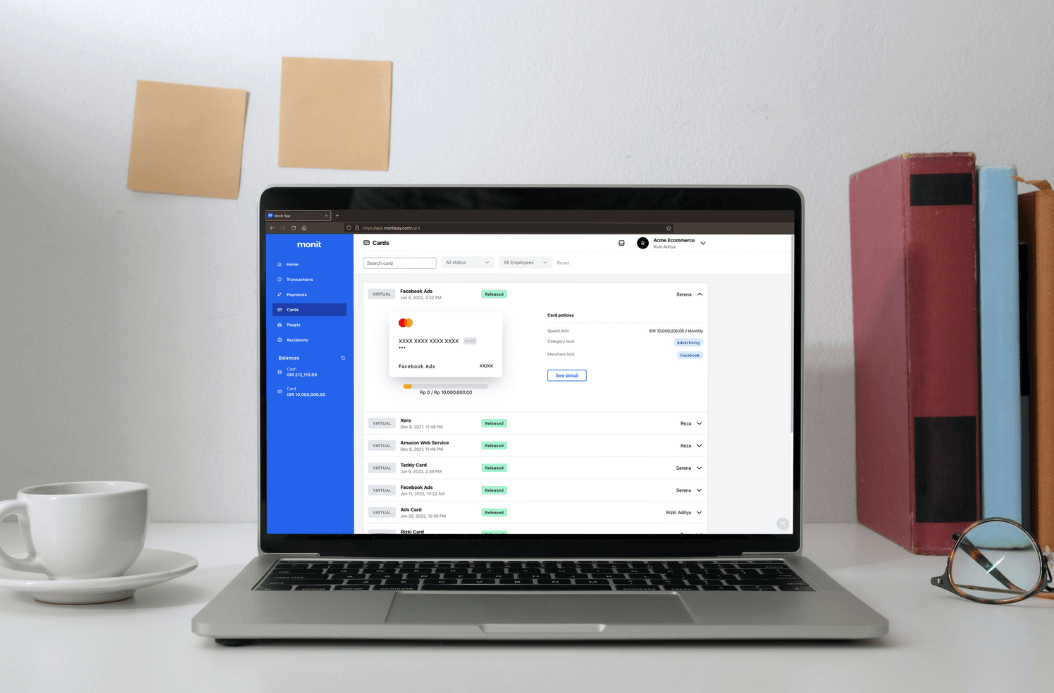

Through Monit.id, businesses can manage their finances like bill payments, Reimbursement, or disbursement via bank transfer. They also handle the need for virtual credit cards to handle different types of payments.

"We want to offer a new way for companies to manage payments for digital services using virtual credit cards. Is it for purposes of tools such as SaaS, servers, to advertising campaigns on social media, all can be easily managed through Monit.id," said Monit.id Co-founder Rizki Aditya.

Business model and monetization strategy

The problem of using a company's credit card, which mostly still relies on the ownership of the founder or company leader, is the only solution applied by the company at this time when it comes to making payments for digital services. Through Monit.id, they can now control the card, can determine credit card limits, can lock merchants they want to use and will refuse payments that are not registered.

Monit.id also has visibility that is claimed not to be provided by conventional banks in general. Because billing statements usually it will be given at the end of the month by the bank, while at Monit.id if there is a transaction they can see the transaction directly using the dashboard and notifications.

Currently Monit.id acts as a system integrator. At Bank Indonesia there is a license as a platform that connects to financial institutions.

"For the current monetization strategy still transactional base, so if the card is used by the client, we will get interchange fees from partner banks. But maybe in the future the more financial instruments provided, the monetization will increase. For example, you can go through commission fee, interest fee and others," said Rizki.

Currently Monit.id has established strategic partnerships with banks CIMB Niaga and UOB bank. Although currently focusing on B2B but seeing the opportunities that exist, Monit.id does not rule out providing services to the B2C segment.

"Currently Monit.id is targeting services E-commerce and technology companies. Most of them require a credit card to make server subscription payments, cloud, to tools SaaS for the team engineer them to marketing campaigns through social media," said Rizki.

Initial funding

Beginning in 2022 Monit.id has successfully pocketed initial funding from Init 6, 1982 Ventures, and one venture capital who declined to be identified. It is not stated how much the investment was received, but the company wants to use the fresh funds to acquire more clients and add to the team. Monit.id also has plans to conduct a further stage of fundraising this year.

"We see that there is still room for platforms like Monit.id to grow if we look at the current credit and debit card transactions of around $500 billion. From there, we can reach 10% which can be profitable. It could be this potential that makes investors interested in investing. to Monit.id," said Rizki.

According to Init 6 Managing Partner Achmad Zaky, looking back at his experience in building Bukalapak, he was quite frustrated in managing spending, especially digital spending. Most payments for digital expenses require a credit card and it is very difficult for companies to apply for a corporate credit card to a bank.

More Coverage:

"From this experience, we believe that many companies, especially SMEs face the same problem and therefore Monit.id can help them to be more productive and efficient by providing an all in one expense management system including corporate credit cards for payments," said Zaky. .

Added by him like all investments that have been given, startup founders play a big role in the decisions taken. In this case Init 6 likes the way the founders of Monit.id execute and build the product. Init 6 was also amazed at how they disrupted the status quo by simplifying the company's credit card application process which is notoriously an inconvenience for companies.

"They have secured strategic partnerships with two global credit card providers and two regional banks. This partnership is very important for Monit.id to strengthen their position in the market and provide the best solutions for clients. We believe that Monit can be a game changer in the financial technology sector B2B," said Zaky.

Sign up for our

newsletter