Marketplace Business Boosts Bukalapak's Revenue Performance in Q3 2023

Bukalapak aggressively encourages sales of products that have high take rates and margins

PT Bukalapak.com Tbk (IDX: BUKA) reported that its total revenue rose 29% (YoY) to IDR 3,3 trillion in the nine months of 2023, driven by growth in the Marketplace business. Despite this, BUKA experienced a net loss of IDR 776 billion, falling short of the profit achieved in the same period last year of IDR 3,6 trillion.

Broken down by business line, Marketplace revenue throughout the nine months of 2023 is still the largest contributor with a portion of IDR 1,7 trillion or up 67% (YoY), followed by O2O revenue of IDR 1,5 trillion or up 10% (YoY), and Procurement revenue which fell 89% to IDR 11 billion.

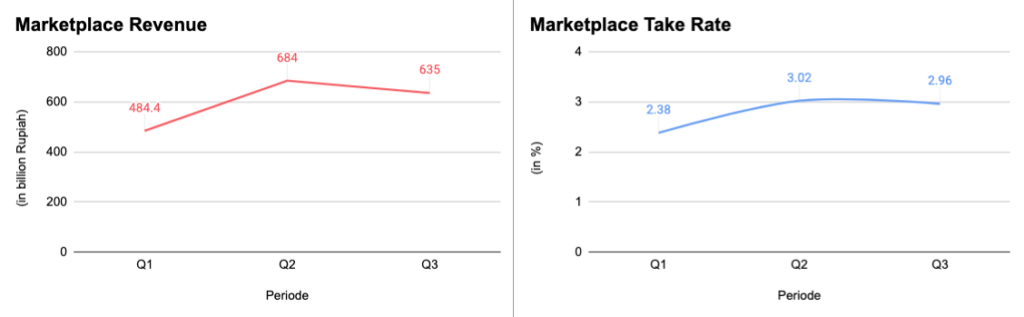

Meanwhile, based on financial performance in the third quarter of 2023 alone, Bukalapak earned revenue of IDR 1,1 trillion or an increase of 29% (YoY), of which IDR 635 billion came from the Marketplace line and IDR 561 billion from O2O.

Then, adjusted EBITDA in the third quarter of 2023 was recorded at minus IDR 95 billion, but improved 71% compared to the previous year. In its official statement, Bukalapak stated that this EBITDA improvement reflects an 18% increase from the initial projection determined in conjunction with 2022 performance, namely adjusted EBITDA loss IDR 100 billion-IDR 125 billion.

Responding to the performance in the third quarter of 2023, Bukalapak President Teddy Oetomo said that the Marketplace business and O2O operations continued to provide good results in applications and platforms. "We are still on track to achieve profitability in the next quarters after achieving improvements in adjusted EBITDA for seven consecutive quarters," he said.

The company remains optimistic that it can achieve profits according to its projections at the end of 2023 based on adjusted EBITDA. For this reason, his party is focusing on encouraging business by take rate high performance and operational efficiency to maintain long-term growth momentum.

As of September 30 2023, Bukalapak was recorded as having total cash/cash equivalents and current investments of IDR 19,7 trillion.

Business with take rate high

It is known that Bukalapak is aggressively encouraging its business lines take rate and high margins. According to the Director of Strategy, Corp. Communication, and Investor Relations Bukalapak Carl Reading some time ago, virtual products and Gaming (past marketplace my item) is a product that produces take rate and high margins.

However, there is no data in the financial reports that shows the actual performance of virtual products or gaming.DailySocial.id have tried to contact Bukalapak management regarding this matter, but there has been no response until this news was published.

In total, levels take rate Bukalapak recorded an increase of 64 basis points (YoY) to 2,82. This increase was driven by increased supply and supply chain efficiency. They assess that there is potential for growth due to products with take rate higher levels can be felt in the future.

Bukalapak's steps to focus on virtual products and Gaming, it could be said to get out of the fierce e-commerce war dominated by dominant players, such as Tokopedia, Shopee, and Lazada. Bukalapak through the itemku platform targets market segments gamer the projected numbers reach 180 million in Indonesia.

In the midst of intense industrial competition, e-commerce players required to achieve profitability. A number of players are starting to make savings by limiting subsidies, discounts and logistics costs.

Sign up for our

newsletter