Indonesia's Digital Economy Reaches $40 Billion, E-commerce Business Makes Biggest Contribution

Exploring the “e-Conomy SEA 2019” report released by Google, Temasek, and Bain & Company

Google and Temasek have re-released their annual reports highlighting the development of the digital economy in Southeast Asia. Titled e-Conomy SEA 2019, there are some interesting things highlighted in the report. Since 2015 there has been a growth in the number of internet users reaching 100 million people – the addition of the last year has reached 10 million. For 2019 the number of internet users in Southeast Asia reaches 360 million people. The new users are mostly from the 15-19 year old demographic.

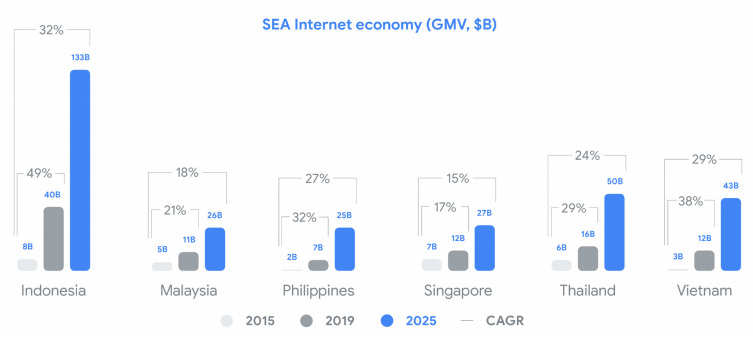

This growth also contributes to the growth of the internet/digital economy. In 2019 the value reached $100 billion, is projected to reach $300 billion by 2025. The forecast increased, after last year's report predicts the figure will be as high as $240 billion – in 2018 it was $72 billion.

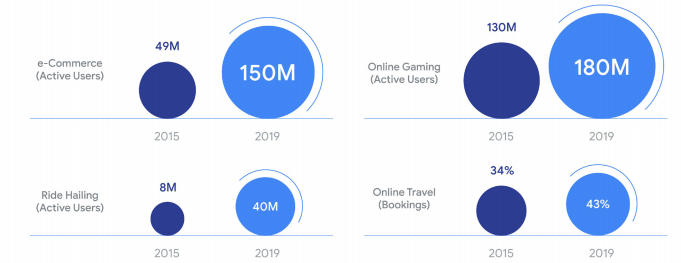

In terms of the internet industry sub-sector, the allocation of the largest number of users goes to the category online games (180 million active users), continued E-commerce and ride hailing. This figure is reinforced by train Esports which is indeed growing in this area – business is still looking for identity with a business model that continues to evolve, from just a game game normal.

Service request ride hailing also had a significant impact. Since 2015, the report notes that the number of users has grown by 5x. From an industry perspective, Grab and Gojek which is trying to continue to win the regional market. The two consistently raise new funding to strengthen expansion in each country.

Indonesia still dominates

Indonesia's digital economy is estimated to reach $130 billion by 2025, this year the figure has reached $40 billion – average growth 49% per year. E-commerce and ride hailing be the main driver in the region; plus the adoption of digital payments that dominates all application-based services. The related business growth is supported by continuous investment. Including the support provided to unicorn Indonesia, its value reached $4 billion in 2018.

Compared to six other countries that have also experienced a high surge from the internet economy, Indonesia does have more significance in terms of value. Judging from the geographical area and the total population, the comparison is indeed very far. Vietnam is predicted to be the second largest market share after Indonesia. Digital businessmen are starting to pay attention to this area to strengthen their business. Some of the big digital companies in Indonesia – you name it Gojek and Traveloka—also debuted there.

In its reports, Google-Temasek always highlights e-commerce, online travel, online media, and ride-hailing. The four main sectors are considered to have a major role in transforming business in the Southeast Asia region – as a locomotive as well as a gateway to the digital economy. In Indonesia itself, the platform E-commerce and ride hailing has been able to present many new opportunities, especially in order to encourage SMEs to move up class and open up wider job opportunities.

Indonesia is gaining momentum, at least the number of internet users this year has reached 152 million users, exceeding the total population. Last year sector online travel still leading the gains, this year's turn E-commerce. Enhancement E-commerce from 2015 it reached 88%, this year the figure (GMV – Gross Merchandise Volume) has reached $21 billion. While for online travel still at $10 billion. Ride-hailing get a share of $6 billion.

Centralized in the metro area

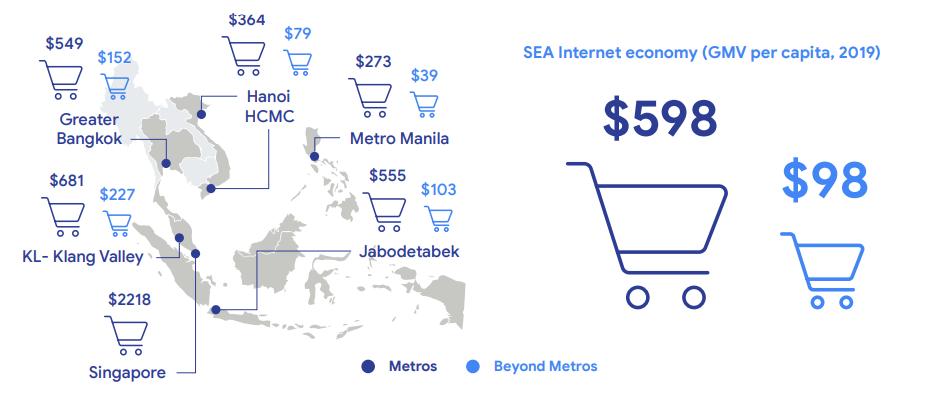

Another highlight is also conveyed in the report on the distribution of the internet economy in the region. Research compares the economic cycle that occurs in metro areas or urban centers, most of which outperform other areas many times. In Indonesia, for example, the GMV per capita for the internet economy in Greater Jakarta reached $555 while outside the region it was only $103.

Meanwhile, the overall population in Southeast Asia residing in the metro area is only 15% of the total. However, some digital startups have a "noble mission" to reach rural areas. As in Indonesia, the penetration of digital payment applications is mostly targeted at reaching users unbankable. Including some E-commerce which tries to accommodate products from SMEs in the region.

Sign up for our

newsletter