Women and Investment: The Importance of Being Financially Independent

Following are the results of a discussion with one of the female leaders in the Indonesian technology industry, Pluang Founder Claudia Kolonas

For one reason, financial matters are often seen as the sole responsibility of men. With more and more women working today, the world is becoming more familiar with the concept of gender equality even in the investment sector. In this modern era, many women have made a living [or at least made money] for their families or at least for themselves. Today, they have planned investments in order to be financially independent.

Based on the 2021 Global Gender Gap Report conducted by the World Economic Forum, Indonesia is said to have closed 68,8% of the total gender gap, ranking 101st globally, although this year's gap is 1,3 points higher than the previous period.

The main causes of this decline are predicted to be due to greater economic participation and inequality of opportunities. The reason is the sharp decline in women's participation in senior roles. Beyond this indicator, women's participation in the labor market is much less than that of men (55,9% women and 84% men) while the wage and income gap remains large (69,7% and 51,7 respectively %). In addition, 81,8% of women occupy jobs in the informal sector (compared to 79,4% of men).

Claudia Kolonas is one of the few female founders in the Indonesian technology industry. He founded an investment platform, Pluang, with the aim of promoting financial inclusion in Indonesia. As a woman in the fintech industry, there are always challenges that must be overcome. However, while carrying out her mission, Claudia tries to avoid all the negativity that surrounds her potential and maintains self-confidence when others may doubt her capabilities as a female leader.

Become a financially independent woman

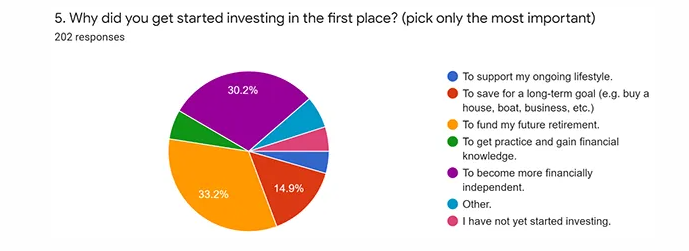

According to Women and Finance: The Rich Thinking Quantitative Survey 2019 by Barbara Steward, CFA, most women understand the importance of being financially independent. In the survey, more than 200 women from 24 countries were asked the most important reason why they invest, the second most popular answer was "to become more financially independent", and at the top was, "funding for retirement".

In a society that demands patriarchy like Indonesia, women usually have a smaller contribution in terms of financial support for the family. Moreover, when they are married, the rule that is often applied is that she is her husband's responsibility. Maybe this sounds comforting, but in reality this expression is a bit scary, to give up responsibility for yourself for what? No one can truly guarantee someone's well-being.

Claudia says, “I think investing is essential for women. It is very important for women to be financially independent, especially when their husband leaves them. When women are married, women usually have a greater burden of expenses, therefore it is very important to save for an emergency fund. This emergency fund will be very useful when there are unexpected events such as job loss, etc."

Financial independence is an important theme for women. Financially empowered women are not only more confident but also more productive and able to have work-life balance. This is one of the main factors that can measure a woman's prospects for success.

"The most important thing is to provide support for women, especially for those with families, who want to enter the technology industry. It is important to have an equal platform to work for both men and women," he added.

In terms of investment capabilities, research also shows that women spend more time researching their investment options. While they take less risk than men when it comes to investing, that doesn't automatically mean they're risk-averse. In contrast, women are more likely than men to take appropriate levels of risk with their investments. These two characteristics will produce better investment results.

Investing in the midst of a pandemic

There are several investment goals that are common in society. Some people invest to maintain prosperity [post-retirement], generate income [for daily needs], or gain profits from their capital assets. In fact, investment platforms are reaping blessings amidst this pandemic. Basically, because people spend more time on the internet during WFH (work from home) and investing is getting easier because it is supported by technology.

In Indonesia, several platforms are available to accommodate these goals, including Investree, Pluang, Seedlings, etc. This allows people to invest in gold, stock markets, mutual funds, and many other forms of investment. It gets easier with one click.

Based on data from the Indonesian Central Securities Depository (KSEI), in the first four months of this year the number of capital market investors increased 31,11% to a total of 5,08 million. Meanwhile, mutual fund investors increased 38,85% to 4,40 million investors.

Source: KSEI investor demographics April 2021

Source: KSEI investor demographics April 2021The demographic report also implies that women have succeeded in narrowing the investment gap to 38,45% with an estimated asset value of IDR 208,84 trillion. This information is supported by the fact that Pluang, one of the leading investment platforms in Indonesia, claims that the majority of its investors are women. Following investment statistics and trends, the company also plans to add new products this year.

"This year I personally focused on purchasing government debt products such as SUN or ORI, as well as investing in mutual funds and also in BUMN bonds. "In my opinion, there are still many opportunities to increase the value of fixed income products in Indonesia, and the risks are quite moderate," explained Claudia.

Despite all the convenience of investing money on digital platforms, the internet is not immune from various fraud attempts. There have been several cases involving "fraudulent" investments spread via gadgets. This problem is very complex and requires participation from the entire ecosystem. The market requires further education, product understanding and not violating basic morals.

The good news is that the financial literacy index and financial inclusion index in Indonesia have increased since 2019. OJK reports that the financial literacy index value has reached 38,03%, while the financial inclusion index has reached 76,19% in 2020.

Claudia also mentioned that many investment products became more volatile during the pandemic so risks increased. “We think it is very important to be able to educate our users about investment risks, especially when there is economic uncertainty,” he added.

Investing is not just a game. Even though it sounds fun, are you willing to risk money to survive? Simply because most colleagues are 'hyped' about the buzzing industry. Investment is fundamental to achieving financial independence. However, it's important to invest in something you can understand.

-Original article in English, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium