Partnership Expansion, Wise Strengthens Remittance Services in Indonesia

Wise Platform is an infrastructure service that will be optimized in the local market; Bank Mandiri has become their first partner

Interstate remittance services or ramitances are an important aspect of the financial industry landscape, because many Indonesian citizens work abroad and send money back to their homeland to support their families. In Indonesia, there are several money transfer services available, including through banks, money transfer agent, and platforms online.

As one of the global technology companies that provides services for sending and managing money, Wise sees the flow of remittances to Indonesia is expected to grow by around 3% in 2022 to $9,7 billion, based on a report released by World Bank. To DailySocial.id, Wise Indonesia Country Manager Elian Ciptono revealed their business plans in Indonesia and the expansion of strategic partnerships with banks and non-banks.

Partnership with banking

One of the challenges of using money transfer services in Indonesia is the high cost of sending money. According to the World Bank, the average cost of sending money to Indonesia is around 7% of the amount sent, higher than the global average of 6,5%. However, the Indonesian government has taken steps to reduce the cost of remittance services by encouraging competition between service providers and implementing policies to streamline the remittance process.

Until now, banks are the most common money transfer service providers in Indonesia. Many banks offer money transfer services that allow customers to transfer money to other banks in Indonesia or abroad. Fees charged by banks for money transfer services vary depending on the amount of money transferred, the destination country, and the speed of the transfer.

Since its launch in 2011, Wise has continued to develop the Wise Platform, a payment transaction infrastructure service for banks and non-banks. To date, more than 60 banks and large companies around the world have integrated the Wise Platform into their infrastructure.

After launching a low-cost and fast money transfer service from Indonesia in 2020, the company wants to deepen their commitment through the Wise Platform to Indonesia, by collaborating with Bank Mandiri. Bank Mandiri is Wise's first partner in Indonesia to integrate the Wise Platform into its application, Livin' by Mandiri.

"By integrating the Wise Platform, Bank Mandiri can offer its 16 million users the ability to send money at affordable prices across 5 currencies (USD, SGD, GBP, EUR, AUD). Additionally, 52% of transfers sent via Wise globally are completed instantly (less than 20 seconds), thereby providing better speed and convenience for Bank Mandiri customers."

Previously the company had also established strategic cooperation with Instamoney. Wise can serve customers in Indonesia who want to send money to 80 countries, including Australia, Malaysia, Singapore, Japan, United Kingdom and China (via Alipay).

"When it was first launched in Indonesia in 2020, we worked with Instamoney as a local partner. We have now obtained a license from Bank Indonesia, and continue to provide a faster, cheaper and more convenient way to send money from Indonesia to abroad," said Elian.

Globally the company has launched 15 new partners in 4 new markets and given 10 million people access to Wise's fast, cheap and transparent international payments directly from existing service providers' platforms. Founded by Taavet Hinrikus and Kristo Käärmann, Wise launched in 2011 under the original name TransferWise.

Apart from Wise, currently platforms offering remittance services include, Flip, Instamoney, Oh!, yourpay, wallex and Transfez.

Wise's business plans and targets in Indonesia

Indonesia is one of the world's largest recipients of remittances, with millions of Indonesians working abroad and sending money home to their families. According to the World Bank, Indonesia received approximately $10,5 billion in remittances in 2020, making it the 10th largest recipient of remittances in the world.

Online money transfer platforms have also become increasingly popular in Indonesia in recent years. Platforms like Wise offer fast and affordable money transfer services, with competitive exchange rates and low fees. This platform is very attractive to the younger generation of Indonesia who are more comfortable in using online and mobile banking.

Asked how many Wise users there are in Indonesia to date, Elian was reluctant to reveal further. But globally, there are around 16 million people and businesses using Wise, processing £9 billion in cross-border transactions every month, saving around £1,5 billion per year.

More Coverage:

"Since launching in 2011, we have continued to focus and invest in the four pillars of our mission, price, speed, convenience and transparency to build the best way for people and businesses to move and manage their money internationally," said Elian.

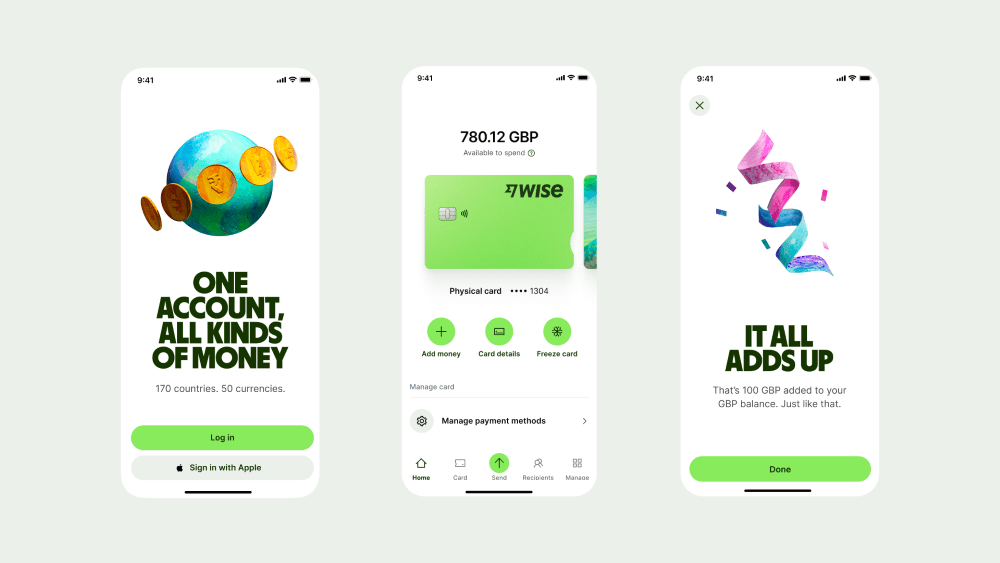

Recently Wise has also introduced their new interface, which is expected to be used by users consisting of people, businesses and banks. This cosmetic change also highlights Wise's commitment to building a faster, cheaper and more transparent alternative for managing money in multiple currencies.

"Our journey in Indonesia is still very new, but we see continued growth thanks to continuous investment in product development and expansion. One thing is clear, we remain focused on making Wise accessible to everyone, everywhere, and bringing more many features for our customers in Indonesia."

Sign up for our

newsletter