Two Years of QRIS: Adoption Amid Acceleration of Indonesian Digital Finance

DailySocial collects a number of interesting insights regarding QRIS adoption through a small survey

Some time ago, Bank Indonesia (BI) stated that the total payment transactions using the QRIS method had increased rapidly over the past year. QRIS transaction value reaches IDR 9 trillion in the first semester of 2021 or up 214% compared to the same period last year. Total merchant using QRIS also rose to 8,2 million. At least, there is an addition of around 3 million from 6 million merchant at the end of 2020.

In a webinar Digi that was held Infobank, Assistant Governor and Head of the Payment System Policy Department of Bank Indonesia, Filianingsih Hendarta, revealed that the Covid-19 pandemic had an effect boost extraordinary contribution to the acceleration of digital finance in Indonesia. In addition to the factor of shifting consumer behavior to digital, this acceleration is helped by the closer collaboration of actors in the digital ecosystem in the banking and non-bank sectors.

“In the near future, we will also launch the Customer Presented Mode feature because now we only have Merchant Presented Mode. We are also piloting QRIS transactions for cross border, good inbound as well as dan outbound, said the woman who is familiarly called Fili.

With this unexpected achievement, what is the hope of implementing QRIS in the future in the current situation, and what efforts can be made to encourage its adoption?

About QRIS

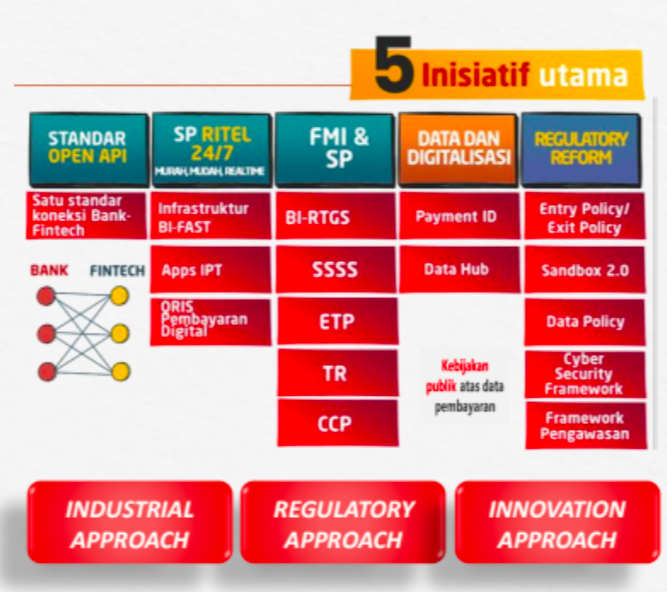

QRIS or Quick Response Code Indonesian Standard (QRIS) is part of five major initiatives launched by Bank Indonesia towards the Indonesian Payment System (SPI) 2025.

QRIS was developed by Bank Indonesia and the Indonesian Payment System Association (ASPI) to combine various types of QR from various Payment System Service Providers (PJSP) into one QR Code. As a digital payment system, QRIS is designed as a QR Code Standard for server-based electronic money applications, digital wallets, and mobile banking.

Technically, QRIS is available in two types. First, in static format (printed media/stickers, same QR Code for every transaction, QR Code has no nominal value so input is manual). Second, dynamic (QR Code via receipt printed by the EDC machine/displayed on the monitor, QR Code is always different for each transaction, QR Code has a payment nominal).

People can pay for transactions at merchant with one QR Code for all platforms. The scenario is like this, if you can't buy drinks because merchant regarding not accepting your payment option, QRIS will enable you merchant to receive every payment from every platform. No more need for one EDC machine for one platform. QRIS provides space for people to make payments regardless of platform with one QR Code.

Then, why do we need QRIS? This technology can expand national non-cash payment acceptance more efficiently. Through the use of one standard QR Code, providers of goods and services do not need to have various types of QR Codes from different publishers.

Long before QRIS was launched, the government had actually implemented QR Codes as a means of payment since the middle of 2015. However, at that time PJSP was still using QR exclusively. With growing smartphone penetration and opportunities to help the segment unbanked and underbanked, BI decided to standardize the QR Code.

Another reason is that BI sees examples of high success in QR as a means of payment in several countries, namely China through Alipay and WeChatPay, and India through PayTm and BharatQR.

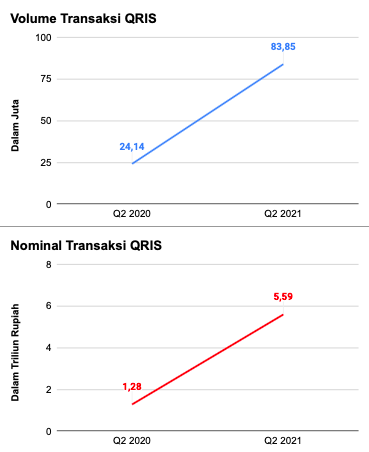

Two years after its official launch, QRIS has reaped positive achievements--most of which were helped by the pandemic. Based on BI data, QRIS transaction volume rose 247% in the second quarter of 2021 to 83,85 million transactions. Meanwhile, the transaction value skyrocketed 336% to IDR 5,59 trillion compared to the same period last year.

Just like QRIS, other players and industries in the digital financial ecosystem have also experienced positive growth due to the pandemic. As stated by Fili in the webinar, the growth of the digital financial ecosystem (EKD) this year is projected to continue to increase.

Adoption and challenges

Considering that QRIS is still in its infancy, progress adoption is not yet massive. Consumers encounter many difficulties in using it, especially with society's current limitations on movement. This is known from a small survey, involving 65 respondents, which was conducted DailySocial in August 2021 online.

This survey may not be able to represent the majority of issues in the field, but the respondents provide interesting perspectives which can actually provide room for improvement for the stakeholders involved.

First, the challenges when transacting with QRIS. According to respondents, as many as 65,6% of respondents admitted that there were many merchant have not yet adopted QRIS. Then, around 55,7% thought that internet connections made transactions difficult, and 29,5% of respondents said it was a process scan QRIS is relatively old.

What is quite interesting is that several respondents highlighted how merchant all they found was using QRIS as a display. They judge, ada merchant who have activated QRIS, but cashiers rarely offer it to consumers because they don't know how to use it.

Meanwhile, some respondents admitted that they were not interested in trying out QRIS because QRIS availability at merchant limited (60,9%), consumers don't know how to use it (17,4%), the feature is not yet available on the device (13%), and cashiers rarely offer payment with QRIS (4,3%).

From the perspective of business actors, BI has actually relaxed its policies so as not to burden its implementation. Quote Cash, BI sets transaction fees or merchant discount rate (MDR) borne by the partner/merchantt is only 0,7%. Using QR only costs IDR 35 thousand for one QR code each merchant.

Expansion merchant

The Covid-19 pandemic has had a positive impact on Indonesia's digital financial ecosystem. However, the government and stakeholders ideally should not use this as a temporary golden moment. There needs to be more room for improvement so that QRIS adoption can increase consistently until the post-Covid era. Moreover, while some people are getting used to the digital payment transition,

Still from the survey we conducted, many respondents hope that the use of QRIS can be expanded and not limited to food and beverage transactions only. As many as 87,3% of respondents hope that QRIS can be used by street vendors, 81% in markets, 76,2% government services, and 68,3% for public transportation.

The government also needs to think about how to maximize QRIS adoption if social restrictions continue. With the tightening of activities in public places, such as shopping centers, how to implement QRIS if many merchants are not operating. Except for reservations food delivery.

As reported Business, BCA experienced a decline in physical transactions, which affected services using the QRIS method. Meanwhile, according to our respondents, they are starting to use QRIS less frequently with activities tightening in the last few months. As many as 20% of respondents admitted that they only made transactions once in the last 1 months and 3-2 times per month. As many as 3% said they made QRIS transactions around 16,7-2 times per week.

DailySocial I tried to ask Bank Indonesia for a response regarding the above issues, but there was no further statement. BI has actually updated its QRIS usage policy by increasing it limit transactions from IDR 2 million to IDR 5 million.

In the near future, BI will also release a Customer Presented Mode feature where merchants do it scan. But is this enough? It is hoped that the government will not lose momentum with the current turmoil of digital acceleration and changes in consumer behavior.

Sign up for our

newsletter

Premium

Premium