Advance Intelligence Group Valuation Reaches $2 Billion, How is Its Business Unit Performing in Indonesia

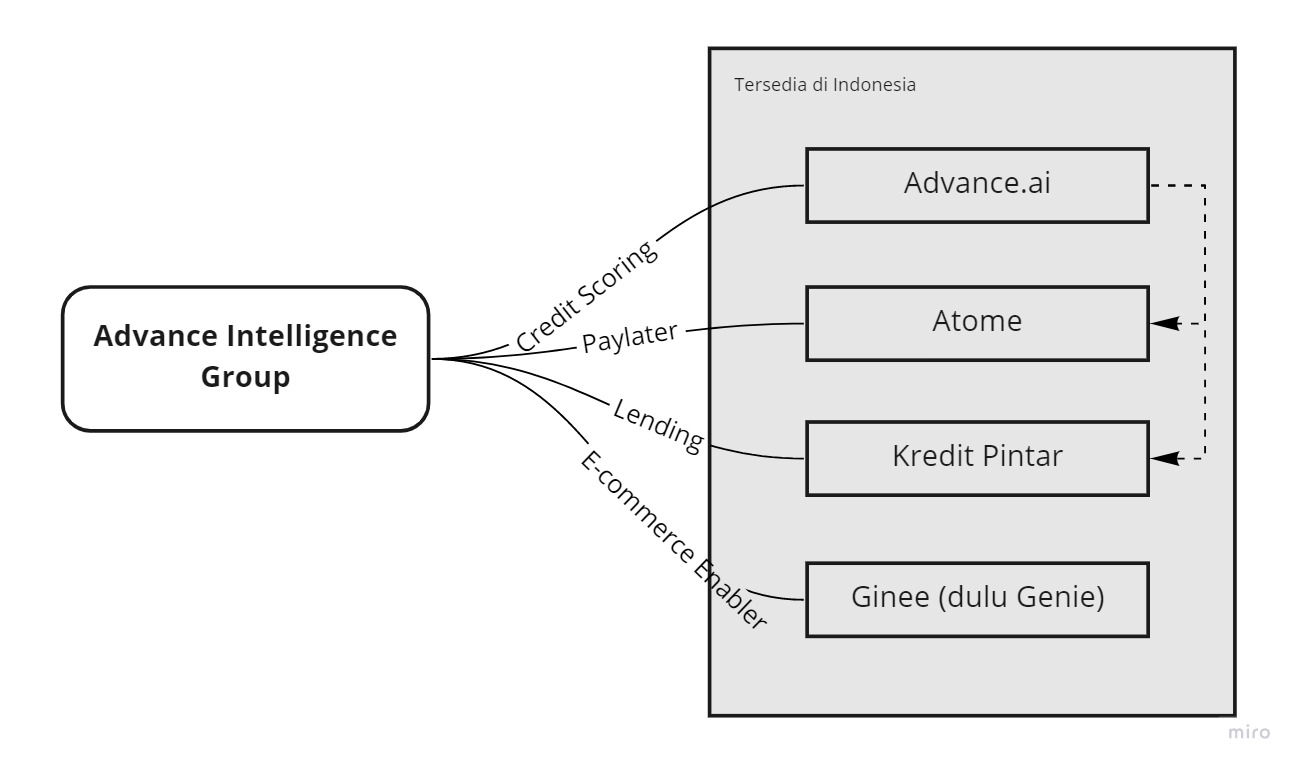

Operate Advance.ai for credit scoring platform, Atome for paylater, Smart Credit for cashloan, and Ginee for e-commerce enabler

The Advance Intelligence Group on Wednesday (22/9) announced the acquisition of a series D funding of $400 million. This round was led by SoftBank Vision Fund 2 and Warburg Pincus; with the participation of Northstar, Vision Plus Capital, Gaorong Capital, and EDBI. This investment brings the company's valuation to around $2 billion.

Founded in 2016, this group of companies oversees several brand digital services that also operate in Indonesia. First there advance.ai, the product presented helps other digital players (especially fintech) with various solutions such as credit scoring, e-KYC, recognition service etc. Second, they operate services paylater Atome, integrated in consumer applications such as JD.id, Zalore, Pomelo, and so on.

Third, the Advance Intelligence Group also operates the platform Smart Credit in Indonesia -- targeting consumers. Lastly, they have service E-commerceenablers Ginee (previously named Genie), helps business people do business management on various platforms online marketplace in one dashboard. Its capabilities are included in the realm of fulfillment.

Business performance fintech

The company said that the fresh funds obtained will be focused on encouraging service growth paylater and digital lending across Asia. Apart from that, they will also deepen AI and analysis capabilities big data. It is clear that various strategic steps must be prepared immediately to win the market. This is because all the business lines that Advance is involved in, especially in Indonesia, are faced with quite fierce competition.

Let's review them one by one, starting from service paylater Atome. Potentially, this business model has great opportunities in Indonesia, as proven by several surveys regarding payment methods. One of them did Katadata Insight Center together Kredivo, currently paylater became the number four popular payment (27%), after e-wallet (65%), bank transfer (51%), and Alfamart/Indomaret (29%). Public understanding is also good, as many as 86% of people said they already knew paylater with a medium level of knowledge.

In Indonesia, concept paylater Popularly divided into two approaches. First, services from consumer platform subsidiaries – such as TravelokaPaylater from Traveloka, GopayPayater from Gojek, and SPaylater from Shopee. Second, is an established service standalone and integrated in various consumer applications. Atome goes into the second approach, competing with several other providers, as follows:

| Application | Downloads (Playstore) | Rating (Playstore) |

| Akulaku | 10 million+ | 3 (Shopping) |

| Atom | 1 million+ | 19 (Shopping) |

| Home Credit | 10 million+ | 33 (Finance) |

| indodan | 5 million+ | 30 (Finance) |

| July | 5 million+ | 28 (Finance) |

| Kredivo | 10 million+ | 10 (Finance) |

From a study we conducted at the end of 2020 on players paylater, in many aspects Atome is not superior to other players. For example, regarding integration in top 20 e-commerce in Indonesia, other services such as Kredivo, Akulaku, or Home Credit has more options. Likewise regarding the maximum credit limit and tenor options provided. For more details, read the service comparison paylater through: Study Paylater Services on Indonesian E-commerce Platforms.

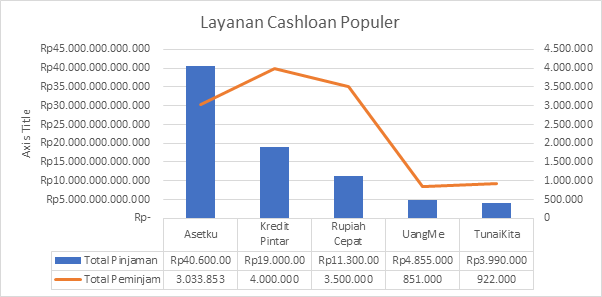

If paylater the focus is on financing the purchase of goods, services fintech lending cashloan providing credit loans in the form of cash for consumers. From the Advance group, they have Smart Kiredit. Looking at the total value of loans and borrowers that have existed since its founding, their platform is included top 5 cashloans in Indonesia, it competes with several other services such as Asetku, Rupiah Fast, UangMe, and TunaiKita.

Credit scoring services still have big opportunities

Both Atome and Kredit Pintar also utilize Advance.ai as a basis for credit scoring, in determining the suitability of prospective customers. The Advance group business itself actually started with the artificial intelligence services they developed to support business fintech. Several companies such as Bank Mega, Dana Mart, and even Home Credit also use its services.

Rules regarding credit scoring platforms are accommodated in the POJK concerning Digital Financial Innovation. As of May 2020, there were 12 companies that had been registered as part of it. Meanwhile, from then until now, new players continue to emerge. Starting from the platform open finance Finantier, which also develops scoring services, has become a giant online marketplace local Tokopedia building a subsidiary Toko Score.

| Platform Name | Company name | Date |

| Avatec | PT AVATEC SERVICES INDONESIA | Noted: March 26, 2019 |

| Acura Labs | PT ACURA LABS INDONESIA | Noted: March 26, 2019 |

| TSI | PT TRUSTING SOCIAL INDONESIA | Noted: March 26, 2019 |

| Tongdun | PT TONGDUN TECHNOLOGY INDONESIA | Noted: July 15, 2019 |

| Bps | PT BANGUN SOCIAL TRUST | Noted: October 25, 2019 |

| PYXIS | PT DIGITAL SYNERGY TECHNOLOGY | Noted: October 25, 2019 |

| CheckScore | PT PUNCAK ACCESS FINANCIAL | Noted: October 25, 2019 |

| Fineoz | PT FINEOZ INNOVATION TECHNOLOGY | Noted: October 25, 2019 |

| CredoLab | PT CREDOLAB INDONESIA SCORING | Noted: December 23, 2019 |

| Izidata | PT IZI DATA INDONESIA | Noted: February 10, 2019 |

| OLDI | PT ORANGE INDONESIAN DIGITAL SERVICES | Noted: February 10, 2019 |

| SDB Score | PT SEMANGAT DIGITAL NATION | Noted: February 10, 2019 |

The potential of credit scoring platforms will follow the growth of the industries that use them, none other than that digital lending. According to a study conducted by Grand View Research, the market size of digital lending platforms will reach $5,80 billion this year. It is projected to reach $26,08 billion in 2028 with a CAGR of 24% in that period.

E-commerce enablers in Indonesia

Ginee only entered Indonesia around March 2021. Their expansion was based on the significant economic value generated from the business E-commerce. The platform presented is intended to help traditional business people to do on-boarding and store management online multichannel. Through the Omnichannel feature, users can manage stock and sales of various types online marketplace in just one dashboard.

Meanwhile, the Fulfillment feature helps business people manage order fulfillment, including product distribution to consumers and logistics. There is also Ginee Chat, which helps business people have a customer service dashboard. Make it easier for them to manage chat incoming data coming from multiple sources in one application.

In Indonesia, currently there are several services that provide similar business processes. Here's the list:

- 8Commerce

- aCommerce

- Anchanto

- egogohub

- WarehouseAda

- IDMarco

- Intrepid Group

- iSeller

- Jarvis Store

- Jet Commerce

- ClickDaily

- PowerCommerce

- SCI E-Commerce

- sirclo

- Tokotalk

More Coverage:

Sirclo is one of the local players which has a unique position; Not only do they provide SaaS services, they also help with logistics and warehousing. Currently, the startup led by Brian Marshall has reached more than 100 thousand people brand, serving more than 4 million end consumers. Meanwhile Ginee is currently helping 75 thousand merchant with 131 million orders successfully handled.

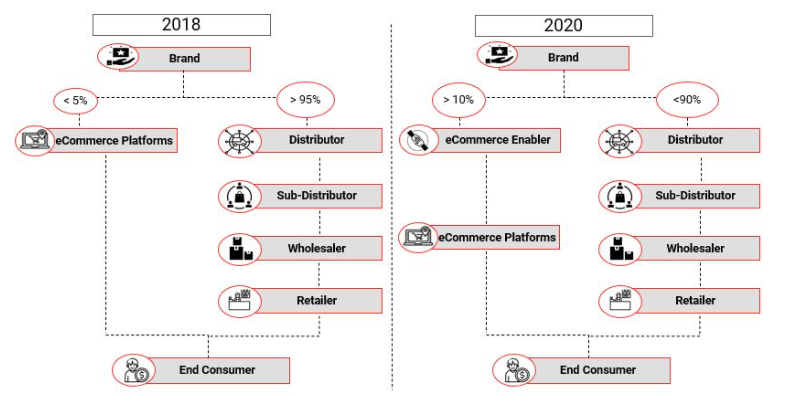

The market size that can be captured by this industry player also has the potential to continue to increase along with the fantastic GMV generated E-commerce. From a business perspective, the efficiency provided also encourages them to be more actively involved in trade online. Previously, brand utilize long supply chains to distribute products to end consumers; technology makes it possible to reduce this long flow.

In general, service e-commerce enablers reaching two segments at once, namely owners brand large and also MSMEs. Ultimately, with fierce market competition, added value such as a service ecosystem and integration into something that is worthy of being a value proposition. For this reason, the players above are competing to provide the most complete features to accommodate sellers' needs online in a manner end-to-end; starting from product data collection, packaging, shipping, reporting, to customer loyalty systems.

Sign up for our

newsletter

Premium

Premium