OCBC NISP Ventura Assisted Startup "Prospeku" Pockets Early Stage Funding

Already has around 17 thousand agents, cooperates with Bank OCBC NISP to provide KPR and KTA facilities

Founded as a project developed through an incubation program OCBC NISP Ventures, Prospekku proptech platform launched independently under the auspices of PT Properti Bawa Untung. As an investor, OCBC NISP Ventura entered into early stage funding with an undisclosed investment value.

The fresh funds will be used to develop a platform that connects potential buyers with agencies and property agents. Currently, Prospekku has more than 17.000 property agents who have joined. This year the company targets to increase the number of property agents and bring more features in the application.

"Prospeku is expected to be more optimal in serving the needs of property business players. In the future, we also hope to contribute positively to business recovery efforts in the Indonesian property sector," said CEO of Prospeku Yulius Elvino.

Prospect features

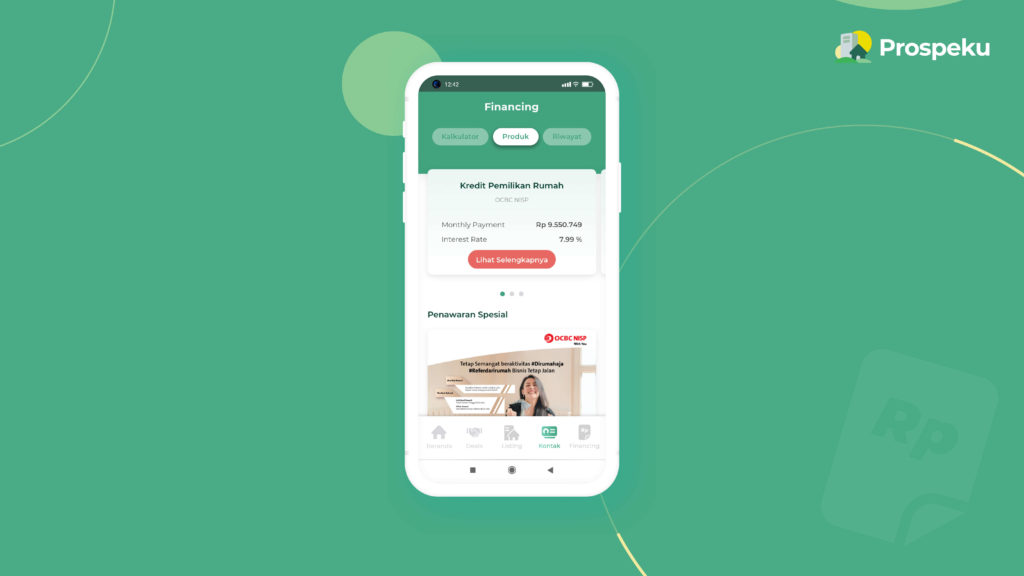

Prospect service is in the form of a mobile application that can be used by all customers stakeholder the process of buying and selling property, including apartments, houses, to land.

In particular, the company wants to make it easier for property agents who have joined to enjoy various features, such as: listings, contacts, deals and financing.

Prospekku claims to guarantee the confidentiality of the data entered through the application and is not shared without the permission of the owner listing or the property in question.

“My prospect is Hassle-free a platform that provides digital solutions to property agents so that they can manage their property listings more effectively. Prospect is ready to assist property agents in managing customer better and easier to market the property. All in one app,” explains Prospect CMO Lucy Kaudin.

Prospekku collaborates with Bank OCBC NISP to provide KPR and KTA facilities. In addition, Prospect has also collaborated with Rumah123,99.co and CicilSEWA.

"Through the synergy and cooperation between Prosepeku and Bank OCBC NISP, property agents and prospective buyers can get the best offers from Bank OCBC NISP mortgages," said Customer Solutions Retail Loan Division Head Bank OCBC NISP Rudy Sutjiawan.

OCBC NISP Venture Focus

Launched in 2020, in total to date, OCBC NISP Ventura has 8 portofolio, including Kiddo, Rukita, GajiGesa, CloudCash, sirclo and decoration.

To DailySocialOCBC NISP's Head of Strategy & Innovation Ka Jit explained, the purpose of establishing this CVC is to create a digital ecosystem that is able to drive the transformation of the banking sector. The company appointed Darryl Ratulangi as Managing Director who will be responsible for carrying out the vision of OCBC NISP Ventura.

Funds worth 400 billion Rupiah were prepared as authorized capital, with 99,9% ownership by Bank OCBC NISP. In addition to investing, several programs that will be run include startup incubation and strategic partnerships. In the initial phase, the company is targeting to be able to foster digital solution developers who are able to increase financial literacy and inclusion in Indonesia.

"We established OCBC NISP Ventura to create transformative value by harnessing the potential of the entrepreneurial spirit and startups in Indonesia with an extensive banking network to respond to the growing needs of the community," said Ka Jit.

Sign up for our

newsletter