CredoLab “Credit Scoring” Startup Announces Series A Funding Worth 103 Billion Rupiah

CredoLab is a startup from Singapore; already has an operational unit in Indonesia and is registered with OJK

Platform developer startups credit scoring or credit rating CredoLab announces that it has closed a series A funding round of $7 million. This latest investment is led by GBG, a company known for its data intelligence solutions for managing the identity of digital platform users.

Access Venture Capital was also involved in the funding, as well as Walden International, which was a previous investor. Early last year the company also raised a pre-series A fund of $3,1 million.

The fresh funds will be focused on increasing business growth in East Asia, as well as expanding into Latin America and Africa.

CredoLab originating from Singapore, currently they also have an operational base in Indonesia. It has also been registered by OJK as the organizer of Digital Financial Innovation (IKD) since December 2019.

In interview with DailySocial, CredoLab Chief Product Officer Michele Tucci revealed, the platform works by reading data on the smartphone to generate user behavior scores. Then the data is processed to estimate the possibility of default. Metadata on the device is accessed anonymously, while ensuring privacy.

Currently service credit scoring CredoLab is used by various institutions, both banks, players fintech, e-commerce, and other technology businesses. The business model is pay per use or pay.

Business credit scoring in Indonesia

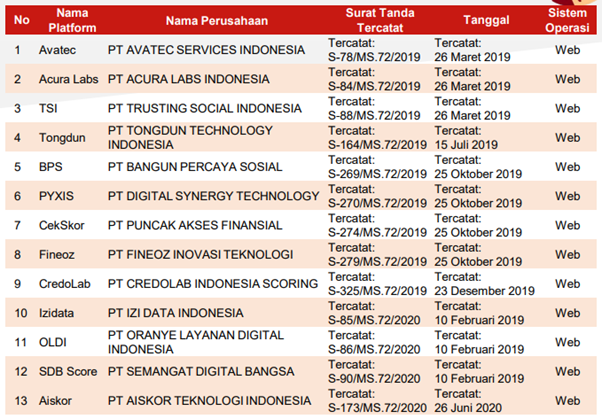

In Indonesia, not only CredoLab offers solutions credit scoring. According to OJK data published as of July 2020, there are at least 13 players currently operating in Indonesia, as follows:

As the number of digital loan service providers increases, platforms credit scoring more in demand. The previous approach that was widely used by banks, namely through credit analysts (with special officers), had several issues when applied in the banking sector fintech. Some of them require a long process and historical data is not always available (especially when serving customers). underbanked and unbanked).

The latest credit assessment services utilize data formed from user activities with their devices, including transaction data made with various applications (such as: e-commerce, ride hailing, e-wallets, etc.), to activities on social media. The analysis process is greatly assisted by technology such as big data, machine learning, and AI.

More Coverage:

The methodology continues to evolve, for example, what is done Pefindo with XL Axiata in the IdTelcoScore product, they released an alternative assessment product using XL Axiata users' cellular numbers to analyze debtors' creditworthiness. Cellular telecommunications data is considered to be one of the important alternative data because it grows significantly and is massive in number.

Before credit scoring platforms developed as they are today, many startups fintech which takes a semi-manual approach. For example some players ask users to upload some identity documents or require them to connect accounts E-commerce to the credit scoring platform – to view transactions that have been made. Others require users to upload collateral documents such as proof of bill payments.

Sign up for our

newsletter