SoftBank Investment Strategy in Technology Startups

The Vision Fund is always focused on startups on a growth scale

Coordinating Minister for Maritime Affairs Luhut Binsar Pandjaitan said this year Softbank (through its managed funds) promised to disburse $2 billion to Indonesian startups, then would add another $2-3 billion in the coming years.

"So maybe 5 billion US dollars in the next three years," explained Luhut.

A very large value in the form of commitment to a country.

SoftBank's definite investment agenda is development Grab and Tokopedia. Elaborated with the government's mission, the strengthening of the business is considered to be able to support various important services and infrastructure projects.

"We will create a headquarters Grab in Indonesia, and also invested $2 billion through Grab. But we will invest more in Indonesia," said SoftBank Founder & CEO Masayoshi Son shortly after meeting President Joko Widodo.

With both head office in Indonesia, Grab will strive for product improvement. Here they will focus on research and development. Products like GrabFood, as conveyed by the President Grab Indonesia Ridzki Kramadibrata. will be the main concern.

Still just a rumor, SoftBank will also invest in a number of other startups. The name that has been raised is an educational startup Ruangguru and marine startup Aruna.

Starting from Alibaba IPO

Son's entrepreneurial journey began when he was a student at the University of California, Berkeley in the 1970s. Together with his colleagues he sells machine translation to game tools (games). In 1981 he returned to Japan and founded SoftBank as a distributor company computer. The IPO in 1994 succeeded in making its business capital increase sharply, then continued expansion.

Son's belief in computer products grew and brought SoftBank to become Japan's leading telecommunications and internet company. In the internet era in the 1990s his business skyrocketed. In 2000 he decided to invest $20 million into Alibaba with a 26% stake.

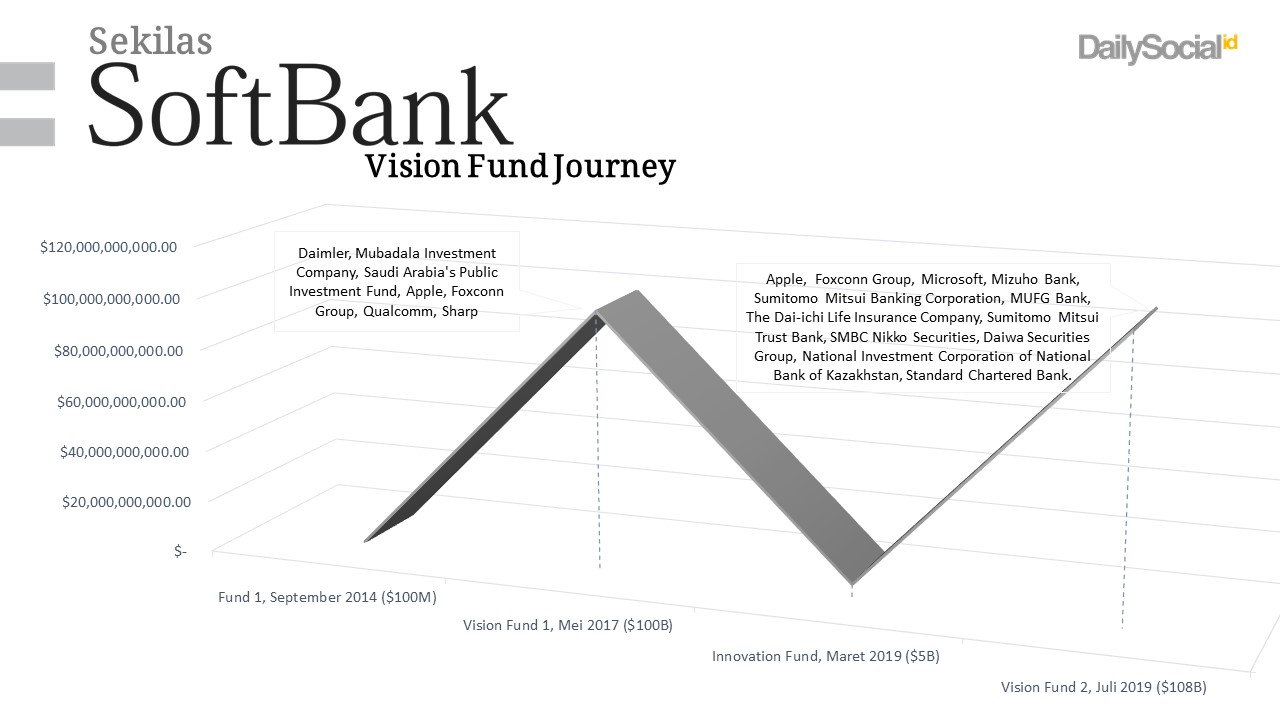

Alibaba is an important milestone for Son. Including increasing the confidence of investors until in 2016 he released the Vision Fund. At that time it was worth $95 billion, including backed by public investment funds of Saudi Arabia and Abu Dhabi. His investment focus is on a late-stage funding round in technology companies that are close to an IPO. Of course, the spirit of venture funders is to get a chance to enter the next trading floor, repeat Alibaba success.

This year has an investment fund of $180 billion

bulan last july 2019, through the SoftBank Vision Fund 2 initiative, Masayoshi Son announced that it has raised approximately US$180 billion in funding. Multinational companies such as Apple, Foxconn, Microsoft and Standard Chartered Bank participated as investors. Most of the funds will be invested in startups and/or global companies that support the acceleration of the artificial intelligence technology revolution.

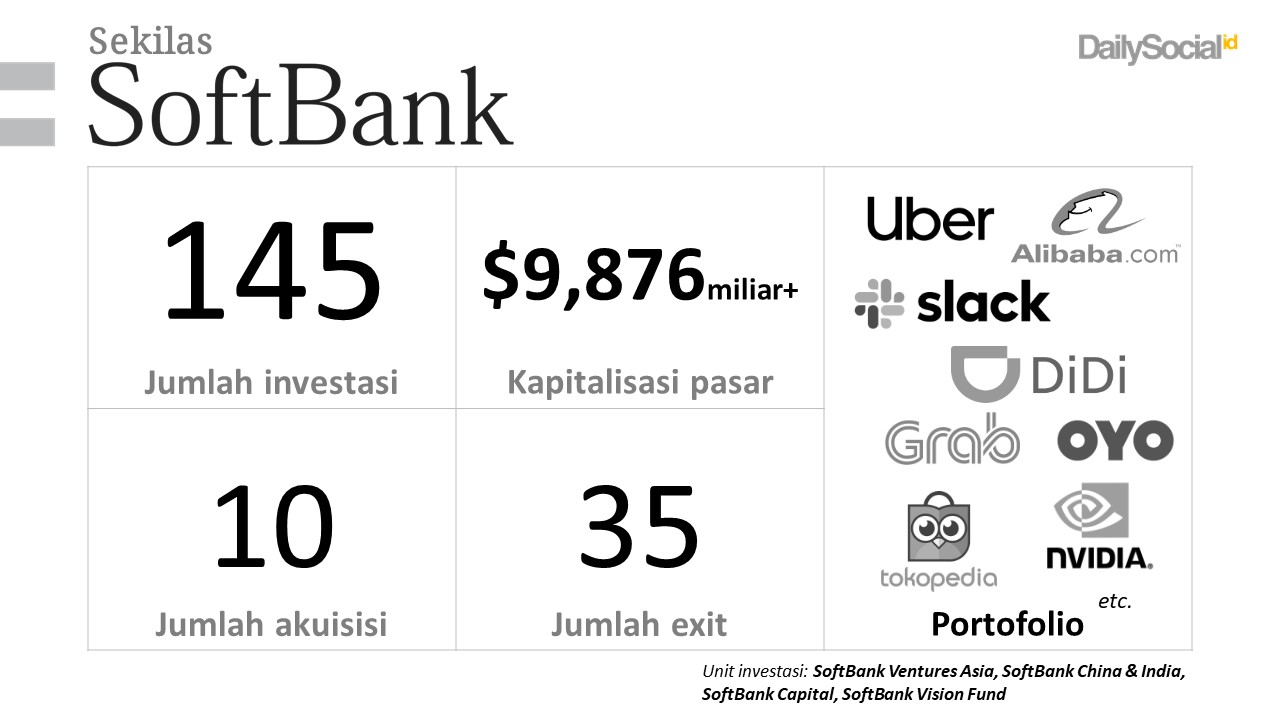

SoftBank was an early investor in Yahoo Japan and Alibaba. Since then they have continued to gamble to invest in technology and telecommunications companies around the world. Klook, Oyo, Tokopedia, Slack, ARM, Nvidia, WeWork, Didi and Grab are several companies that have been included in its portfolio.

Throughout first half In 2019, the company has booked revenue business exceeds 1.169 billion Yen. The consumer sub-sector that contributed the most.

Towards the end of 2018, hotel chains Oyo officially debut in Indonesia. The steps taken are quite aggressive, considering the hectic competition. Platforms budget hotels such as Airy, RedDoorz, and Zen Rooms continue to be in the spotlight, considered to have brought disruption to the sector hospitality. Oyo has partnered with more than 500 property owners, managing more than 530 hotels and 12 thousand rooms in 52 cities in Indonesia.

Apart from Indonesia, the Oyo hotel chain also exists in India, China, the United States of America, Japan, Saudi Arabia and 9 other countries. With full support from the Vision Fund, the company is targeted to compete with Marriott, which is currently the largest hotel chain in the world.

September 2019, tens founder and startup/company executives in SoftBank's portfolio reportedly will gather in Los Angeles. This private meeting will discuss Son's ambition to build a business ecosystem that allows companies to synergize with each other to accelerate faster business growth.

For companies that are included in the Vision Fund portfolio, support for global expansion is expected. As stated by SoftBank Vision Fund CFO Navneet Govil, the funds disbursed are always targeted so that related companies can increase business scale, the Vision Fund's focus is on growth. No doubt the receiving company did various ways to achieve this target, including through acquisitions.

Sign up for our

newsletter