Seven Years of Pawoon and Strategy Introduce POS As Pintu Enter SMEs "Go Digital"

Has 25 thousand merchants from small to enterprise scale spread across 250 cities in Indonesia

Six years ago, Pawoon CEO Ahmad Gadi conveyed his decision to establish Pawoon in 2014 because of his belief in Point of Sales (POS) applications. entry point for small businesses in using technology. His statement is completely correct, because data from BPS in 2020 states that MSMEs have a contribution of 60,3% of Indonesia's total gross domestic product (GDP).

MSMEs absorb 97% of the total workforce and 99% of the total employment. However, digitalization in this sector needs to be further boosted because of the 64,2 million MSME units, only 13% of them utilize digital technology in managing their business.

The pandemic is proof of the importance of migration to digital. According to the central bank, there was an economic downturn for as many as 87,5% of MSMEs because it was affected by the pandemic. However, this also shows that 27,6% of MSMEs operating online actually experienced an increase in sales in 2020 and beyond.

Pawoon continues to encourage this spirit as he enters his seventh year. In a joint interview DailySocial, Chief Strategic Officer of Pawoon Ivan Ekancono said that the level of MSME resistance to POS services is actually getting smaller day by day because they realize that digital can help their business rather than constantly making records manually, but are often confused about where to start.

"From our team's observations in the field, most of them are aware but don't really understand. "Once we educate them and provide a live demo, they become more focused and can immediately use the POS," he explained.

More than just a POS

Pawoon is not the only player in the segment that has made the biggest contribution to the country, out there there are many players of his generation and new players who are trying at the same cake. Therefore, Pawoon has evolved into more than just a POS so that it can continue to accompany all stages of business whose needs continue to grow.

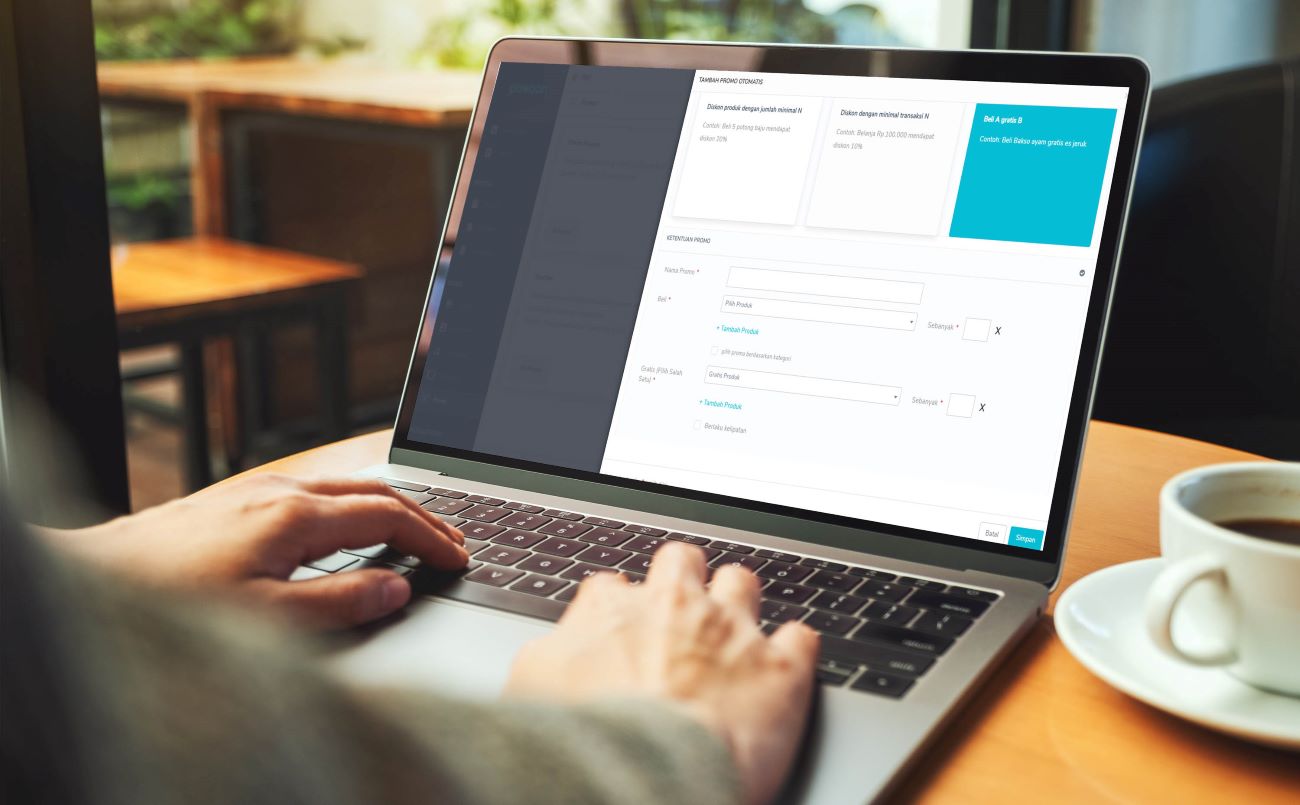

Ivan continued, Pawoon's basic feature is to help business owners record transactions and manage data better. Now offers more features advance, such as inventory management, employee attendance, and promotions that can be accessed at any time.

Next, it integrates with third-party partners to provide additional features. Among them, together with Forstok to combine online and offline stores from business owners, so that all transactions from various platforms can be managed in one Pawoon dashboard.

Then, GrabFood so business owners can receive orders from the channel GrabFood and connect too with GrabExpress and integrated with e-money players, such as GoPay, OVO, DANA, and LinkAja. "We have also partnered with p2p lending and banking to provide easy access to capital so that business owners can continue to develop their businesses."

In order to adapt to the O2O business model, Pawoon released PawoonLive! to accommodate its FnB merchants. This is a self-ordering platform that functions to help customers order food online, be it dine-in, takeaway or delivery because it has been integrated with Go-Send and GrabExpress. The payment process is completely digital and the ordering process is via WhatsApp Order or the microsite provided by PawoonLive!.

In order to provide added value to merchants, thanks to DIVA's entry into the business ranks of shareholders in Pawoon, now a number of DIVA services are available in Pawoon. One of them is the PPOB credit purchasing and payment service, so that when consumers from a merchant visit they can buy credit or pay bills instantly.

“There are still many integrations with DIVA that we will carry out in the future. Of course, we will first look at the priority scale because it has to adapt to the needs of our merchants."

Outside the DIVA group, Pawoon collaborates with Telkomsel to expand POS adoption through the 99% Usahaku application. In this bundling package, Telkomsel provides an additional 2GB data package for merchants who subscribe to Pawoon. This integration makes it easier for Pawoon to reach new merchants, as claimed Telkomsel also has its own MSME base.

Ivan explained, with all the features available and continuing to increase in the future, it strengthens Pawoon's position for all levels of business, even MSMEs. Pawoon only became serious about the MSME segment in 2019 after previously only playing in the medium to upper business segment. At that time, the development of MSMEs increased rapidly even to this day.

In its composition, Pawoon has more than 25 thousand merchants consisting of 60% MSMEs and the remaining 40% enterprises. Most of these merchants are engaged in FnB, retail and service businesses (salon, Car Wash, laundry, and so on). All of these merchants are spread across 250 cities throughout Indonesia.

The company has created a subscription system to access its features, starting from IDR 299 thousand per month for the basic package and IDR 599 thousand for the pro package. However, Pawoon also has a free service for small businesses but with limited features.

Ivan looked pricing This has been measured by the ability of merchants' spending levels. Even together Telkomsel, merchants also get additional data packages.

To maintain retention, Pawoon carries out many activation activities, including sharing knowledge with large merchants to share success stories and other activities that involve upgrading capabilities. “Because of the pandemic, we made the activities online. In fact, it is able to attract thousands of visitors for one sharing event."

Next plan

Not only the POS business for MSMEs, the company also has a B2B business to help develop more massive POS adoption with other corporations who are interested in entering this segment. According to Ivan, POS is currently a segment that is being looked at a lot because of its bright prospects, considering that there are still many MSMEs go digital and become pintu a good gateway to introduce more varied digital services in the future.

Next, this year the company will make its merchants Laku Pandai agents with one of the state-owned banks. Ivan said, merchant can provide financial services to its consumers, such as inter-bank transfers to selling financial products, be it insurance or savings services.

"So our coffee shop merchants can serve consumers who want to transfer to the bank, the money can go directly to the designated account, or you can also top up e-toll."

Although not explained in detail, Ivan detailed that currently the share ownership structure in Pawoon is still filled with DIVA and Kejora Ventures. Kejora also invested in DIVA in August 2019 through a special fund called InterVest Star SEA Growth I which is managed together with InterVest.

Responding to the company's potential IPO, Ivan said that the urge was there, but he wanted Pawoon to be able to take the floor "properly", not just looking for funding.

"We want Pawoon to one day be able to list as a public company with shares that the market really enjoys. "Investors buy because they are happy with Pawoon products and believe in the company, so Pawoon shares can be more attractive," he concluded.

Sign up for our

newsletter

Premium

Premium