Global Healthtech Industry Growth Records in 2022

Telemedicine developer startups and healthcare digitization systems dominate funding in this sector

Industry healthtech growing rapidly during the Covid-19 pandemic due to restrictions on interaction while consumers and providers are looking for ways to access and provide health services safely. However, as the pandemic has started to recede, it is reported that this industry is losing its teeth.

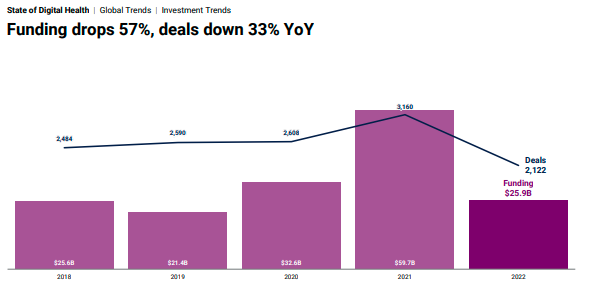

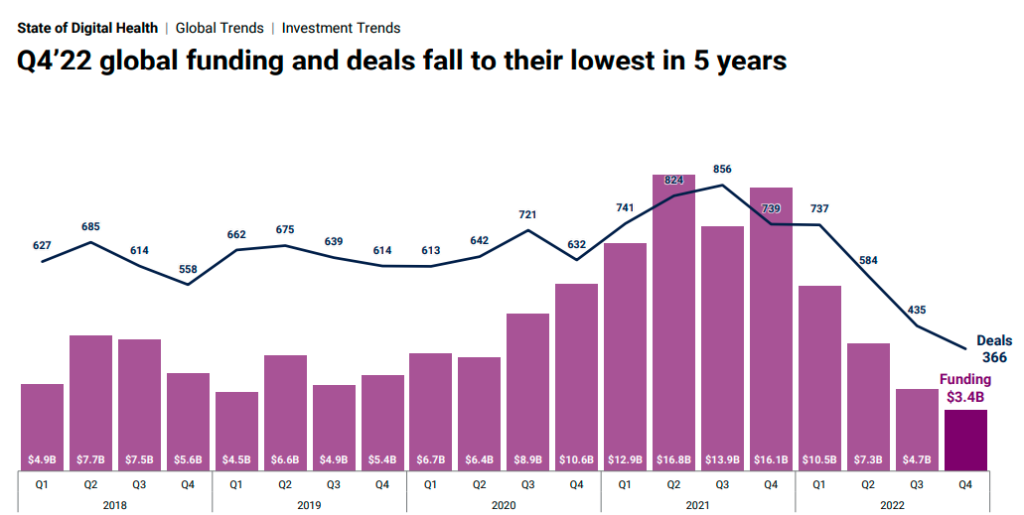

CBInsight through a report entitled "State of Digital health" shows that in the last five years, global funding for the industry healthtech quite dynamic. Had experienced a significant increase in 2020-2021, but again decreased in 2022. The lowest point in global funding in the industry healthtech is in Q4 of 2022.

Digital health startup funding will drop to $25,9 billion in 2022, down 57% from last year's record high of $59,7 billion. Funding fell each quarter, with Q4'22 representing the lowest quarterly funding in the last 5 years. The digital health space saw 2.122 deals in 2022, down 33% from 2021.

A decline in activity also occurred in the number of M&A deals by 50% YoY in 2022. M&A activity in the digital health space declined for 3 consecutive quarters. In Q4'22 there were only about 21 M&A deals. This is the lowest quarterly figure in the last 5 years.

For healthtech Globally, the United States (US) is still a country with industrial growth healthtech the fastest. On the investment side, 74% of global funding in Q4'22 worth $2,5 billion went to companies healthtech US-based. Meanwhile, funding for Asia-based digital health companies reached just $0,4 billion in Q4'22.

On the valuation side, Q4'22 marked the first quarter without births unicorn only since 2018. 2022 will see 107 startups achieve the status unicorn in total, making it the second highest year for births unicorn after 2021. The US leads, accounting for 81% of all new ones. unicorns in 2022.

Register unicorn top Globally, it is dominated by US players, led by Devoted Health with a current valuation of $12,6 billion, followed by Talkdesk with a valuation of $10 billion. The European country included in this list is France with the startup Doctolib. The Asian representative on this list is We Doctor from China.

The dominating solution

Technology is changing the medical device industry. Technology companies leverage artificial intelligence (AI), advanced devices, sensors, and other technologies to speed up diagnosis, improve the quality of ongoing patient care, and increase the overall accuracy of patient diagnostic results.

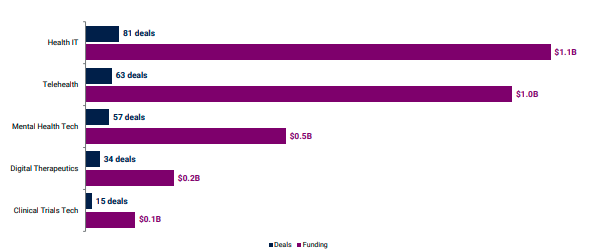

CBInsights divides healthtech into five main categories, namely Clinical Trials Tech, Digital Therapeuthics, Mental Health Tech, Telehealth, and Health IT. The last two names are the solution healthtech which scored the most deals and funding in 2022.

Health IT itself covers the area where information technology (IT) is involved in the design, development, creation, utilization and maintenance of information systems in the health industry. Automated and interoperable information systems will continue to improve medical and public health care, lowering costs, increasing efficiency, reducing errors and increasing patient satisfaction, while optimizing reimbursement for outpatient and inpatient healthcare providers.

Regarding players who provide health IT solutions, many of them are still focused on the US, for example Dispatch Health, Komodo Health and Maven. From Asia, India is a pioneer by presenting BeatO, developer of a health monitoring app that helps diabetes patients track their glucose levels.

While telehealth or telemedicine is the use of digital information and communications technology to access health care services remotely and manage patient health care. From Southeast Asia, applications such as Doctor Anywhere and Singapore-based Speedoc made it to the list top equity deals in Q4'22 by CBInsights.

landscape healthtech in Indonesia

More Coverage:

The Covid-19 pandemic has become an important catalyst for the Ministry of Health (Kemenkes) to transform the Indonesian health industry. Like a super fast train, the Ministry of Health has implemented a number of very progressive steps over the past year to start its transformation. This condition also encourages increased use of telemedicine.

Since the end of 2021 until now, the big agenda of the Ministry of Health is reflected in the realization of the launch (1) digital transformation roadmap(2) regulatory sandbox, (3) the Indonesia Healthcare System platform named "Satu Sehat", and—one of the most significant—(4) new regulations regarding the implementation of Electronic Medical Records (RME).

In fact, technology-based health services or healthtech in Indonesia this existed before the pandemic. We know HealthReplies.com, Halodoc, Clickdoctor, and Smart Clinic. Services offered range from teleconsultation, marketplace health products, to digitizing the health ecosystem.

Teleconsultation is one of the services healthtech one of whose popularity has skyrocketed is to access mental health services. This is explained in the report "Indonesia's Mental Health State and Access to Medical Assistance" published by market research platform startup Populix.

Regardless, there is still a lot of innovation in the field healthtech which can be explored so that it is not limited to teleconsultation services alone. Survey The report of Statista project market value digital health in Indonesia will reach $1,98 billion in 2022. The largest segment is projected to come from digital fitness and well-being with total projected revenue of $1,14 billion in 2022.

Sign up for our

newsletter