Product Integration Gojek In-Depth on Tokopedia, GoPayLater is Now Available

The signal for Gopay's presence at Tokopedia is getting closer

Merged company from Gojek and Tokopedia, Goto, the deeper the product integration between the two on each platform. The latest information is the presence of services fintech BNPL (buy now pay later) from Gopay, namely GoPayLater which is now available on the Tokopedia application.

There has been no official information provided by the company regarding the latest news. The presence of GoPayLater is certainly an indication of the clarity of Tokopedia's efforts to reduce the dominance of OVO on its platform.

Before GoTo was inaugurated to the public, the Tokopedia loyalty program that had used OVO Points finally revived TokoPoints in April 2021 after being released in 2018.

Through OVO Points, previously Tokopedia users could earn points to earn cashback from every transaction made on Tokopedia. OVO Points can be used as a payment method, convert 1 point worth Rp1.

TokoPoints can also be exchanged without a minimum/maximum point limit for all transactions for physical products and various digital products. The use of TokoPoints for physical product transactions can also be combined with other promos and Free Shipping at the same time.

Tokopedia also provides gamification that users can use to collect TokoPoints every day.

The emergence of GoPayLater means that it is only a matter of time until Gopay finally arrives at Tokopedia. So far, OVO is the main payment method available on the Tokopedia main page for various transactions. At Tokopedia, there are instant balance top up features, transfers, and payments with QR codes that are directly connected to OVO.

Quote from Deal Street Asia, Tokopedia and its affiliates own a 41% stake in OVO. In details, Tokopedia controls a 36,1% stake in OVO's holding company, Bumi Cakrawala Perkasa, Tokopedia Co-Founders Leontinus Alpha Edison and William Tanuwijaya own 5% through Wahana Inovasi Lestari which was acquired Grab in February 2020. Meanwhile Grab Inc. holds a 39,2% stake in parent OVO.

GoPayLater itself is a product of Findaya, a startup p2p loans acquired Gojek in 2018. In its development, through joint interviews DailySocial in February 2021, GoPayLater was delivered already expand its service coverage, not only can be used for all transactions in the application Gojek and its affiliated offline merchants.

Number of partners E-commerce Those that can accept payments with GoPayLater are Blibli, JD.id, Zalora, and many more.

It was revealed that last year the growth of transactions with GoPayLater increased by 3,3 times. The largest transactions were contributed by purchasing food through GoFood and paying bills on GoBills.

"Gopay Paylater is one of the most popular services for users, as evidenced by the increase in transactions up to 3,3 times throughout 2020 with NPL below the industry," said Head of Growth GoPayLater Neni Veronica.

Service penetration fintech

Industry which is the domain of GoPayLater continues to show a growth trend in Indonesia. Based on OJK statistics, in the first semester of 2021 the distribution figure reached Rp. 70,88 trillion, almost matching the achievement of last year's Rp. 74,41 trillion. If you look at it cumulatively, it has reached Rp221,56 trillion.

This figure is predicted to continue to grow, given that there are still many community groups underserved and unbanked. Players such as GoPayLater who carry BNPL or digital credit cards, fill out gap the need for adequate financial access with a digital approach.

More Coverage:

Competition in the field of electronic money itself is no less interesting. In Indonesia, the competition map is getting sharper, including the five dominant players in the market. They are none other than Gopay, OVO, DANA, ShopeePay, and LinkAja. In various studies, the five alternate positions with each other in each period.

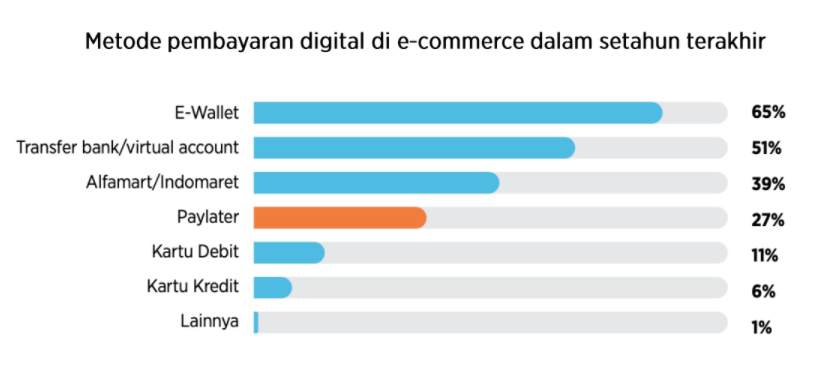

According to the survey results summarized in Fintech Report 2020, there are five digital payment applications that are most widely used according to respondents. Sequentially include Gopay (87%), OVO (80,4%), Dana (75,6%), ShopeePay (53,2%), and LinkAja (47,5%).

Meanwhile, according to a survey conducted by Neurosensum, ShopeePay was recorded to dominate the electronic money market share during the November 2020-January 2021 period with a percentage of 68%. The next position is OVO (62%), then DANA (53%), GoPay (54%), and LinkAja (23%). In this finding, respondents were noted to use multiple e-wallets for different needs.

In terms of frequency of use, ShopeePay is also in the top position with a combined total of 14,4 transactions per month or 9 times (Online) and 5,4 times (off line). OVO followed in second place with a total of 13,5 times of use per month or 8,1 times (Online) and 5,4 times (offline). In third place, GoPay with a total of 13,1 times per month or 8 times (Online) and 5,1 times (off line).

Sign up for our

newsletter