Payment Startup Durianpay Pockets 28 Billion Rupiah Led by Surge

Durianpay as a payment aggregator works closely with several payment gateways and fund transfer providers to build solutions for various types of businesses

Payment solutions startup Durianpay announced a $2 million (over 28 billion Rupiah) funding round led by Surge from Sequoia Capital India. Also taking part in the round were AC Ventures, Kenangan Fund, and angel investors other prominent. ranks angel investors These include Ankiti Bose (Zilingo), Ankit Jain, Harshet Lunani (Qoala), Joe Wadakethalakal (ex-Brilio), Reynold Wijaya (Modalku), Sai Srinivas (MPL), and Tanay Tayal (Moonfrog).

Durianpay will use the fresh funds to develop more solutions and deepen its business penetration to be accepted by more users.

Durianpay is a one-stop payment provider that enables businesses to grow and thrive through a one-stop solution for processing checkout seamless, easy-to-integrate API and modern dashboard. This startup was founded by Antara Sara Mathai, Kumar Puspesh, and Natasha Ardiani in September 2020 in Jakarta.

The backgrounds of the three have been in the industry for a long time fintech. Mathai has led the product team at Citrus Pay and OnlinePajak. While Puspesh was previously the founder of Moonfrog, a game development company from India. Also, Natasha who has led ShopeePay, Shopee PayLater, and the loan and collection business at OVO.

“Durianpay offers a one-stop solution for businesses in the region to better manage their payment processes. We built our payment products and solutions with business and developer aspects in mind, with a vision to modernize payments by providing a next-generation product experience that is secure and customizable," said Durianpay Co-Founder Natasha Ardiani in an official statement, Thursday (12/8).

Suspected increase in transactions E-commerce

This service is also present because in the Southeast Asia region there has been an increase in transaction volume E-commerce significantly in recent years. However, this increase is not accompanied by the development of payment solutions, especially in Indonesia, which is still fragmented, manual, and not yet optimal.

This is what causes the drop-off high at the time checkout payments, verification and reconciliation processes for merchant which is still manual, prone to errors, and fraud.

For founder see a significant opportunity for businesses of all sizes to benefit from an easy-to-operate, fully integrated and fully integrated payment system. Durianpay as a payment aggregator cooperates with several payment gateway and fund transfer providers to develop solutions needed by various types of businesses.

For example, automatic reconciliation features, instant payment links, promos, and other features that aim to optimize transactions between sellers and buyers. Through a single integration, Durianpay offers businesses and developers access to a wider range of payment options, interface code-free so businesses can create workflows that deploy payment infrastructure automatically.

Checkout and payments are now fully customizable directly by merchants. With this solution, businesses have the ability to change their payment infrastructure without requiring external intervention. This includes the ability to connect third party solutions for fraud detection, KYC, CRM, Business intelligence directly into the system without incurring additional burdens on product, financial, or technology teams.

Since its launch, Durianpay has been adopted by more than 15 businesses in Indonesia by leveraging innovations such as split payments and multi-branch settlement. Kopi Kenangan, Alta School, and Chilibeli are some of the users of the Durianpay solution.

Durianpay is part of Surge's fifth cohort, which consists of 23 companies that have developed state-of-the-art digital solutions that help companies and individuals in the Southeast Asia region. The company has headquarters in Singapore and Indonesia.

In the cohort, apart from Durianpay, there were two other local companies that passed as participants. They are Rara Delivery (revolutionary instant delivery for e-commerce brands) and Bukugaji/Vara (an easy staff management platform for MSMEs in Southeast Asia).

Digital payment potential

One of the factors that forces businesses to adopt a system similar to Durianpay is the high adoption of digital payment services in the community. Especially to meet their daily needs, nowadays not a few people, especially in urban areas, are using digital wallets more through their smart phones.

More Coverage:

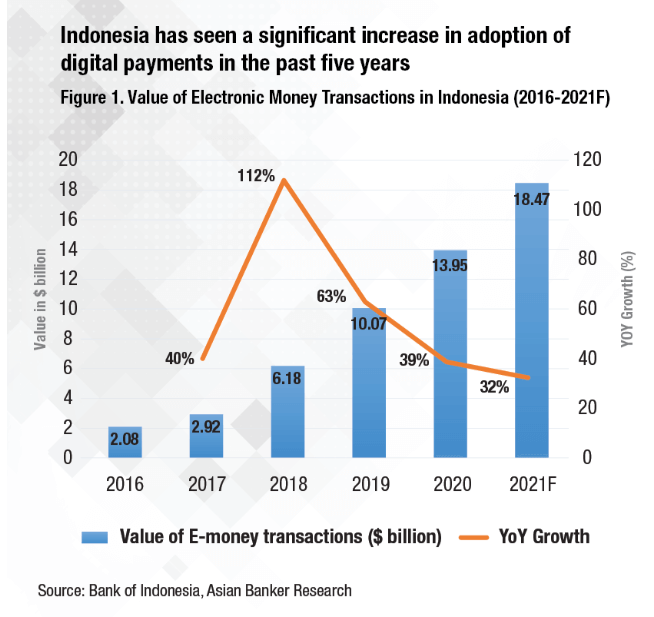

According to data, the adoption of electronic applications in Indonesia also continues to increase from year to year -- both in terms of adopters and the value of the transactions generated.

Seeing this potential, the platform fintech payment also continues to sharpen its products. Apart from Durianpay, other payment provider platforms have also been present in Indonesia. Starting from Midtrans which has become a financial group family Gojek, then there are Xendit, Doku, Xfers (Fazz Financial Group), Faspay, and others.

Midtrans also recently presented a Payment Link product to make it easier for players social commerce process digital payments by sharing a special link. Unlike previous models which had to integrate APIs, users simply created a unique link to accommodate each payment.

Sign up for our

newsletter