Durianpay Revolution Ease of "Checkout" Process for Online Business

Offer a one-stop solution for payment systems; released Instapay to target social commerce sellers and freelancers

In the midst of the excitement transaction E-commerce in Indonesia, there are still payment solutions that are still fragmented, manual, and not yet optimal. This condition results in high drop-off When checkout payment. Even for merchants, the manual verification and reconciliation process is very prone to errors and fraud.

The opportunity that startups want to solve Durianpay payment aggregator. Startup founded by Antara Sara Mathai, Kumar Puspesh, and Natasha Ardiani last year. All three have deep experience in the payments industry.

Mathai is experienced in building products payment gateway in India and the United States, then brought it to Indonesia and built products to make it easier for consumers to pay all kinds of taxes at OnlinePajak, Mathai's former company. Mathai met Puspesh while the two were working on Zynga, the platform Gaming leading in India. Puspesh worked at Moonfrog, one of the developers game in India.

Meanwhile, Natasha has strong experience as a public policy practitioner and began her career as a entrepreneur for the first time. Previously, Natasha worked in Shopee's digital payments, namely ShopeePay and Shopee PayLater, and led the loan and collection business at OVO.

In a joint interview DailySocial, Durianpay Co-Founder Natasha Ardiani explained by looking at the challenges and solutions needed to streamline the process checkout, Durianpay develops payment solutions that make it easier for merchants and consumers.

One stop solution

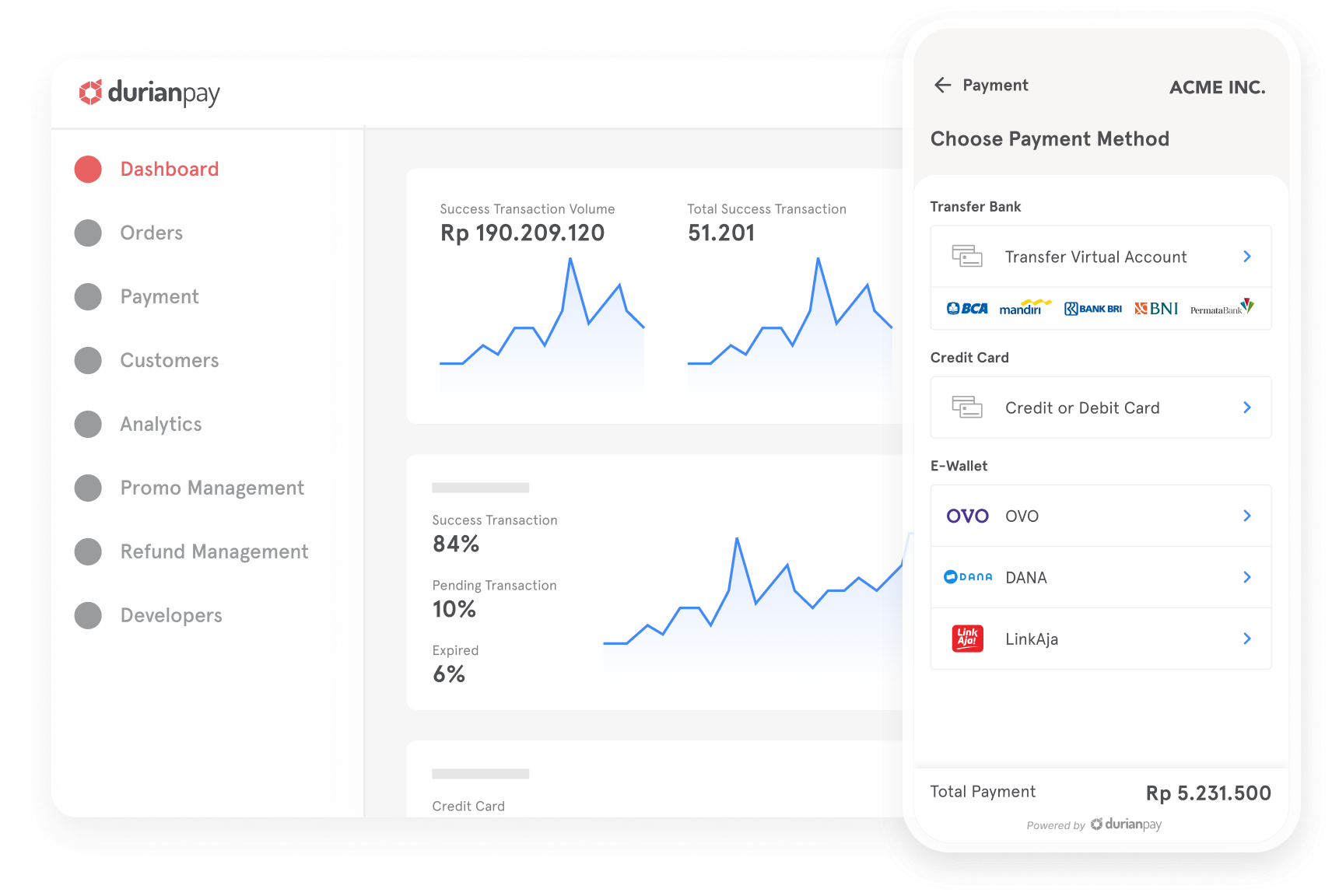

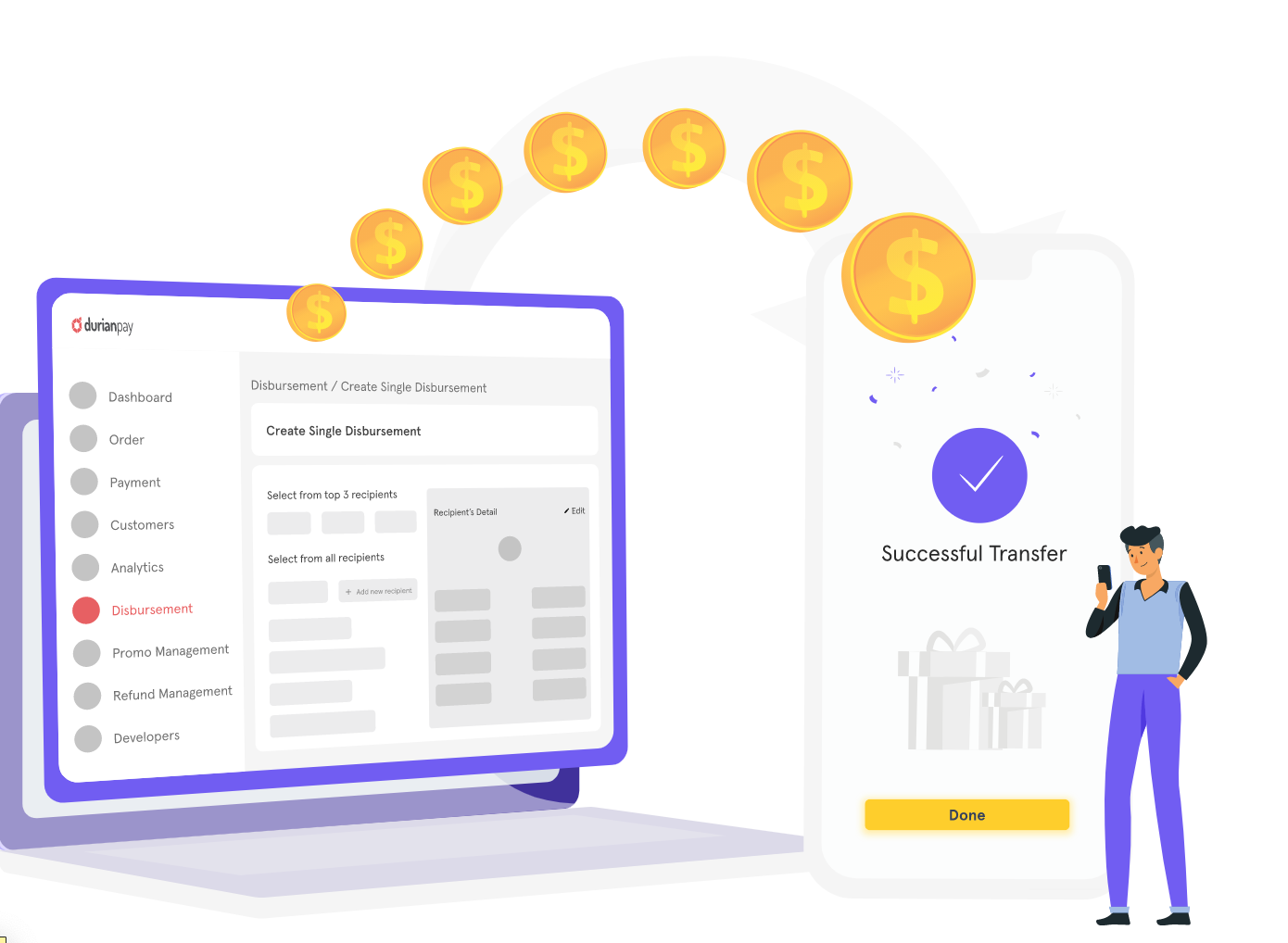

Durianpay as a payment aggregator works with a number of payment gateway and fund transfer providers to build solutions needed by merchants of various business scales. Among them, the automatic reconciliation feature; instant payment; promo feature (make it easier for sellers to curate promos based on payment methods).

Then, features split-payment (allowing consumers to pay for one order with two or more different payment methods); and refund management to simplify the process of refunding to consumers. "These features differentiate Durianpay from similar platforms," he explained.

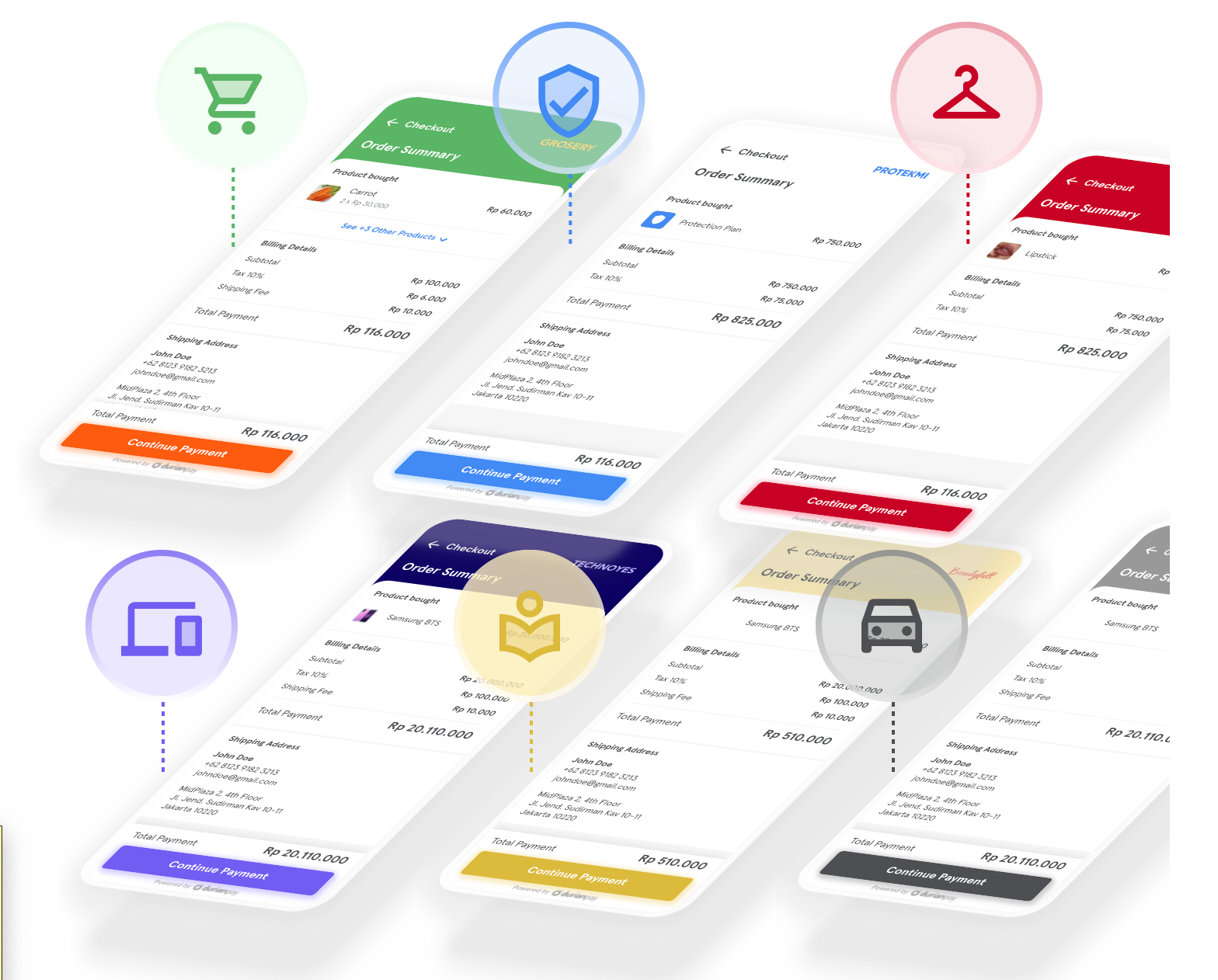

The solution is plug-and-play making it easier merchant choose which solution they need. Company-provided payment methods, including bank transfer (virtual accounts), direct discharge, debit and credit cards, payments through retail outlets, electronic money, payments paylater, to internet banking. “We only charge fees based on receipt of payment and successful delivery of payment.”

Merchant who are already utilizing the Durianpay solution, among others Ruangguru, Memories Coffee, Super Apps, Chilibeli, Home Shox, and many more. "We target large to small businesses as clients/consumers are directly related to the solutions offered and can be applied at all types and levels of business."

Not only targeting startup companies, Durianpay also targets business people social commerce to freelancers. Natasha explained, currently several solutions provided by payment SaaS B2B players require complex integration, so business owners have to do a lot of manual intervention for payment reconciliation. The majority of them also charge high prices for small entrepreneurs.

“Trying to solve this problem, Durianpay is innovating by presenting products that can bridge the technology gap in the market.”

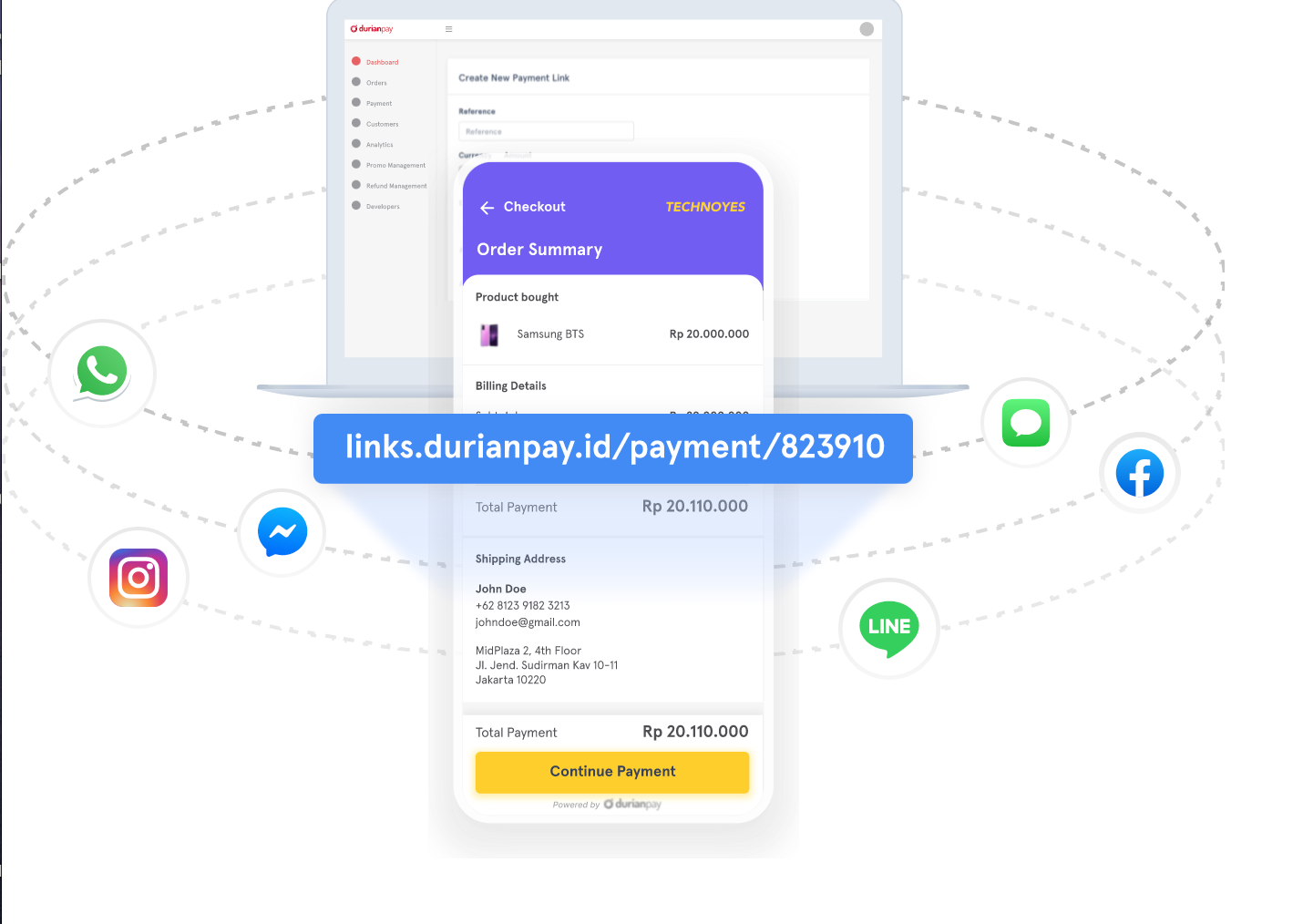

The solution is named Instagram. Through a single integration, the company offers access to a wide range of payment options and a codeless interface that businesses can use to automate workflows. Also, implementing a payment infrastructure that is instant and easy. Process checkout and payments are fully customizable and modified by the business owner.

"We want to continue to innovate to produce modern and relevant products in the market and later make any type of business able to facilitate payments for anything and anywhere," concluded Natasha.

Digital payment potential

A number of companies with similar solutions, such as Midtrans with its Payment Link product, are also targeting the same solution as Durianpay. Xendit with the Xendit Bisnis application also offers the convenience of selling and managing business via smartphones. Beyond that, there are DOKU, Xfers, Faspay, and others who are trying to work on more business segments to enjoy the convenience of an integrated payment system.

More Coverage:

One of the factors that forces businesses to adopt the above system is because of the high adoption of digital payment services in the community. Especially to meet their daily needs, nowadays not a few people, especially in urban areas, are using digital wallets more through their smart phones.

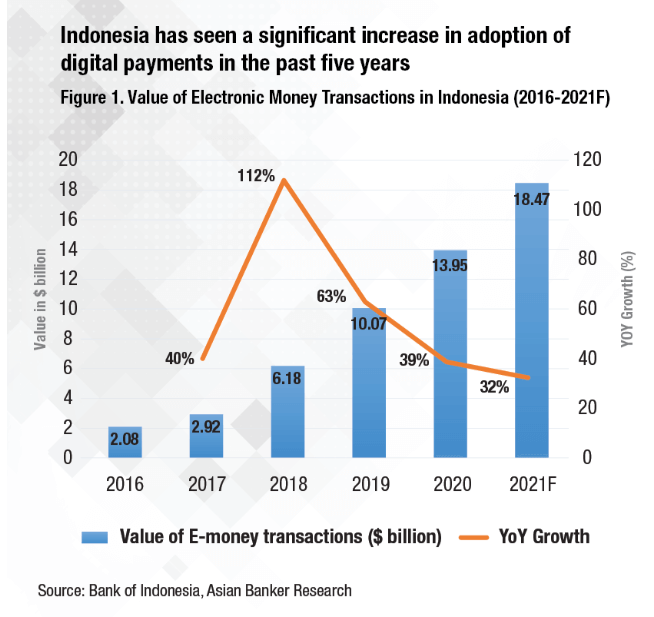

According to data, the adoption of electronic applications in Indonesia also continues to increase from year to year — both in terms of adopters and the value of the transactions generated.

To maximize this potential, Durinapay also recently received funding of $2 million (over 28 billion Rupiah) led by Surge from Sequoia Capital India. The fresh funds will be used to develop more solutions and deepen its business penetration to be accepted by more users.

Sign up for our

newsletter