Paylater is Increasingly Interested by Consumers for Online Shopping

Paylater accounts for 2,9% of total global e-commerce transactions in 2021 and is projected to increase to 5,3% in 2025

Rapid development E-commerce contributed to the significant growth of the digital payment ecosystem in Indonesia. Because the platform presented can play a significant role in facilitating transactions with various digital payment methods.

After the digital wallet era, now the use of paylater consumers are getting more attention when transacting on the platform E-commerce. Based on the latest report Kredivo titled "Indonesian E-commerce Consumer Behavior"as of June 2022, paylater (17%) became the most frequently used digital payment method after e-wallet (53%) and bank transfers/virtual accounts (20%).

This report also records users paylater on the platform E-commerce increase to 38% in 2022 compared to last year which was around 28%. This survey was conducted in March 2022 on 3500 respondents throughout Indonesia.

In their findings, respondents use paylater for a number of reasons, mainly to buy urgent/urgent needs (58%), shop with short-term installments or less than one year (52%), and get more attractive promos (45%).

However, some respondents are not interested in using paylater because the main reasons do not want to increase debt (43%), fear of being wasteful (35%), and fear of fines if late in paying bills (30%).

"Some consumers have concerns in managing their finances. Here the provider paylater have a role to make marketing strategies that can encourage awareness on the use of paylater wisely. That way, they can manage their expenses," the report said.

Consumer behavior paylater

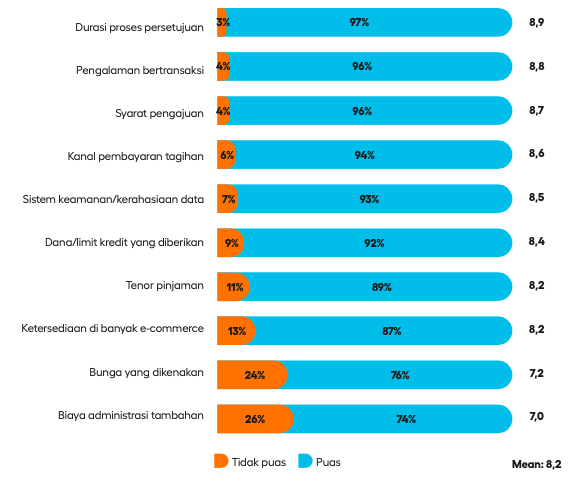

Judging from usage behavior, as many as 70% of respondents mentioned payment flexibility as the main consideration in choosing paylater, Installment tenor varies (53%), can be used on many platforms E-commerce (49%), and limit large loans (35%).

Based on the transaction category, 90% of respondents use paylater to shop online, 50% for buying internet data package, and 49% for monthly billing.

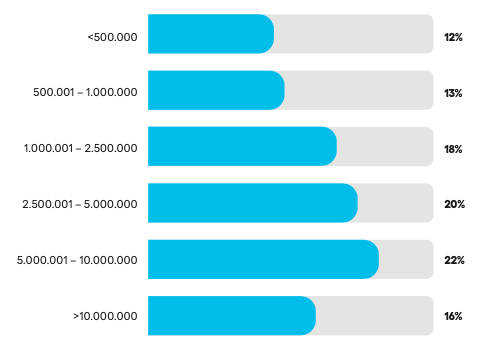

Meanwhile, almost 60% of users paylater spend less than Rp 500 thousand per month when shopping online throughout 2022. On average, respondents spend less than Rp 250 thousand (29%), Rp 250 thousand-Rp 500 thousand (28%), Rp 500 thousand-Rp 1 million (24%), and above IDR 1 million (19%) for transactions with paylater.

Potency paylater

According to the Global Payments Report published by FIS, companies for mobile devices to report the US-based fintech, paylater accounted for 2,9% of total transactions E-commerce globally in 2021 and is projected to increase to 5,3% in 2025.

The data shows great potential paylater as one of the consumer's preferred digital payment methods on a global scale. This is also confirmed by the IDC report on "How Southeast Asia Buys and Pays: Driving New Business Value for Merchants" which indicates the use of paylater in e-commerce transactions in 2020 reached $530 million.

More Coverage:

This figure is equivalent to 58% of the total usage paylater on e-commerce platforms in Southeast Asia of $910 million in 2020. IDC estimates usage value paylater in e-commerce in the region to reach $8,84 billion in 2025, an increase of 8,8 times compared to 2020.

Meanwhile, citing the e-Conomy SEA 2021 report, paylater This is an option to increase financial access, considering that credit card penetration in Indonesia is still very low. Moreover, paylater offers easy access and how to use because the products are already integrated in the process check-out on e-commerce platforms.

Economist and Director of the Center of Economic and Law Studies (CELIOS) Bhima Yudhistira assesses that e-commerce and digital finance play a significant role in encouraging wider penetration of digital services in Indonesia. If this positive trend continues, he believes that economic equality can be realized faster with the support of the digital ecosystem.

Sign up for our

newsletter