OVO Collaborates with Bareksa and Manulife to Launch Investment Features

Money market mutual funds are the first product of this e-money and e-investment synergy

The payment platform and digital wallet OVO today (26/1) launched its newest feature "Invest" in collaboration with Bareksa and Manulife. Money market mutual funds are the first product of this synergy, targeting millennials who are just starting to explore the investment world.

President Director of OVO and Co-Founder/CEO of Bareksa Karaniya Dharmasaputra said, “The launch of the Invest feature is part of our commitment to provide affordable, reliable, and convenient access to investment management, especially for novice investors. The product that we provide exclusively on the OVO platform is the Manulife OVO Bareksa Likuid (MOBLI) money market mutual fund managed by Manulife Aset Manajemen Indonesia, one of the largest investment management companies in the world.”

Referring to data from the Financial Services Authority (OJK), the Financial Inclusion Index in Indonesia currently reaches 76,2 percent. Meanwhile, the level of financial literacy shows a number that is still low at 38,0 percent with only 1,7 percent entering the capital market area. To answer these challenges and problems, OVO is supported by Bareksa as a Mutual Funds Selling Agent (APERD) creating a new breakthrough by integrating e-money and e-investments.

Prior to this, several investment platforms also integrated with various consumer digital services. For example, what Pluang did by entering the Dana dan ecosystem Gojek. In fact, because of the high market interest in mutual fund investment, Bukalapak has also form a separate business unit focused on that segment.

"Just as we saw with the integration of Alipay and Yu'e Bao in China, which has recorded great success in introducing massive mutual fund investment among millennials. In developing this breakthrough, we have consulted with Bank Indonesia (BI) and OJK. Therefore, we are grateful for the support of BI and OJK who are pro-innovation and visionary in the use of fintech to increase financial inclusion and deepen our financial markets," explained Karaniya.

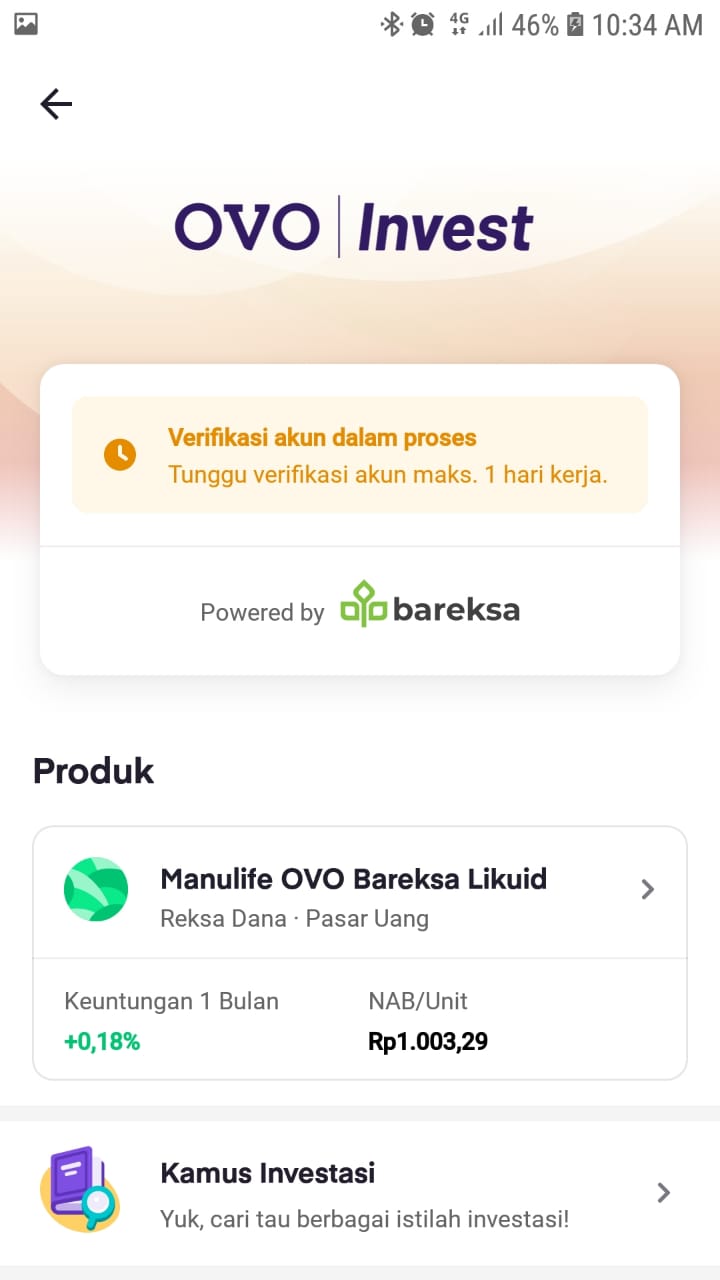

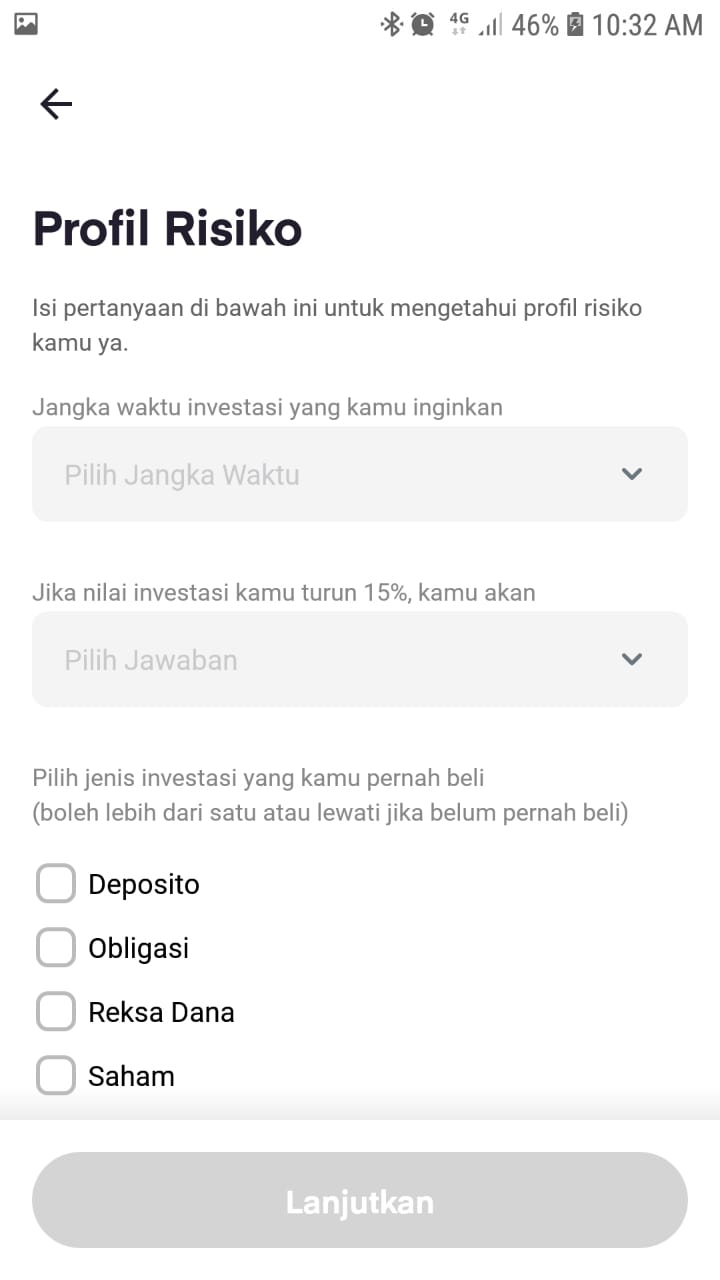

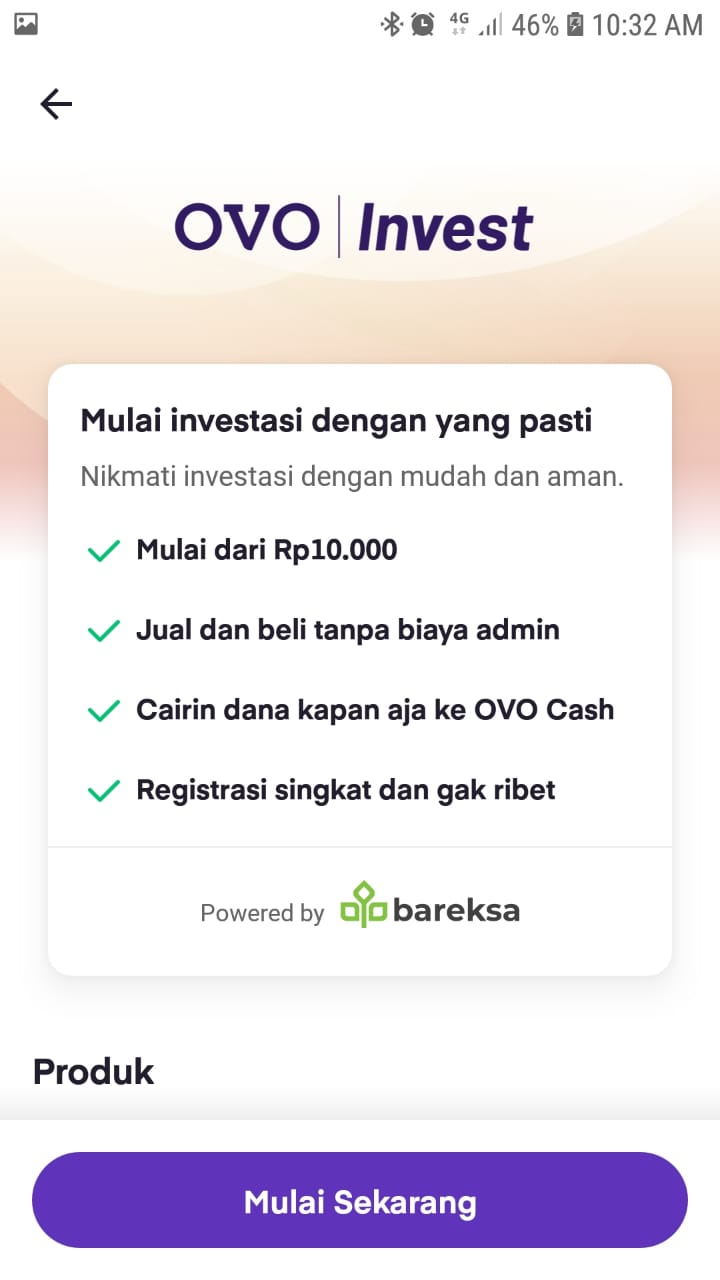

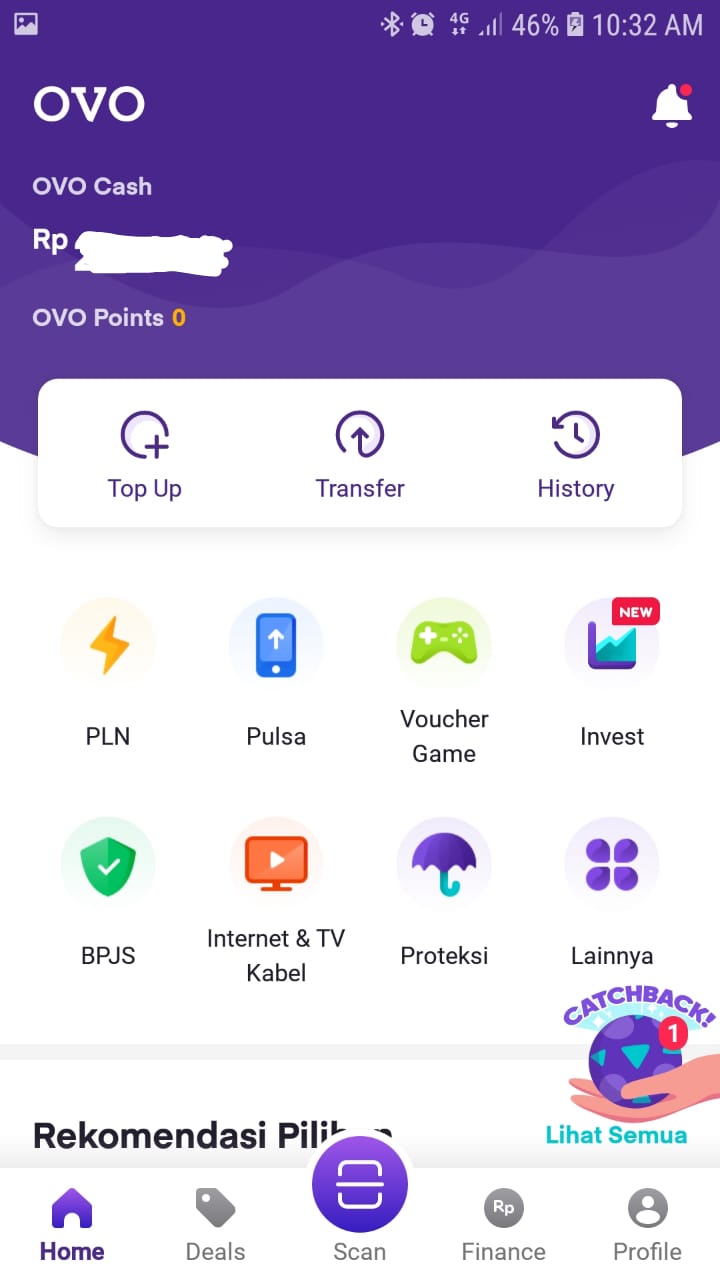

MOBLI money market mutual funds are available exclusively on the OVO app. Users who have updated the service will find the "Invest" feature on the main OVO page. After entering the "Invest" feature, users only need to fill out a risk profile and wait for the verification process and can immediately set the nominal they want to invest.invest starting from Rp. 10 thousand.

More Coverage:

In addition to offering the convenience and convenience of transacting [shopping, paying bills, etc.] and investing in one platform, another advantage is the instant disbursement process, which allows investors to withdraw their investment directly into their OVO Cash balance.

One of Financialcoach who was also present at the launch of OVO "Invest", Philip Mulyana also stated that investing in mutual funds can also be a good emergency fund savings option for novice investors. The consideration is that money market mutual funds are one of the safest investment instruments but provide a hefty return.

Sign up for our

newsletter