OJK Issues Carbon Exchange Rules

POJK No. 14 of 2023 contains guidelines and references for carbon trading

The Financial Services Authority (OJK) has just issued regulations regarding Carbon Exchanges following government instructions in achieving reductions in greenhouse gas (GHG) emissions, and in line with the Paris Agreement on climate change.

Delivered in official statement, OJK Regulation (POJK) Number 14 of 2023 contains Carbon Trading through Carbon Exchanges which will become guidelines and references for Carbon Trading through Carbon Exchanges carried out by market operators.

POJK Carbon Exchange is mandated in Law Number 4 of 2023 concerning the Development and Strengthening of the Financial Sector (UU P2SK) to regulate carbon trading through carbon exchanges. The preparation of the POJK on the Carbon Exchange has gone through a consultation process with the DPR's Commission XI.

The following are a number of substances contained in the POJK on the Carbon Exchange:

- Carbon Exchange Operators are required to have paid-up capital of at least IDR 100 billion. This capital is prohibited from coming from loans.

- Carbon Exchange Operators are required to have a business license from OJK.

- Carbon Exchange Operators are required to have approval from OJK to carry out other activities and develop Carbon Unit products.

- Carbon units that can be traded on the Carbon Exchange are Securities and must be registered in the National Registry System for Climate Change Control (SRN-PPI) and Carbon Exchange Operators.

- OJK will carry out supervision on the Carbon Exchange, such as supervising (1) Carbon Exchange Operators, (2) Carbon Trading supporting market infrastructure, (3) Carbon Exchange Service Users, (4) Transactions and settlement of Carbon Unit transactions, up to (5) Parties, products, and/or activities related to Carbon Trading through Carbon Exchanges.

Carbon Exchange

The Carbon Exchange is a market mechanism that regulates trade by bringing together sellers of emission absorption services and buyers who produce greenhouse gases. The Carbon Exchange was formed to achieve the Indonesian government's target of reducing nationally determined GHG emissions (NDC) by 29% on its own or up to 41% with international support in 2030.

Citing the ICDX information that was proclaimed Tempo Newspaper, carbon trading consists of two models, namely voluntary and mandatory carbon trading. The first model involves the voluntary issuance, purchase and sale of carbon credits.

Meanwhile, the mandatory trading model will be implemented according to the mechanism cap and trade determined by a country, namely determining the quota of a company's carbon emissions based on existing criteria and within a certain period. As of February 2023, there are 42 companies allowed to trade carbon emissions.

Innovation in the field of carbon

The need for solutions in the field of green technology (cleantech), particularly decarbonization, began to develop in Indonesia. The emergence of innovation developers in the field of carbon is expected to be able to help companies/industry that have been producing the largest greenhouse gas emissions.

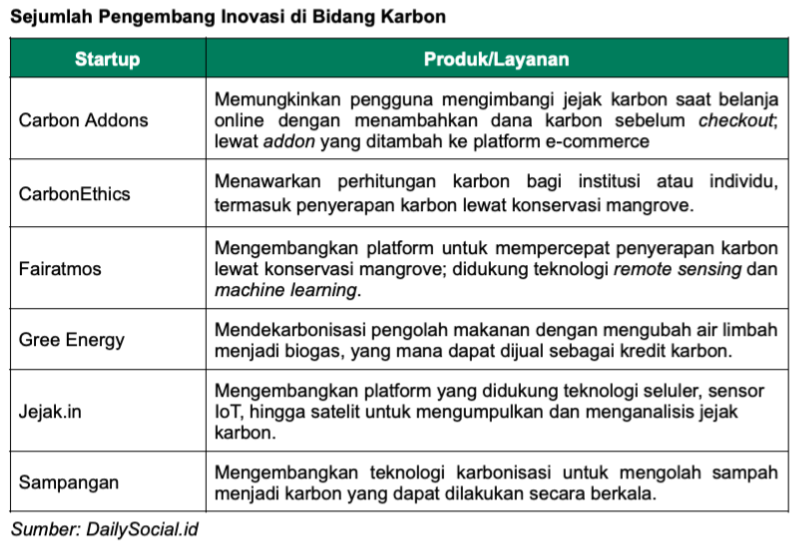

Based on the data collected DailySocial.id, there are various business models offered by carbon innovation developers in Indonesia, for example carbon accounting, carbon sequestration, or carbon footprint data collection.

Impact sectors, especially the environmental sector, are generally difficult to operate due to capital constraints. However, a number of green startups in Indonesia have managed to obtain funding, either through venture capitalists or through accelerator programs.

More Coverage:

Some of them are Fairatmos which received IDR 69 billion in initial funding led by Go-Ventures (now called Argor Capital) and FFB Renewable Creations, and Green Energy which pocketed IDR 49,9 billion in pre-series A funding led by Earthcare Group.

In addition, efforts to achieve carbon emission reduction targets have also stimulated the interest of a number of investment firms, non-profit organizations, and venture builder to provide access to capital focused on impactful solutions. Some of them are East Ventures, AC Ventures, New Energy Nexus Indonesia, and Ecoxyztem.

Sign up for our

newsletter