Modalku Group Gets Additional Debt Funding of 256 Billion Rupiah

The company is also reported to have received additional equity funding from Mitsui Banking Corporation worth $15 million

Modalku Group announced that it has obtained loan funds (debt funding) of $18 million (over 256 billion Rupiah) from a syndicate led by three financial institutions, namely Helicap Investments, Social Impact Debt Fund (managed by Taurus Wealth Advisors), and a financial services group from Japan. This round is part of the funding debt that is being held by the company which aims to raise $120 million.

These loan funds will be redistributed to finance MSMEs in the four countries where the Modalku Group operates.

Separately, according to the information obtained DailySocial.id, Sumitomo Mitsui Banking Corporation (SMBC) invested in equity for Modalku of $15 million (over 213 million Rupiah) in a Series C round.

Previously, in April 2020, Modalku Group announced a series C . equity funding for $40 million from a number of investors, including Softbank through the Growth Acceleration Fund, BRI Ventures, and Sequoia through SCI Investments.

In his official statement, through funding debt With this announcement, Helicap Securities acts as the lead board with a single mandate, along with funding received from impact investors from Europe, such as Triodos Investment Management who has been in the ranks of institutional lenders at Modalku since the end of 2019.

Modalku Co-founder and CEO Reynold Wijaya said, the Covid-19 pandemic is an important test for the resilience of the Modalku Group and he is grateful to have successfully passed it, one way is by using a credit model based on Artificial Intelligence (AI).

"We will use the funds to continue to develop the world of digital lending for SMEs. We believe that this is the beginning of a long-term relationship and will consistently drive the evolution of the company going forward,” he said, Thursday (7/10).

Co-founder and CEO of Helicap Pte. Ltd., David Z. Wang added, helicopter was established with the aim of breaking down barriers for those who need venture capital and those who can provide venture capital. This transaction proves that the interest and ability of individuals and institutions for funding opportunities through private loans remains and is sustainable.

“Helicap is well positioned to provide access to quality loans through our relationships with well-known lenders such as the Modalku Group,” he said.

Modalku Group was founded in 2015 as a startup p2p loans which provides business loans for MSMEs. Companies use technology to support creditworthy MSMEs, but do not have access to financial services. More than 50% of the GDP of each ASEAN member country is contributed by MSMEs, but because many MSMEs do not have a history of credit transactions or loan guarantees, they are often rejected when applying for business loans to traditional lending institutions.

The Modalku Group makes it easy to access funding using alternative data points, including but not limited to MSME cash flows (which indicate their ability to repay loans), to approve loans.

In early February 2021, Modalku Group announced expansion to Thailand after getting a license through crowdfunding loan from the Thailand Securities and Exchange Commission (SEC). By using the Funding Societies brand, such as its operations in Malaysia and Singapore, the company wants to solve the challenge of 3 million MSMEs whose business is hampered because it is difficult to obtain business loans, especially short-term loans.

The issue is the same as in Indonesia because conventional financial institutions there are more focused on long-term loans and loans without collateral.

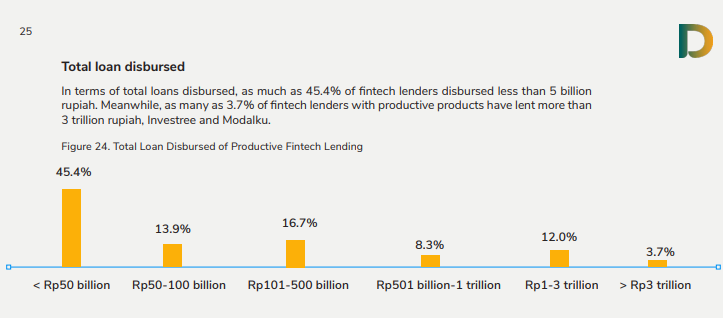

The portion of the productive sector is still minimal

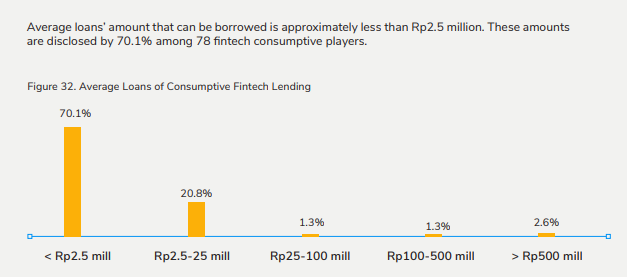

Menurut report DSResearch and AFPILast year, as many as 36,1 million borrowers in the productive sector borrowed Rp. 2,5 million to Rp. 25 million. Only 17,6% of them borrowed more than Rp500 million. This sector still needs to be further boosted by regulators, especially during this pandemic, many MSMEs have been hit and have to survive.

More Coverage:

Sign up for our

newsletter