Can the Indonesian Sharia Bank Giant Empower the State Sharia Fintech Ecosystem?

Bank Syariah Indonesia is a consortium of three state-owned banks that will redefine the Islamic economy in the region

Netti Husna is a biology teacher at a public secondary school in South Tangerang, on the southwest border of Jakarta. In the evenings, Husna teaches Arabic on her front porch, where children of Muslim families gather to read the official language of the Koran. As a devout Muslim, Husna does her best to live her life according to the teachings of Islam. He follows the rules that have been mapped out by generations of religious devout, including how he handles his financial problems. This 50-year-old woman is very careful in choosing financial services that suit her needs.

“I don't use credit cards and I never borrow money from conventional financial institutions because they charge interest, which is part of usury, a practice that is forbidden in my religion,” Husna told KrASIA. His caution now extends to fintech products. "I'm okay with the mobile payment platform because it's allowed by the Indonesian Ulema Council [MUI], but I don't use the feature paylater because it carries the principle like a credit card,” he said.

In recent years, sharia-based fintech platforms have sprung up in Indonesia, offering a variety of services such as loans for micro, small and medium enterprises (MSMEs), as well as hajj and umrah (hajj to Mecca) financing. In collaboration with Islamic banks, Islamic fintech companies bring the Muslim community into financial services. However, Islamic fintech is not as comprehensive as conventional platforms.

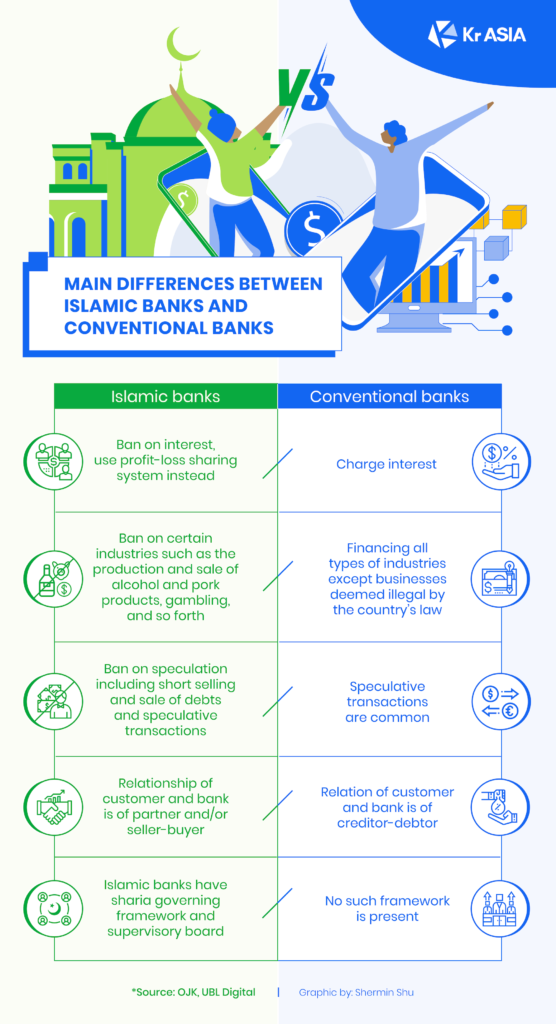

Husna along with millions of other Muslims in Indonesia rely on sharia economics and banking options that comply with Islamic law. One of the fundamental principles is the prohibition of interest charged by lenders and investors. In contrast, Islamic banking operates a system in which profits and losses are shared. Any income from speculation (qimar) or chance (maysir) is also prohibited, as is participation in contracts that involve excessive risk (gharar), such as short selling in the stock and commodity markets. In addition, funds deposited with Islamic banking institutions are not used to support industries that are haram — sinful under Islamic law — such as the production or sale of alcoholic beverages and pork products, gambling, and anything related to pornography.

There are 225 million Muslims living in Indonesia, the largest Muslim population in a single country. To advance the sharia economy, President Joko Widodo launched Bank Syariah Indonesia (BSI) on February 1 by merging three state-owned banks — Bank BRI Syariah, Bank Syariah Mandiri, and Bank BNI Syariah — making it the country's largest Islamic bank. BSI is a new milestone in the Islamic economy in Indonesia. The government and other stakeholders expect BSI to become one of the largest Islamic banking institutions in the world.

Husna is an old customer of Bank Syariah Mandiri. He is not sure how the merger will impact customers like him, but he hopes BSI can provide better and more comprehensive sharia services for Muslims.

Image by Shermin Shu/KrASIA.

Image by Shermin Shu/KrASIA.Sharing infrastructure for Islamic fintech

BSI has a core capital of around IDR 20,4 trillion (USD 1,4 billion). They aim to increase that amount to IDR 30 trillion (USD 2,1 billion) by 2022. This will strengthen the sharia fintech infrastructure, according to Lutfi Adhiansyah, CEO of fintech platform Ammana.

"There are no Islamic banks that issue e-money themselves, because some digital services such as bank accounts lenders and payment gateway can only be issued by BUKU 4 banks [which have prerequisites to have a core capital of IDR 30 trillion]. Current mobile banking services are also very limited, customers cannot open online accounts or use digital signatures. Islamic bank technology is not as sophisticated as conventional banks," said Lutfi to KrASIA. He also serves as the head of the sharia cluster at AFPI, the Indonesian fintech lending association.

With some basic changes that BSI can use as momentum, the fintech platform can integrate with halal megabanks and tap into segments outside lending, such as credit scoring, e-KYC, digital signatures, and so on, said Lutfi. Simply put, the scale of BSI provides an opportunity to reach further than the three institutions that make up the foundation.

The banks that are the backbone of BSI will integrate their customer data to make it easier for fintech companies that work with BSI to offer services to their customers. On a macro level, the presence of Bank Syariah Indonesia shows the government's intention to make Indonesia a center for the Islamic economy on a regional and global scale, on par with Malaysia and Maybank Islamic, the largest Islamic bank in Southeast Asia, even Saudi Arabia and Bank Al Rajhi, which are the largest Islamic banks in Southeast Asia. largest Islamic bank in this world.

Dima Djani, co-founder and CEO of P2P lending platform Alami Sharia, hopes that BSI can formulate new support for the sharia fintech ecosystem, especially in relation to the previously limited funding options, which include institutional lenders for P2P lending and equity financing for the companies themselves. "If we look at conventional banks such as Bank BRI or Bank Mandiri, they provide infrastructure end-to-end to regular P2P lending platforms. They have an arm in the VC field that provides equity for fintech. From an operational perspective, they provide lender funds accounts that make it easier for lenders to conduct funding transactions on the fintech platform. This is still lacking in sharia fintech. "Dima added that with the increase in assets, BSI can direct more funds through the fintech platform.

However, he tempered that prediction with slow expectations. “The merger process is very complicated, especially when it involves three big banks. They must integrate systems, databases, and teams, including those related to fintech partnerships. It will take time for banks to complete the integration before moving on to the next plan,” said Dima.

Dima assessed that many Islamic financial institutions have difficulty competing with entities that offer conventional services, both in terms of price, reach, and technology. That's why the government strongly supports BSI. But there needs to be acceleration, twice as fast as conventional banks that are already equipped with advanced technology. Maybe one day BSI will also transform into a digital Islamic bank, but that is unlikely to happen in the near future,” he said.

Sharia fintech and Islamic economics

Indonesia is home to 12,7% of the world's Muslims, a larger share than any other country. But that alone does not appear to be enough to excite the country's Islamic economy. Indonesia still lags behind Malaysia, which is leading the industry globally, according to Global Islamic Economy State Report published in 2020 by Salam Gateway, a news platform covering Muslim-focused economic developments. Indonesia lags behind in fourth place.

In June 2020, Islamic banking assets reached IDR 545,39 trillion (USD 39,22 billion), 9,22% higher year-on-year, and total disbursed funding reached IDR 377 trillion (USD 27,1 billion), according to data released compiled by the state financial authority, OJK. The market share of sharia banking is 6,18%, with 196 institutions consisting of 14 sharia commercial banks, 20 sharia business units, and 162 sharia people's finance banks.

Among the population, Islamic financial literacy is still low, at around 8% in 2019, while national financial literacy is at 38%, according to OJK data.

Fintech startups operating in the segment niche This must be able to face various challenges such as low Islamic financial literacy and incomplete infrastructure. Of the 149 fintech lenders that are licensed and registered with the OJK as of January 2021, only ten are fully shariah. Last year, OJK revoked sharia fintech platform licenses Technology Syarfi, and unregister for the named Danakoo because it cannot meet OJK requirements.

However, Luthfi Adhiansyah is optimistic that sharia fintech, especially lending, will be more widely used and stable in the coming years. “During the pandemic, Islamic lending platforms disbursed around Rp 1,7 trillion, up from Rp 1 trillion last year. This shows an increase in demand in this sector," he said.

There are financial institutions and fintech companies that offer both conventional and Islamic financial services. Diversification is meant to cater to different types of clients, but it sometimes backfires — conservative customers doubt the authenticity of sharia-compliant financial products if they believe their money can be mixed with cash handled in non-Islamic ways.

Lutfi believes that there is a need for a strict separation between conventional and sharia financial services in order to build and maintain customer trust. This is the key to making Islamic finance widely usable.

Another obstacle is the lack of funds. So far, no venture capital firm is dedicated to supporting Islamic platforms, and investors prefer financial service providers that run Islamic finance options alongside conventional services. That means specialized platforms are often overlooked when investors are looking for targets to inject funds into.

The only sharia fintech startup that has recently received new capital is Experience, which pocketed USD 20 million in an equity and debt funding round last month, following an initial round led by Golden Gate Ventures in 2019. The startup claims to be the first to raise a “Sharia-based VC funding scheme,” referring to its appropriate capital arrangement structure. with Islamic rules. In a previous interview with KrASIA, Dima explained that the sharia profit-sharing scheme is similar to equity financing.

“There are several VCs who are interested in exploring sharia fintech, but ultimately prefer to invest in ordinary companies that have sharia business units, because they are considered easier and less risky. I think it is important for regulators to separate the two types of business, and I hope BSI can inspire other institutions, including fintech, to do this. spin-off its sharia business unit to become a fully sharia company,” explained Lutfi.

Despite the many challenges, industry insiders believe that a newly established giant Islamic bank can become the foundation for Islamic fintech in Indonesia and beyond, helping this niche segment grow and compete with established conventional players.

-This article was first released by KrASIA. Re-released in Indonesian as part of the collaboration with DailySocial

Sign up for our

newsletter