Observing OCBC NISP's Efforts to Digitize "Trade Finance" Services

Has officially presented an online-based Bank Guarantee service that can be accessed via the Velocity@ocbcnisp platform platform

PT OCBC NISP Tbk (IDX: NISP) officially presents a -based Bank Guarantee service online which can be accessed via the Velocity@ocbcnisp platform. This service allows business people to issue and change Bank Guarantees without the need to visit a branch office.

Bank OCBC NISP's Trade Finance Division Head Gianto Kusno said that his party is trying to accommodate the needs of customers who have limited mobility during the Covid-19 pandemic by digitizing banking services for corporations.

With this new access, customers can access Bank Guarantee services which are claimed to be easy, fast, and safe. In addition to saving costs and time, customers are also not bothered with various paper-based administrative processes (paperless).

For information, Bank Guarantee is one of the important financial instruments needed in the process of cooperation or business agreements, especially for business actors who need Trade Finance services.

“Previously, corporate customers could monitor outstanding as well as facility ceilings trade which is owned. Now, customers can issue and change Bank Guarantees without having to come to the branch office," said Gianto in his official statement.

Service digitization trade finance

Contacted separately, Gianto revealed that the transformation of banking services for corporations had actually started before the pandemic. However, with the development of the current situation, his party ensures that it will continue to accelerate the development of digital capabilities in order to meet the needs of corporate customers.

One that has been realized is the application mobile devices Velocity@ocbcnisp which was launched in April 2020. After that, the company launched Velocity@ocbcnisp in a web version which is claimed to be designed with high security standards to provide the freedom of transacting like transacting at a branch office.

In the future, OCBC NISP will prepare digital access for other Trade Finance facilities. For example, the Letter of Credit (LC) and Domestic Documentary Letter of Credit (SKBDN) services can be accessed online online via Velocity@ocbcnisp. It is targeting that all transactions for issuance, amendment, and payment of LC and SKBDN can also be made at web-based Velocity@ocbcnisp.

"We see that our digital transformation is very relevant [in the current situation], and we will continue to accelerate it to support our customers during a pandemic," he said.

Gianto admitted that he is optimistic that this digitalization can encourage the growth of Trade Finance services considering the company has seen positive growth. Based on OCBC NISP data, the average monthly transaction value in the pre-Covid period (during 2019) compared to the first semester of 2021 rose 134%, while the number of users rose 22%. This increase was mainly contributed by the web-based Velocity@ocbcnisp and mobile devices.

“We focus on socializing various services that can be utilized by corporate customers at Velocity@ocbcnisp, both web-based and online. mobile devices. We hope that more corporate customers will take advantage of this service.”

Many still rely on paper-based processes

As reported in the 2020 Global Trade Survey published by the International Chamber of Commerce, trade activities and trade finance or trade finance experiencing a crisis due to Covid-19. A total of 346 high-ranking bank respondents in 85 countries in the world expressed concern about the potential for a decline in transactions trade finance.

More Coverage:

Regarding this concern, as many as 54% of respondents considered transformative technology to be one of the priorities that need to be considered if they want to secure future business growth. According to respondents, digital technology can open up opportunities for greater transformation in the global financial industry, which is still synonymous with paper-based administrative processes.

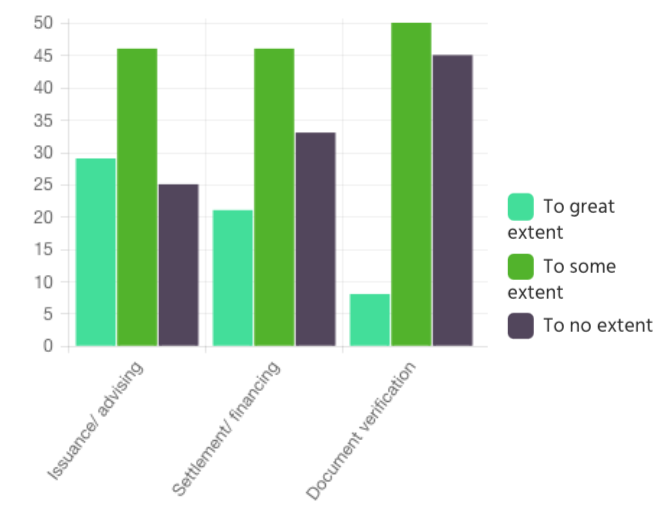

Referring to the data in the field, many trade transactions have not been carried out entirely through digital. There are still many banking sectors that rely on paper-based transactions for trading activities, especially in document verification activities. settlement/financing, and publishing.

Sign up for our

newsletter