LinkAja Encourages SMEs in Tier 2 and Tier 3 Cities to Access Digital Financial Services

Increase collaboration and explore acquisition opportunities with relevant platforms

Since its initial launch, LinkAja has focused on providing digital financial services for the middle class/aspirants and MSME actors. This is what is claimed to distinguish LinkAja from similar platforms.

In addition to being supported by a number of state-owned companies, the company has also received investment from Gojek and Grab.

To DailySocial, CEO of LinkAja Haryati Lawidjaja, revealed their strategy to strengthen services and products. LinkAja's next priority will be to focus on Tier 2 and Tier 3 cities and expand collaboration and potential acquisitions with platforms that share the same vision and mission.

Collaboration and investment

With the support of various investors, LinkAja's collaboration with all shareholders and partners has one goal, namely to become a national electronic money that can support the government in increasing financial and economic inclusion through easy access to digital financial services for all Indonesians.

"Well Grab nor Gojek committed together with LinkAja to support the Government in encouraging financial inclusion in Indonesia," said Haryati.

In the past year, LinkAja has acquire iGrow, a p2p lending startup that focuses on productive financing in agriculture. This step was taken by the company to expand its business line to online financing, especially for the MSME productive sector.

"This step is expected to improve people's welfare through economic independence. We chose iGrow – because of the similarities life purpose, vision, and mission to empower mass to aspirant segment to be able to have economic independence," said Haryati.

In the DS Launchpad Ultra 2021 webinar session some time ago, Haryati mentioned the collaboration that had been carried out together with parent company and other state-owned companies have encouraged the company's business growth.

It is noted that to date LinkAja has collaborated with more than 1,1 million MSMEs or up 104% compared to the previous year. The majority of MSMEs are engaged in the super ultra micro market in second and third tier cities, according to the company's focus area. They also partner with more than 100 financial industries that provide various digital financial solutions for both consumers and businesses.

For online shopping, they have partnered with more than 7.500 online marketplaces, 400 thousand national merchants, and 750 traditional markets.

LinkAja's latest collaboration is with Tokko, an online store creation platform. The company was founded in December 2019 by Krishnan Menon and Lorenzo Peracchione, who are under the auspices of PT Beegroup Financial Indonesia (a group with Cash book).

This collaboration between Tokko and LinkAja aims to support Tokko's MSME partners so that they can reach LinkAja users via email special banners which will be displayed in the LinkAja application. This initiative is also expected to help merchant LinkAja is transforming their business from offline to online.

Excellent service

Currently 73% of LinkAja users are in tier 2 and 3 cities. use case The company's priority is as the most complete means of payment for various modes of land transportation, including trains, buses, ride hailing, and taxis.

"We also present a variety of use cases other relevant to the daily needs of the people in each region. LinkAja focuses on tier 2 and 3 cities where we work with local governments to be able to encourage local MSMEs as well as local communities in financial inclusion," said Haryati.

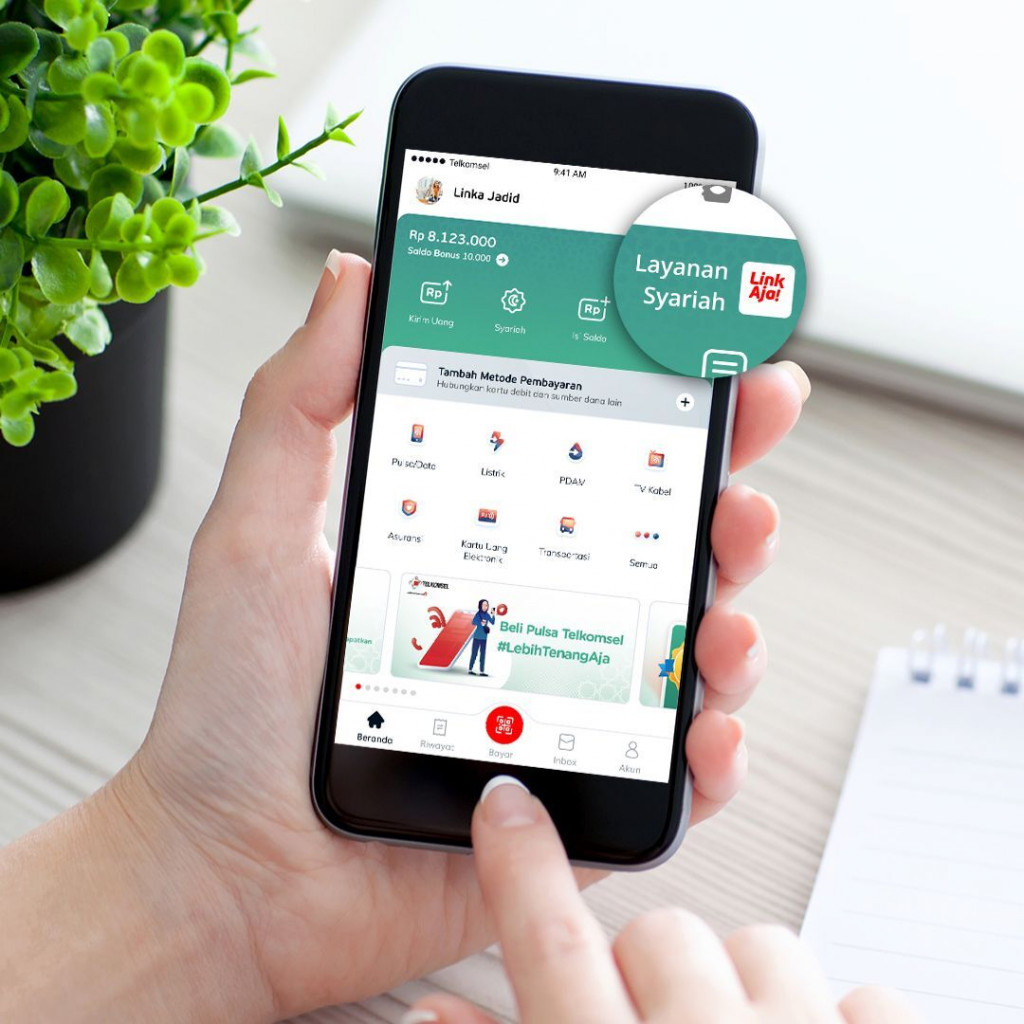

For sharia services, LinkAja claims to be the only electronic money platform that has a sharia certificate from DSN MUI and Bank Indonesia. Haryati said that the reason for the launch of sharia services by LinkAja was the large Muslim population in the country. Previously there was no relevant electronic money platform for sharia.

LinkAja also opens opportunities by providing sharia-based financing to help MSMEs. The company seeks to nurture them, including helping to obtain halal certification. Registered service Sharia LinkAja have had more than 3,5 million users.

Focus now

LinkAja strives to strike a balance between agility and governance. It is important for them to be able to produce innovations that are fast but still relevant and of course can be modified.scale-up.

Another thing that will also be the focus of the company going forward is fintech services which are increasingly integrated into all aspects of the economy in Indonesia.

Company uncover has processed 1,4 billion transactions over the past year. Don't just focus on the market consumer and MSMEs for digital financial solutions, but also playing in the realm of enterprise for various solutions, such as cash collection (cash handling risk, real-time reporting, and non-cash payments), incentive disbursements (thaw real-time, integrated reporting, and flexible use cases), and cross sell & advertisement (maximizing product reach using appropriate platforms).

"All parties, both the government and parties in the fintech industry and related ecosystems [..] collaborate more openly with all stakeholders so that benefits The benefits of fintech services can be increasingly felt for all levels of Indonesian society, [for example] in terms of infrastructure for digital connectivity," concluded Haryati.

Sign up for our

newsletter