Learn Digital Bank, Ecosystem, and Future Prospects

Bank Jago provides digital bank literacy through journalistic training

In the last three years, the Indonesian banking industry has been enlivened with the establishment of digital banks, both in the form of new banks and conversions from existing banks.Existing). As a first step, the Government through the Financial Services Authority (OJK) released a new regulation that is expected to accommodate the needs of digital bank players.

POJK Number 12/POJK.03/2021 contains various provisions related to the establishment of banks and capital. Among them are the provisions for the establishment of two types of digital banks. First, the establishment of a new bank as a digital bank and second, bank transformation Existing general become a digital bank

In addition, the new rules are also to provide clear boundaries regarding the digital banking business considering that this trend is still relatively new in the Indonesian banking industry.

In its efforts, digital banks continue to carry out literacy so that people understand the business and services they run. This is while taking advantage of the momentum of rapid digital financial acceleration during the Covid-19 pandemic. Based on FICO survey in 2020, 54% of Indonesian consumers prefer to use digital channels to interact with banks, 3% mobile banking, 7% internet banking, and 14% pass telephone banking.

However, we cannot forget that there are still large groups of people in Indonesia who are more comfortable making financial transactions by visiting ATMs or bank branches.

PT Bank Jago Tbk (IDX: ARTO) held journalism training to provide an in-depth understanding of digital banks. DailySocial had the opportunity to take part in the training held in Bali.

Several prominent observers participated, including Research Director of the Indonesian Center of Reform on Economics (CORE) Piter Abdullah, Indonesian Stock Exchange Business Development Advisor Poltak Hotradero, and Director of the Center of Economic and Law Studies (CELIOS) Bima Yudhistira.

Perception of digital banks

Not a few people in Indonesia recognize digital banking as a service digital banking. Again, considering that the business model is still new, understanding of digital banking is still considered unclear among the public.

Indonesian Center of Reform on Economics (CORE) Research Director Piter Abdullah provided a definition that could significantly differentiate digital banks from conventional banks. According to him, Digital banks are defined as banks and services where we no longer need to think about where the head office, branch offices are, the number of ATMs, including the number of people operating them..

Just like the GoPay and OVO digital wallet platforms, we don't need to know where the money is stored. With the phenomenon of internet and smartphone adoption over the past decade, he believes that the bank business will remain the same, however deliveredIt's just that now it's starting to be different.

According to him, this perception is normal considering that people are used to making transactions at banks. Banks are identified as financial institutions with branch offices and head offices. In contrast to the pre-digital era, banking competition can be seen from banks' efforts to build an ecosystem. In the context of conventional banks, Their ecosystem is branch offices and ATMs.

Now slowly the existence of ATM machines is starting to become irrelevant. People are starting to get used to financial transactions via platforms mobile banking as well as digital wallets. This massive adoption was enjoyed by the banking industry during the pandemic.

Based on OJK data, a total of 2.593 branch office networks were closed from 2017 to August 2021. The closure of these branch offices is in line with the bank's digital transformation which can be seen from the increasing volume of digital transactions.

According to Piter, in the current situation, if conventional banks have not transformed towards digital banks, this does not mean they have failed to digitize. This is more of a failure of competition. It should be noted, the factors of banking excellence have changed, what was superior in the past, could become a burden in the era of the digital ecosystem.

"This is not a sprint race, but a marathon, endurance is what determines. Moreover, digital banking is still a new trend in Indonesia. Therefore, this is the reason for established banks to prepare themselves, but not immediately face-to-face but passing by proxy or its subsidiaries," explained Piter.

The above explanation is a bit reminiscent of a hypothesis Bank Jago founder Jerry Ng when deciding to annex Bank Artos and change its name. Jerry thinks Bank Artos doesn't have much legacy (branch offices, ATMs and HR). With this condition, his party can freely develop technology from scratch rather than taking a bank that already has thousands of branch offices.

Digital bank case study

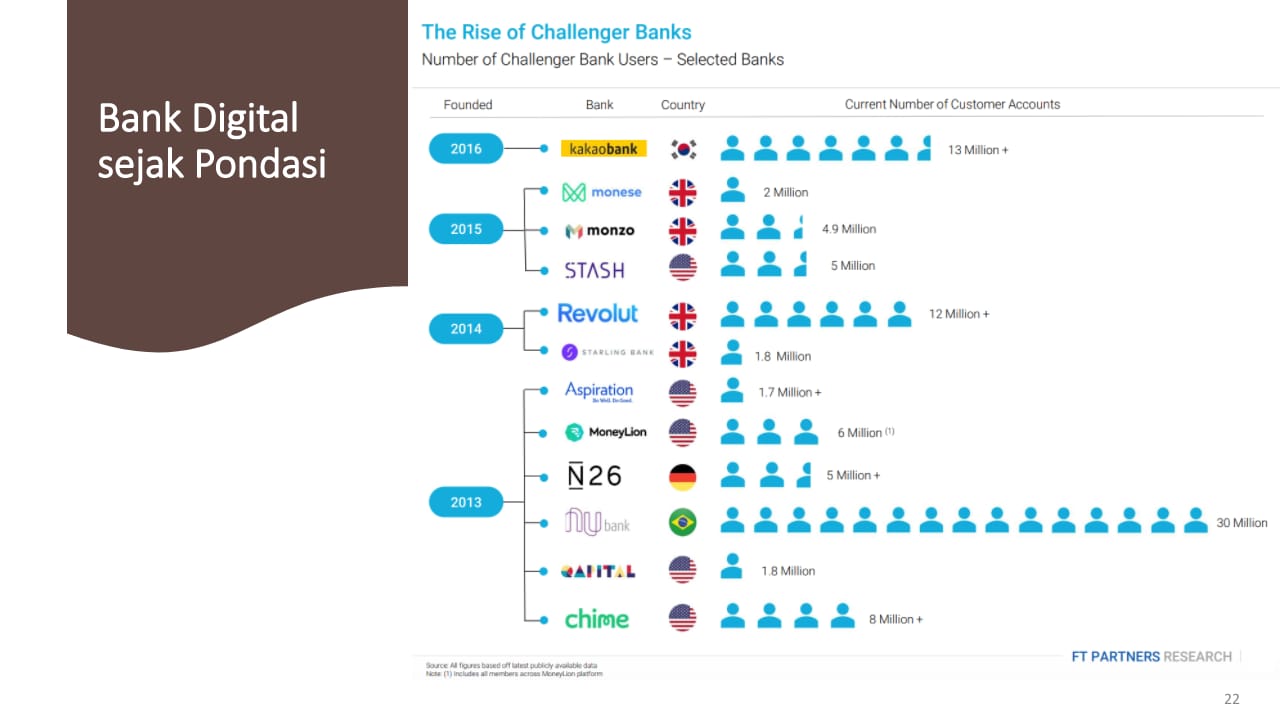

In the next presentation, Indonesian Stock Exchange Business Development Advisor Poltak Hotradero highlighted the digital ecosystem as one of the key factors in digital banks. He took several examples of successful digital banks in the world that apply a similar model, for example KakaoBank from South Korea.

KakaoBank was founded in 2016 and is owned by internet giant Kakao Corp. At the beginning of its emergence, KakaoBank recorded extraordinary achievements. In five days, KakaoBank had 1 million users.

KakaoBank also recorded financial performance above the industry average. For example, deposit growth was 13,65% from the industry average of 11,98%. Then, KakaoBank's NPL was also 0,26% where the industry reached 1,78%. Meanwhile, fee income reached 30,16% of the industry's 28,02%.

According to Poltak, KakaoBank's success cannot be separated from the large digital ecosystem owned by its parent company. Kakao has a diverse service portfolio, such as chat services, fintech, e-commerce and games.

"The evolution of the internet has brought about changes in humans and money. Machines also interact with each other thanks to the internet. This is the foundation for the development of digital banks where payments, liquidity and analytics will be in the cloud (cloud). In other words, technology enables [digital] banks to do so scale up faster," he said.

In the future, Poltak mentioned three types of banks that will compete, including conventional banks, digital banks, and embedded banks. Poltak defines embedded banks (Bank-as-a-Service/BaaS) as a service that has operated digitally from the start and entered the ecosystem (native). He also assessed embedded bank will be part of plumbing system corporate or individual financial services.

"Digital platforms will facilitate synergies with other digital financial services, such as investment and insurance services. However, it should be noted that the biggest cost and risk of the digital transition is failure to maintain market share and segments. These factors can make banks irrelevant," he added.

Therefore, he underlined that digitalization is a competitive necessity. Don't let the financial sector only have its role handed over to banks, considering that the business and service potential is so large. He believes that market expansion is important to develop digital banks considering that there are still market segments that have not been tapped in Indonesia and can only be served digitally.

Digital bank projections

According to his study, Director of the Center of Economic and Law Studies (CELIOS) Bhima Yudhistira divides digital banks into three models, namely direct bank,neobanksand bank challenger.

He explained, ddirect bank increasing opportunities for banking services, such as savings and channeling digital loan. Then, neobanks operates as a bank fully digital, without branch offices, and has a mobile application. Temporary, bank challenger is said to revolutionize the way of transactions, new lending models, and personal finance.

Bhima revealed the potential for market accumulation bank challenger and neobanks globally it could reach $578 billion by 2027 according to a Medici Research report.

We try to take other sources to provide deeper definitions, especially on neobanks and bank challenger. Quote FinTech Magazine, neobank offers flexibility to a variety of services, including payroll and expense management. Apart from that, neobanks also offer corporate financial solutions to answer the challenges faced by MSMEs.

The presence of an API helps to integrate business flows with banking requirements. Nevertheless, neobanks do not have a banking license because they operate by relying on partner banks. As such, they cannot offer traditional banking services.

While bank challenger Leveraging technology to streamline banking processes. However, bank challenger also maintain a physical presence to operate fintech services. Shovel bank challenger generally much smaller than in the banking sector mainstream. It is estimated that there are 100 bank challenger globally today.

Different from neobanks, bank challenger has a banking license and can offer customers a variety of traditional and digital banking services. These traditional banking services can also be accessed and utilized more accommodatingly than public banks.

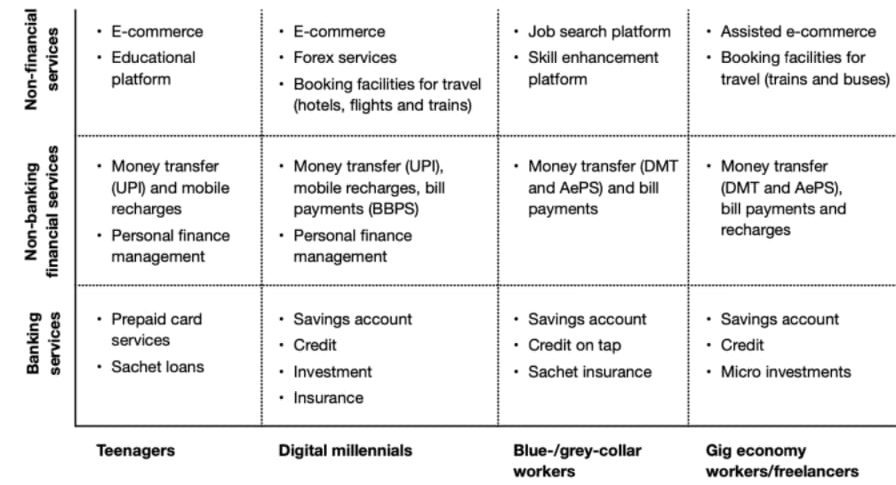

Furthermore, Bhima assessed that digital banks offer a number of advantages, both for individuals and business actors. At the individual level, digital banks increase customer literacy regarding other financial products, for example investments. According to World Bank data in 2020, the share of stock market capitalization in GDP is still relatively small. The emergence of digital banks is projected to encourage investment interest.

In addition, digital banks can encourage financial control efforts in the MSME sector with financial transparency and efficiency. Moreover, business actors can also get access to financing distributed by digital banks through the scheme channeling.

"So far, banks have not competed with technology, but with big flower. Then, suddenly digital banks appeared that offered easy services and access to capital. Currently Indonesia has 65 million MSMEs and some of them have not received loans. Digital banks can increase that financing capacity. "If Indonesia wants to restore its economy to the 5% level, credit growth must triple," he explained.

Based on data-driven credit scoring, digital banks can continue to grow by channeling credit to untouched segments. In the future, this credit distribution can use indicators rating customer transactions on the platform e-commerce, food delivery, or ride hailing.

Sign up for our

newsletter

Premium

Premium