AFTECH Describes the Market Landscape, Challenges and Trends of Fintech Investment

Digital payments and online loans are entering a mature phase; neobank clusters to Digital Financial Innovations are still in the growth phase

The Indonesian Fintech Association (AFTECH) has re-released the 2021 Annual Member Survey Report which describes the service landscape fintech in Indonesia, the achievement of growth, to investment trends in the future.

For information, currently AFTECH protect the perpetrator fintech which is divided into six business models or clusters, including payment systems, loans, online, neobank, crowdfunding securities, wealth management, and Digital Financial Innovation or IKD (consisting of 16 sub-clusters). As of the end of 2021, the number of AFTECH members stood at 352, up from the same period in 2020 and 2019 of 302 and 219 members, respectively.

The following are a number of important achievements and findings from AFTECH's annual report as summarized DailySocial.id the following.

Digital payments and loans online

Survey shows digital payments and loans online into two business models fintech which has entered a mature phase in Indonesia, is also driven by factors of consolidation among market leaders and sloping growth.

Chairman of AFTECH Pandu Sjahrir reveal category neobanks, IDD, wealth managementand crowdfunding securities still in the growth phase, which is due to a number of factors, such as new bank regulations, especially related to digital banks, to the non-optimal exploitation of the market in terms of product and service offerings. Even so, he judged the service fintech began to gain traction in the market.

Overall, service adoption fintech in Indonesia increased significantly throughout 2021. This increase was reflected in a number of achievements, including:

- The value of electronic money transactions increased by 58,5 percent (YoY) to Rp35 trillion.

- The adoption of the Quick Response Code Indonesia Standard (QRIS) exceeded the target of 12 million merchants before the end of 2021.

- Loan distribution through the platform fintech co-financing to more than 13,47 million borrower accounts reaching IDR 13,6 trillion as of December 2021

- Adoption fintech to invest in the capital market and digital assets has also increased.

From the digital payment category, 28 percent of respondents have pocketed an annual transaction value of Rp. 5 billion-Rp 500 billion, while another 28 percent have collected a total annual transaction of Rp. 500 billion-5 trillion. Referring to Bank Indonesia statistics as of December 2021, total digital payment transactions reached IDR 35,1 trillion, up 60 percent compared to the same period last year. This transaction is dominated by actors fintech not banks.

From category loan online, OJK data recorded a growth of 70 percent to Rp13,6 trillion in December 2021. The focus of lending is still centered on the island of Java where nearly 70 percent of total transactions originate from the region, followed by overseas (28%) and outside Java (1,9%). Cities outside Java each contributed less than 1 percent of total transactions, except for North Sumatra (1,8%) and Bengkulu (1%).

Currently, the amount Actioncalendar and borrowers on the platform fintech respectively 809.494 and 73,2 million as of December 2021. Meanwhile, as of December 2020, the number of Actioncalendar and quantity borrowers about 716.913 and 43,6 million, respectively.

The performer's challenge fintech

OJK data records Indonesia's financial literacy index rose 8,3 percent from 29,7 percent in 2016 to 38 percent in 2019. With the growth of this index, fintech realize the importance of service expansion fintech to the countryside. Meanwhile, 69 percent of fintech players have served this area.

However, the perpetrator fintech Indonesia still faces major challenges to expand its business outside Jakarta, where 23 percent and 19 percent of respondents admit that it is difficult to expand outside Java and rural areas due to financial literacy (55%), infrastructure (44%), and culture (20%). ).

Despite the obstacles above, 45 percent of the perpetrators fintech admitted that he was optimistic that he could continue his expansion to areas outside Greater Jakarta so that he could achieve the national financial inclusion target.

"In terms of infrastructure, although technology affects service expansion fintech in the regions, as many as 53 respondents have positive respondents to the growth and improvement of infrastructure in the future," said Pandu.

Market share and expansion

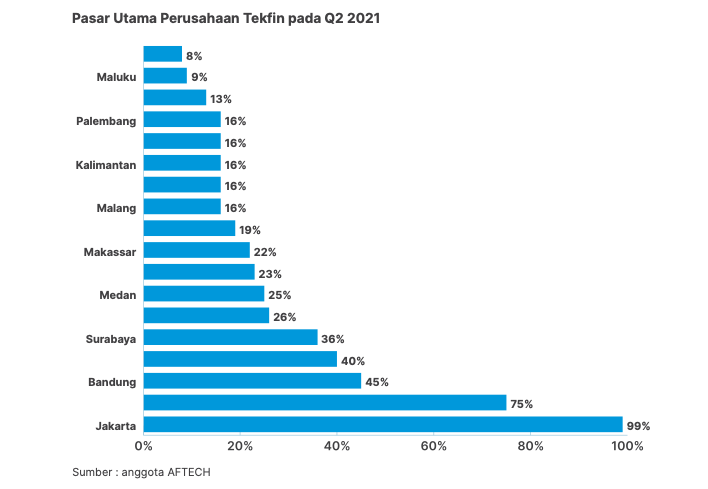

Based on the survey results, the Greater Jakarta area is still the main fintech market, where 99 percent and 75 percent of respondents respectively answered Jakarta and Bodetabek as the main target users, followed by Bandung (45%) and Surabaya (36%).

As many as 69 percent of respondents claimed to have served rural areas in Indonesia. This indicates that most fintechs do not only focus on urban areas.

In addition, the perpetrator fintech also still encourages user penetration in the segment MSMEs, especially for women entrepreneurs. As many as 42 percent of respondents recorded the transaction value of MSME users amounting to more than IDR 80 billion. As for 12 percent of them earned less than Rp500 million from MSMEs.

Of the 33 percent of respondents, 25-50 percent of MSME users are run by women, reinforcing the notion that women make a significant contribution to the fintech industry.

"Therefore, financial and digital literacy for women is becoming increasingly important so that MSME actors can maximize the products and services available in the financial services industry to develop their businesses," the report said.

In terms of business development, respondents revealed a number of important points in determining business strategies to boost future income. Among them are fintech players who want to focus on high-income products (59%), enter new markets including overseas and rural areas (34%), explore new business lines (52%), and there are no plans to expand or focus on products. certain (7%).

In addition, 75 percent of fintech players in Indonesia plan to expand their market reach to rural areas. This finding shows a positive signal for the fintech industry to increase the distribution of financial services throughout Indonesia.

Investation fintech

Investment in sector fintech Indonesia recorded a 13-fold growth since 2017 which was only $64 million to $904 million in Q3 2021. This amount is two to three times higher than the investment made by players fintech in neighboring countries.

More Coverage:

When compared to the total investment to other sectors, both from domestic and foreign investors, investment fintech in Indonesia from the first quarter to the third quarter of 2021 it was 58 percent higher in the machinery and electronics sector, and 157 percent higher than the textile sector.

Improvement of the investment climate to the sector fintech cannot be separated from the increasing number of young people who are familiar with digital services, mobile penetration, and the middle class in the Southeast Asian region. Growth fintech accelerated due to the Covid-19 pandemic.

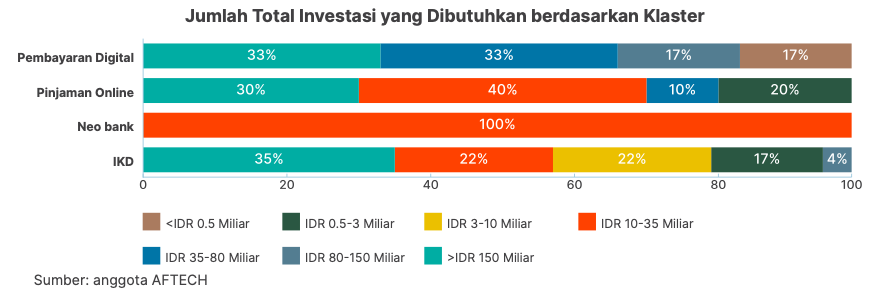

From the point of view of investment needs, currently one in three digital payment clusters, online loans, and IKD still needs more than IDR 150 billion in the next 1-2 years. On the other hand, 17 percent of respondents from digital payment players believe they only need an investment of less than IDR 500 million in the next 1-2 years.

"This shows that the digital payment cluster has entered a more mature stage compared to the fintech in another cluster," said Pandu.

Sign up for our

newsletter