JULO Expands Loan Ceiling Function, Inaugurates Digital Credit

Target the disbursement of accumulative loans to a maximum of IDR 5 trillion by the end of this year

Startups JULO inaugurated "JULO Digital Credit" to expand the loan ceiling functionality so that it can be used for various types of transactions. Previously, the ceiling could only be used for cash loans transferred by JULO to the borrower's account.

Co-founder & CEO JULO Adrianus Hitijahubessy said, the transformation of this product was motivated by the needs of the people who are now completely digital when conducting daily transactions. Although JULO still focuses on productive loans, according to company data, it turns out that 3/4 of the borrowers use their credit limit for non-consumptive purposes.

“But activities that improve their standard of living, such as small business capital, paying school fees, renovating houses. There is also a consumptive, but we don't mind it. For us after going through underwriting strict rules, they pass credit worthiness, so they are given the freedom [to use the limit] whatever their needs,” he explained, Thursday (22/9).

JULO Kedit Digital offers a digital credit limit of up to Rp. 15 million with a tenor of up to nine months and an interest of 0,1% per day. As for the payment, it can be done using the monthly installment method, thus easing the burden on users' expenses.

Limits can be used for transactions E-commerce JULO partners, pay bills, top-up balances e-wallet, cash loans, fund transfers to own or other people's accounts, and QRIS scan transactions. In presenting the transfer feature to e-wallet and QRIS, JULO in collaboration with partners.

Separately when contacted DailySocial.id, Adrianus revealed for QRIS partners, companies working with DOKU as a technology provider. DOKU has a license from Bank Indonesia to facilitate QRIS transactions. "Meanwhile if the balance transfer e-money we exist licensed partners others because the licenses required are different,” he explained.

The expansion of the JULO credit limit function has actually been carried out by players lending others, among other things Akulaku and Kredivo which offers a variety of digital transactions in its application.

This new product also removes JULO's old products, namely JULO Cicil and JULO Mini. Adrianus said the two products have become part of the JULO digital credit because they have the same function. "In fact, we have expanded its features because basically the spirit is the same, in the past we could repay the bill for up to six months, now it has been extended to nine months."

He continued, this digital credit also expands the target of JULO users from the middle to lower economic class, to all circles, including the younger generation who live in rural and urban areas. For preventive measures against bad loans, digital credit is very helpful in terms of continuous credit score assessment.

Because, all consumer habits when transacting and when paying credit bills will be recorded. "Digital credit has various types of transactions which will enrich credit score each consumer. Previously credit score only at the time of initial submission.”

There is no mention of the ratio of bad loans in JULO. But Adrianus said the same as the company mostly, JULO also experienced an increase in the ratio during this pandemic. “Objectively it should be kept as low as possible. It is undeniable that we are also affected during the pandemic. For that we do win-win solution. "

It is targeted that this year's total loan disbursement can reach Rp4 trillion to Rp5 trillion cumulatively since it first started operating in 2016. As of May 2021 yesterday, the figure has reached Rp2 trillion. JULO has served 500 thousand customers, up from 2020 of 350 thousand customers.

Business performance

According to OJK statistical data as of May 2021, there are 118 organizers conventional and 9 sharia. In total, the total assets owned reach 4,1 trillion Rupiah. The platforms also managed to accommodate around 8,7 million lender accounts (p2p) channeling 13,8 trillion Rupiah of funds.

More Coverage:

The dominance of the consumer loan portion still dominates the total distribution portfolio in the industry. When you see during 2020 yesterday, consumptive distribution takes up a portion of 62,04% of the total new loans IDR 74,41 trillion. However, the trend is slowly decreasing due to the OJK's push for lending players to work on productive financing in their portfolios.

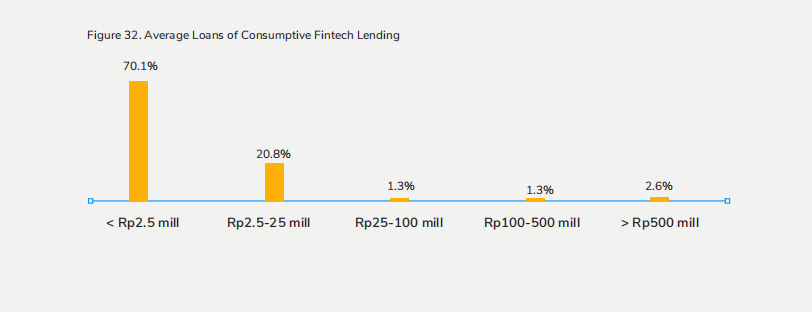

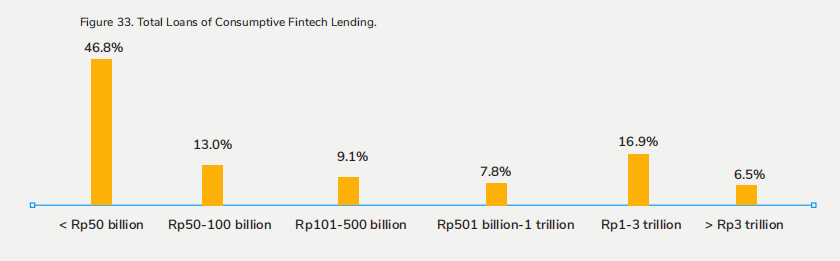

Menurut reportDSInnovate and AFPI, the average consumer loan disbursed by the platforms was under Rp2,5 million (70,1%), followed by Rp2,5 million-Rp25 million (20,8%), and Rp25 million-Rp100 million (1,3, 46,8%). As for the total loan disbursement, there were 50% of companies that disbursed loans of up to Rp1 billion, more than Rp23 trillion (5%). In addition, there are 3 players who have distributed more than IDR XNUMX trillion to their borrowers: Pendanaan.com, Asetku, UangMe, Kredivo and Smart Credit.

Sign up for our

newsletter