Customized Microinsurance Products Are Key to Increasing Penetration

According to OJK data, insurance penetration last year was only 3,01%, which is relatively low in Southeast Asia

Enter Gojek, Grab and other tech companies into the realm insurtech gives confidence that it is time for the public to be introduced more deeply to product variations wealth management Next up is insurance. At the bank, insurance products are included in the product range wealth management, after securities and mutual funds.

Based on data from the OJK, insurance penetration last year was relatively low at 3,01%. The ratio of population to insurance policies owned by Indonesia lags behind Malaysia, Thailand and the Philippines. This small number becomes a savory cake when viewed from a business perspective. So, insurtech to be the next business vertical of fintech which is now widely encroached.

Quoting from the report DSResearch, factors Indonesian people's reluctance to insurance is caused by a number of factors. Namely, related to the procedure to get it (33,62%); the price is considered too expensive (24,15%); do not understand about the product and its benefits (20,76%). There are several respondents (13,56%) who relate to the prohibition of religion.

Tech players who are involved actually open access to new products in a simple way but have a big impact. Besides Gojek and Grab, Traveloka, Tokopedia, Bukalapak, there is Tanamduit which has created a special unit for making it insurtech.

If you look closely, the products they offer with insurance partners are mostly micro products with affordable premium prices and short terms. It all has a purpose. That they want to slowly familiarize insurance products based on daily needs.

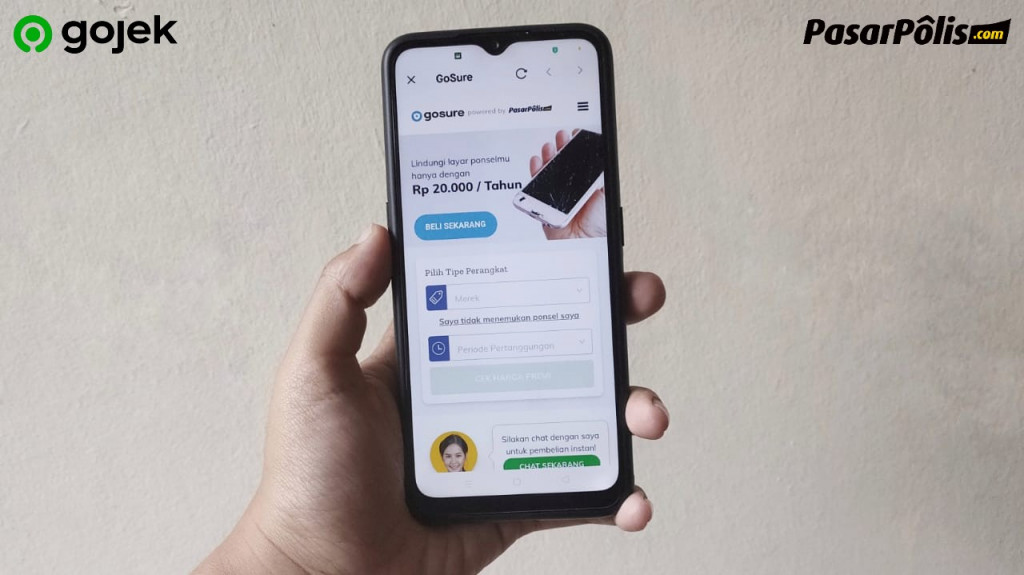

Gojek, through the product GoSure with PasarPolis, provides insurance products for gadgets, travel insurance for planes and trains, and motorcycle insurance. The premium price offered is quite affordable, for example Rp. 20 thousand / year for gadgets, and Rp. 50 thousand/year for motorcycles with protection benefits of up to Rp. 2,5 million.

"Since its presence in beta in October 2019, GoSure has received positive enthusiasm from customers. Overall, the total products sold until January 2020 have increased by 60 times, gadget insurance is the most popular," said Head of Third Party Platform. Gojek Sony Radhityo to DailySocial.

"So in the future, we will continue to develop a variety of unique and tailored protections that make our customers' daily lives easier," he added.

GoSure also includes accident insurance protection services for driver partners and passengers when using GoRide services. Grab also employs a similar strategy. Previously, Grab do a trial run with Qoala, one of the participants from Grab Velocity Ventures, to launch insurtech especially for the Indonesian market. The product provided is insurance gadgets.

While in Singapore, via Grab Financial Group, they released GrabInsure Insurance Agency by cooperating with Chubb as insurance partner. The first product to go on sale was travel insurance, with a premium price of S$2,5 per day to any destination globally.

Mentioned this product will be released gradually to the market Grab in Southeast Asia for the next few months. Chubb also has an operational office in Indonesia.

Micro products for easier identification

Director of Insurtech money Itha Sargianitha explained, releasing a unique and micro insurance product is the fastest approach so that more people will feel the benefits of having insurance. Before digital disrupted the insurance industry, this product was known to be very exclusive and had the impression of being very difficult to claim. One other thing, this is a strong reason why insurance products have low penetration.

"The best first step is to go into micro products to make it easier to understand and easier to combine with people's lifestyles," explained Itha to DailySocial.

A fast claim process can actually be done, but only for certain products. Including travel insurance if the flight is canceled by the airline. This information can already be integrated with the insurance company, so that if this condition occurs, the claim will automatically be paid immediately without the customer having to make a report.

Identifying claims to prevent fraud is a mandatory SOP for insurance companies. There are processes that cannot be cut. “This so challenges largest in insurance. But technology can help as a solution. At us, every time there is a claim, we will automatically notify the progress through the application.”

"Society is not no I want to buy insurance, but because I don't believe it, aftersalesit's difficult when you want to claim. What we can do now is not to promise a quick claim, but an easy claim," he continued.

Tanamduit, initially based on an online investment application, has penetrated insurtech since September 2019 because they saw the need for additional products that could complement the previous product. The approach taken is also the ease of buying insurance with the latest payment methods such as LinkAja, Dana and GoPay.

So far Tanamduit has released five insurance products gadgets, disease free protection, 5 disease protection, tropical disease protection and DHF protection.

In the future, Tanamduit will release travel and personal accident insurance products, pet insurance, vehicle insurance, and other unique community-based products. On the other hand, the company also continues to improve its technology to make claims services more seamless.

“We want unique insurance products to accompany a series of insurance products that are commonly heard by the public. This unique product is not what we are looking for businesses those who already have it, but look deeper benefits-his. We also do a selection and ask suit to match what customers are looking for.”

Insurtech encourage insurance to be more creative

More Coverage:

Tech companies with strong consumer databanks are a powerful weapon for knowing what consumer wants are like. This correlation makes Gojek and Tanamduit have "Power" more to encourage insurance companies to be more creative in composing new products in a customized manner according to their respective targets.

A more detailed description is provided by Tokopedia, which provides the InsurLater feature. Here, the company provides customized insurance products for every transaction that occurs on the platform.

The company sells insurance protection for gadgets, electronics, beauty electronics, furniture, travel, automotive, mother and child, beauty, food. This protection will bebundling when checkout to the payment page with a light premium price.

The protection period will depend on the type of product purchased, but at Tokopedia it starts from 30 days to a maximum of 12 months.

“'We also do research, for example for pet insurance. We ask users what kind of sick animals usually are, what the hospitalization and outpatient costs are like. From there, we will inform the insurance for further discussion for the next process,” concluded Itha.

Sign up for our

newsletter