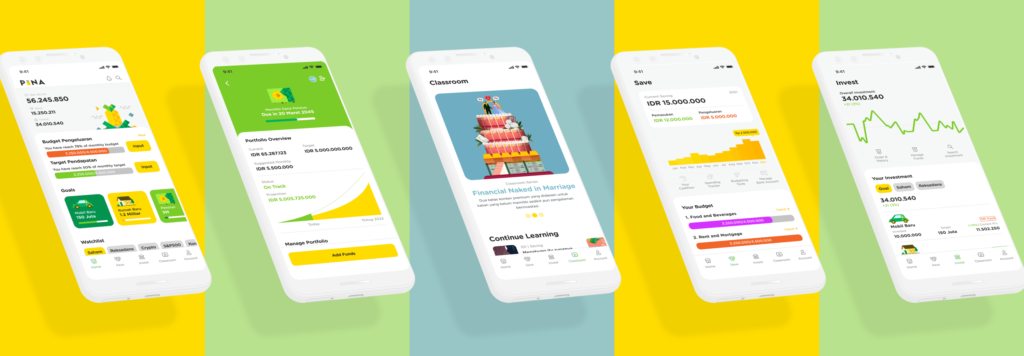

PINA Pockets Initial Funding, Immediately Launches Financial and Investment Management Application

Funding led by 1982 Ventures; the application is targeted to launch in November 2021

The developer of the PINA personal financial management application announced that it had received initial funding with an undisclosed amount. This round was led by 1982 Ventures, with the involvement of iSeed Asia, Prasetia Dwidharma, Oberyn Capital, and a number of angel investors. The fresh funds will be used to accelerate product development and growth before launching in November 2021.

later PINA app will help people manage and grow their money by providing management and investment solutions in one app. This startup was founded by a former executive Grab Daniel van Leeuwen and financial services veteran Christian Hermawan.

"Our mission is to help everyone achieve financial independence by providing products and advice that make complex financial decisions simple and relevant. Wealth creating tools that was reserved for high net worth individuals is now available to everyone. PINA empowers people to invest and manage their money in an understandable way,” said Daniel.

To DailySocial. i,d 1982 Ventures Managing Partner Herston Powers said that although the platform had not yet been launched, the experience of its founders was mature enough to be a strong reason for investors to invest.

"PINA is the first Indonesian personal finance app to serve all Indonesians. The path to personal investment is not stock trading or crypto exchange, but a financial product made for the masses that focuses on building wealth. PINA's holistic approach and values are fully aligned with its mission our mission to transform financial services and empower millions of Indonesians," said Herston.

1982 Ventures itself is a venture capitalist who focuses on startups fintech Based in Singapore, their scope of funding is at an early stage, for businesses in Southeast Asia. Besides PINA, other 1982 Ventures portfolios in Indonesia are Brig and Wagely.

Meanwhile, CEO Prasteia Dwidharma Arya Setiadharma said, "PINA's vision is to empower Indonesians to pursue and secure financial freedom in a simple and straightforward way. Reducing barriers to accessing markets is as important as educating those who want to access them – financial literacy must be a priority. "

Platforms that offer similar services such as PINA include halofina,my financesand Fundtatistics. Not just a personal financial recording application, they also embed investment services and financial education in their application -- their mission is to make it easier for every user to achieve their financial goals.

Target the younger generation

PINA's mission is not only to provide an easier way to invest in Indonesia's emerging financial markets, but also to provide access, trust, and financial literacy to address the low penetration of retail investors, particularly the lower middle class, younger generation, and beginners.

More Coverage:

To smoothen their goals, they have partnered with several parties, including the BNI Sekuritas company to offer various investment products, Original RI for e-KYC and biometric security, and other leading asset management companies. Currently PINA has been registered and is under the supervision of the Financial Services Authority (OJK).

Until Q2 2021, we noted that there were a number of startups wealthtech (financial and investment management) that receive funding from investors, including:

| Announcement | Startups | Round | Amount | Investor |

| January-2021 | zipmex | Series A | $ 6,000,000 | Jump Capital |

| March-2021 | Pluang | Pre-Series B | $ 20,000,000 | Openspace Ventures, Go-Ventures |

| February-2021 | FUNDtastic | Series A | $ 7,700,000 | Ascend Capital Group, Indivara Group |

| January-2021 | Wonderful | Series A | $ 25,000,000 | Horizons Ventures, Alpha JWC Ventures, SoftBank Ventures Asia, Insignia Ventures, Y Combinator |

| January-2021 | Seeds | Series A | $ 30,000,000 | Sequoia Capital India, East Ventures, EV Growth, 500 Startups |

| March-2021 | Wonderful | Series A | $ 65,000,000 | Ribbit Capital, Y Combinator Continuity, ICONIQ Capital, Bangkok Bank PLC, angel investors |

| May-2021 | Pintu | Series A | $ 6,000,000 | Coinbase, Blockchain Ventures, Castle Island Ventures, Intudo Ventures, Alameda Ventures, Angel Investors |

| May-2021 | Seeds | Series B | $ 65,000,000 | Sequoia Capital India, Prosus Ventures, Tencent, Harvard Management Company, AC Ventures, East Ventures |

Future projections will continue to increase, in line with market opportunities for financial management services that continue to be in demand by the market. According to a studi, solution market size wealthtech will reach $54,62 billion by 2021; and will continue to grow to $137,44 billion in 2028 with a CAGR of 12,1%.

Sign up for our

newsletter