Brick Announces Initial Funding, Presents Fintech API Service for Financial Health Identification

Investments are obtained from a number of venture capitalists and angel investors who come from startup founders

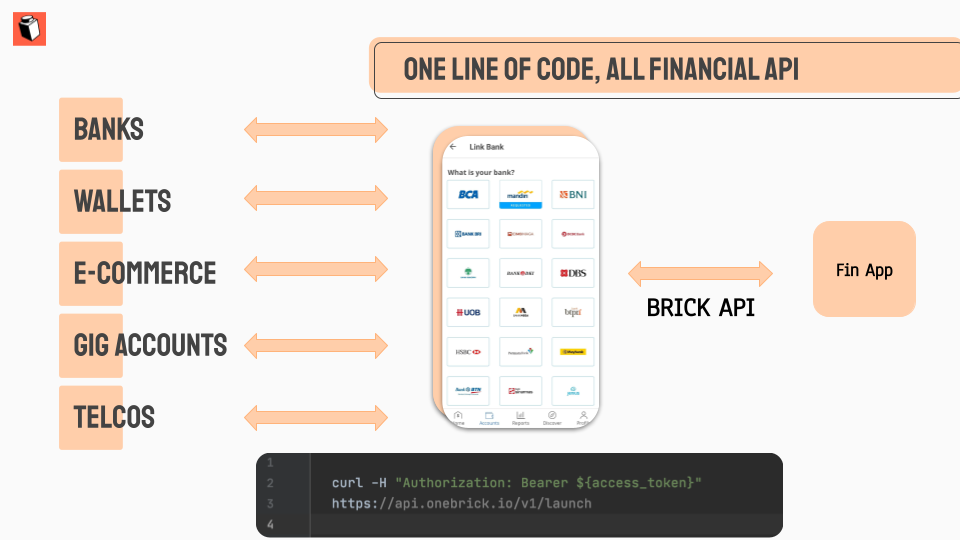

Brick is a startup that develops financial health data management services based on API (Application Programming Interface), its capabilities allow actors fintech or technology companies to get insight more deeply related to the financial health of its users. The goal is to bring financial applications that are more personalized and inclusive.

Today (17/3), Brig announced that it has secured seed funding from a number of investors, including venture capitalists and angel. Among venture capitalists, there are Better Tomorrow Ventures, Prasetia Dwidharma, 1982 Ventures, Antler, and Rally Cap Ventures. Temporary angel investors involved include Shefali Roy (TrueLayer), Kunal Shah (Cred), Reynold Wijaya (Modalku), Quek Siu Rui (Carousell), and the founders of Nium, Xfers, Aspire, BukuWarung, ZenRooms, CareemPay.

The startup was founded by Gavin Tan (CEO) and Deepak Malhotra (CTO) in early 2020. Both have experience developing technology and finance startups. In his statement Gavin explained, "We saw firsthand the lack of modern infrastructure needed to deliver the experience fintech customer requested. That's why we started Brick to empower companies fintech next generation with easy-to-implement, cost-effective and inclusive infrastructure."

Further explained, Brick claims to be compatible with more than 90% of major bank accounts in Indonesia and works with more than 250 developers, 35 technology companies and enterprise clients. fintech in Indonesia. Currently Brick is also participating in the Sembrani Wira acceleration program held by BRI Ventures.

From the description given, the implementation process is more or less like this. API embedded in app fintech developed by business partners, to bridge the service with the payment system used in the application. Data obtained from the aggregation process of payment systems used by end users (banks, digital wallets, e-commerce etc). Some of the data used are identities, accounts, transactions, balances, income, financial assets, to credit payments.

Making its debut in Indonesia, Brick has ambitions to bring this service to Southeast Asia and will use the funds raised to scale the platform, increase coverage and expand into the next market. Later this year, they will also launch new APIs for telcos, mobile wallets, platforms E-commerce, and other innovative financial products.

Services fintech APIs keep popping up

Services fintech API-based programs continue to emerge in Indonesia, this is in line with the API standard regulations that have been socialized by Bank Indonesia since last year. The regulator wants a more open financial ecosystem, allowing each player (digital and conventional) to be able to support each other in improving the financial literacy of people in Indonesia.

The mission of almost all startups fintech what exists in Indonesia is indeed alleviating the gap in the midst of many groups underserved and unbankable. At least there are currently more than 400 companies fintech in Indonesia -- and the number continues to grow from time to time. And one of the strategies they must do to win the market is to present a more comprehensive technology system.

More Coverage:

Service purpose fintech API-based helps them (including digital companies looking to deliver financial features) improve technology capabilities more simply. Instead of developing from scratch and requiring relatively more time and resources, using an API system the process will be much shorter. Especially to ensure compliance with regulations and the payment channel options to be served to users.

As for startups playing With this concept, there are already several, such as Ayoconnect, Finantier, Xendit, Midtrans, Safe, and so on. Each tries to present a unique proposition with certain capabilities.

Sign up for our

newsletter