Throughout Q3 2021, Indonesian Startups Book 13,8 Trillion Rupiah Funding

DailySocial.id processes startup funding data during Q3 2021 based on rotation, vertical, top 20 startups, and top 5 investors

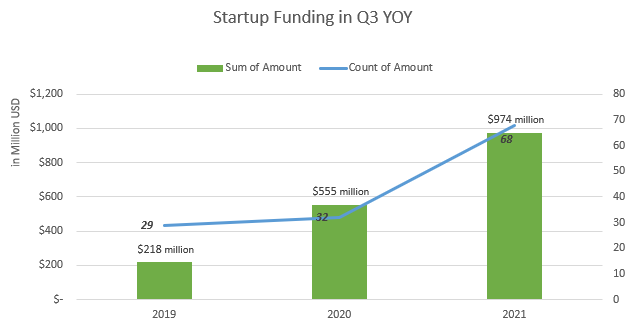

The investment climate in Indonesia's post-pandemic startup ecosystem shows an increasing trend. According to records DailySocial.id, based on funding transactions announced to the public and/or recorded to the regulator, throughout the third quarter (Q3) 2021 there are 68 startup funding that recorded a nominal value of up to $974.220.000 or more than IDR13,8 trillion from 45 transactions the stated value of the funding.

In terms of quantity and nominal, this condition increased compared to the previous two quarters. In Q1 2021 there are around 40 startup funding with a total value of $554.750.000, while in Q2 2021 there were 47 transactions with a nominal value of $750.520.000.

When compared to Q3 in the two previous years, the announced investment value has increased almost 2x.

This is an interesting indication that the pandemic is still delivering the effect of acceleration on the startup investment climate in Indonesia. During the period July to September 2021, there were 2 startups that succeeded in achieving status "unicorns" with its new funding, namely Xendit and Kredivo. Blibli and Tiket.com are the startups that have finally confirmed that their valuation is now above $1 billion.

Funding trends throughout Q3 2021

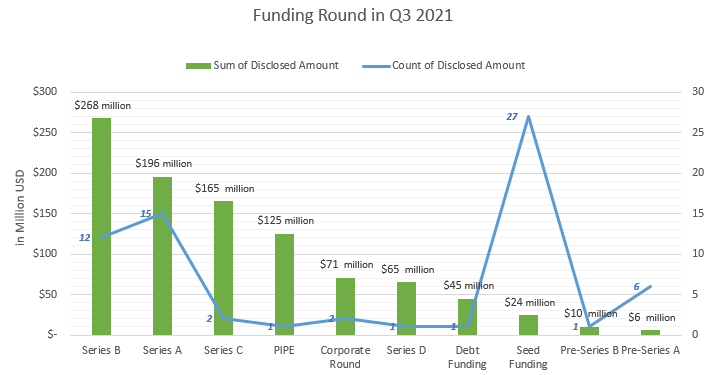

Reviewed more deeply, based on levels, pSeries B funding in this period managed to record the highest value with a quite significant number of transactions. The tendency of investors to do follow-on funding di later stages It has also actually been recorded since 2020, as recorded in Startup Report 2020.

In terms of quantity, transactions in Q3 were mostly in the round seed and Series A.

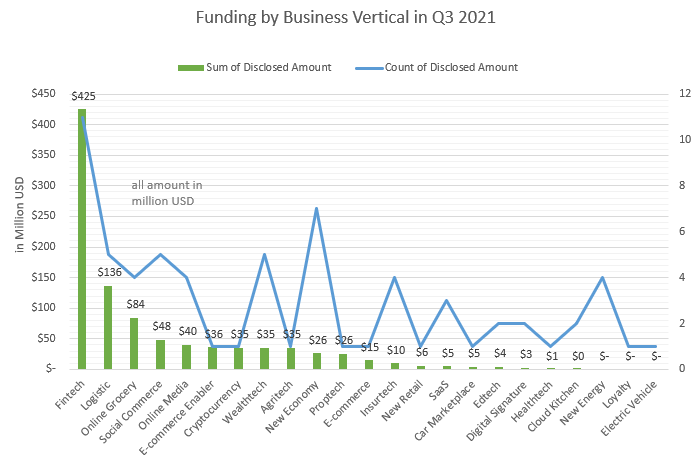

If viewed from the business segment, fintech still dominates the earnings. This trend has continued since the last 3 years amidst the large number of players maneuvering in every sub-vertical fintech, starting from e-money, lending, open finance, paylater, etc.

The next popular sector is logistics. Since the second half of last year, this sector seems to have received special attention from investors. During the pandemic, its performance increased as service supporting infrastructure E-commerce and online marketplace.

Two new verticals are becoming "rising star" in this period is online groceries and social commerce. Apart from funding for existing startups, several investors also supported new players in the round seed. Online grocery is considered to have bright market potential with changes in consumer behavior to start fulfilling daily needs effectively online.

Sector social commerce is also considered relevant in the midst of penetration E-commerce which is not optimal, especially in cities tier-2 to tier-4. The concepts of agency and community empowerment that are promoted are considered relevant to the culture and conditions in many regions in Indonesia.

Featured startups and investors

Of the startups that received funding during Q3, three of them raised hundreds of millions of dollars. Meanwhile, 17 startups also received tens of millions of dollars in funding.

The following is a list of the 20 startups with the largest funding, which were announced publicly, throughout the Q3 2021 period:

| Startups | Funding Value |

| Xendit | $150.000.000 |

| Kredivo | $125.000.000 |

| WarehouseAda | $100.000.000 |

| Happy Fresh | $65.000.000 |

| CloudCash | $56.200.000 |

| Me | $40.000.000 |

| SIRCLO | $36.000.000 |

| Pintu | $35.000.000 |

| Pluang | $35.000.000 |

| Aruna | $35.000.000 |

| DOCK | $32.000.000 |

| AntherAja | $31.000.000 |

| Evermos | $30.000.000 |

| Oh! | $30.000.000 |

| pinhome | $25.500.000 |

| hyperfast | $19.500.000 |

| Experience | $17.500.000 |

| Fresh | $16.000.000 |

| decoration | $15.000.000 |

| Trade | $11.500.000 |

Several investors also actively participate in startup funding rounds in Indonesia. If we look at this period, the majority is still dominated by local venture capitalists, with East Ventures (EV) having the largest quantity.

Through its managed funds, EV invests in startups from the early stages to the growth stage (growth fund). Hypotheses on business models agnostic making it more flexible to help new startups.

The next most active investor is AC Ventures. On several occasions, they did co-investments with EVs.

| Venture Capital | Investment Engagement |

| East Ventures | 17 |

| AC Ventures | 7 |

| Jungle Ventures | 4 |

| Go-Ventures | 4 |

| Vertex Ventures | 4 |

| Alpha JWC Ventures | 4 |

| MDI Ventures | 4 |

| New Energy Nexus | 4 |

| BEENEXT | 4 |

| Insignia Venture Partners | 4 |

What has begun to be seen this year is the active involvement of circles angel investors. Most of them came from circle founder late stage startups and unicorn. There is 15 rounds of startup funding in Indonesia in Q3 2021 involving angel investors. This number increased slightly compared to the previous quarter--in Q2 2021 they were involved in 13 startup funding.

Sign up for our

newsletter

Premium

Premium