On the Second Year of QRIS: Revealing the Transaction Experience through "Mobile Banking" and Digital Money

Digital banking is considered to offer an added value proposition for the use of QRIS

In the first two years, QRIS feature started to show an extraordinary growth in adoption as DailySocial described in the first part of the article. This is validated by Bank Indonesia (BI) data regarding the increase in transactions over the past year.

Aside from transactions, we also saw an increasing enthusiasm from users which highlighted various issues related to QRIS adoption in the field. This issue was revealed through a mini survey we conducted with 65 respondents. Although it does not represent the majority of digital payment service users in Indonesia, this survey is in line with the main spirit, which is to highlight issues to create room for improvement for stakeholders.

In the second part, DailySocial highlights more detailed issues from the user's perspective, such as product categories that are often purchased to which payment platforms are preferred to make transactions using the QRIS method.

QRIS on the run

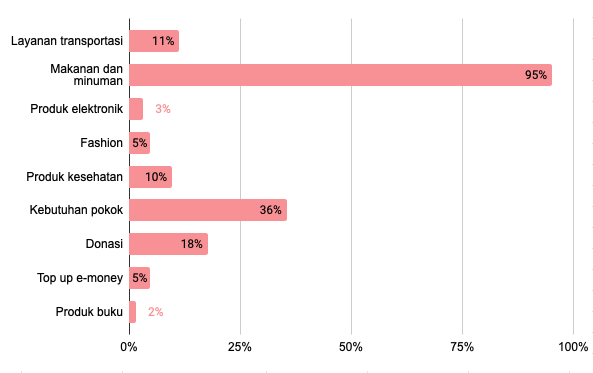

In a previous article, one of the challenges of adopting QRIS is the limitations of merchants that accept payments using this method. Unsurprisingly, most of the respondents admitted to making transactions more for food and beverage (95.2%). In other categories, QRIS transactions are also used to purchase basic needs (35.5%), donations (17.7%), and transportation services (11.3%).

Product categories bought using QRIS / DailySocial

Product categories bought using QRIS / DailySocialOf the 93.8% of respondents who made transactions using the QR Code method, 33.3% of them spent IDR 50,000-IDR 300,001 for transactions. Moreover, by 22.7% of respondents spent more than IDR 1 million, IDR. 500,001-Rp. 1,000,000 (21.2%), IDR 300,001-IDR 500,000 (18.2%), and under IDR 50,000 (4.5%).

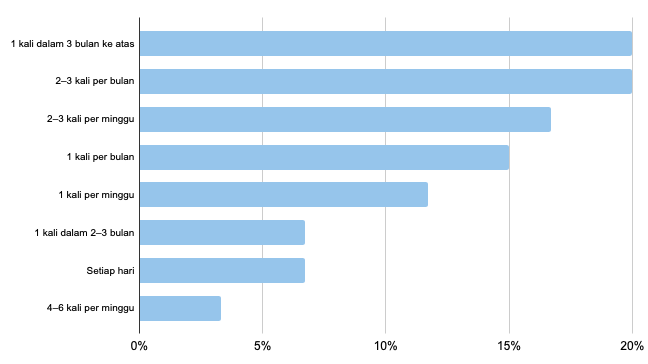

QRIS-based payment transaction frequency / DailySocial

QRIS-based payment transaction frequency / DailySocialWhen QRIS transactions are available for broader categories, such as diverse public transportation, street vendors, and markets, the adoption will certainly increase in a rapid way. In fact, many consumers in this segment still make transactions using cash rather than unfamiliar payment methods.

Mobile banking vs digital money

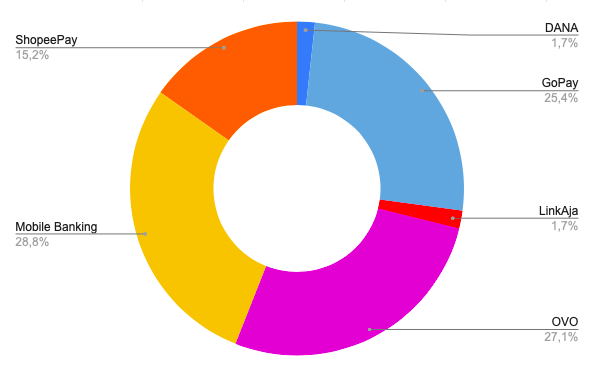

One of the interesting facts we collected from this survey is how users feel more comfortable in making transactions using QRIS method through mobile banking applications (58.1%) rather than digital money (e-money).

Categorized by platform, mobile banking applications (28.8%) still outperform e-money, such as OVO (27.1%), GoPay (25.4%), and ShopeePay (15.25%). And the reason is?

QRIS-based platform for transactions / DailySocial

QRIS-based platform for transactions / DailySocialBased on the elaboration result of a number of respondents, the mobile banking application is automatically connected to savings, therefore, they do not need to top up and incur administrative costs. There is no need to download each e-money application, let alone top up to multiple platforms (if you use more than one).

What's interesting is, digital banking is considered to provide a strong reason why QRIS transactions are more popular in mobile banking applications. Respondents stated, the pocket feature in the application makes it easier to allocate a budget that can be devoted to transactions, such as snacks or transportation, without disturbing other budgets.

Meanwhile, other respondents considered that QRIS transactions via e-money offered a value proposition that mobile banking might not have, including payments with points or rewards. For example, the OVO application. In terms of experience, digital wallets are considered superior due to faster login process than mobile banking.

"Another reason is that users are used to e-money. There are also lots of merchants receive QRIS from e-money. In addition, QRIS is more suitable for transactions with a nominal value of under IDR 500 thousand and e-money is considered appropriate for that need," some respondents said.

Market education

The elaboration seems to be sufficient to answer why as many as 68.8% claimed to obtain information about QRIS from the payment platform they use daily. Meanwhile, 60.9% answered from the merchant where they made transactions. Payment platforms and merchants can be the main vehicle to educate QRIS adoption.

BCA Digital's CEO, Lanny Budiati said one of the efforts to increase awareness to users is through attractive promotions that can only be obtained when making transactions at merchants using the QRIS method. Company data records that around 10% of BCA Digital's total customers have done transactions using QRIS with a total volume of IDR 1 billion since the blu application was released on July 2, 2021.

"We continue to encourage customers to experience the QRIS adoption convenience. We also prepare educational content on various social media channels regarding how to use it and its benefits. Going forward, BCA Digital will continue to encourage the QRIS development based on the roadmap of the Bank Indonesia and the Indonesian Payment System Association (ASPI)," Lanny said to DailySocial.

Meanwhile, Bank Neo Commerce's President Director, Tjandra Gunawan considered that all kinds of new technologies would take a long time in terms of adoption. He admitted the optimism that QRIS adoption will be absorbed quickly considering the trend of cashless payments has mushroomed in the past year. In addition, more merchants and financial applications are providing the QRIS feature.

"Neo Commerce Bank will be active in providing financial education to the public, not only familiarizing with the QRIS feature, but also a safe and comfortable digital lifestyle," he told DailySocial.

-Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium