Impact of COVID-19 on OTA Services and the Tourism Industry

Online ticket booking transactions in 2025 are estimated to reach IDR 355 trillion

The spread of the Corona virus (COVID-19) that started in China is bad news for the tourism industry and its supporting industries. This bad impact has caused industry players to tighten their belts while waiting for the good news of handling this outbreak.

The outbreak of COVID-19 in Wuhan, China, at the end of last January has certainly disrupted the global tourism industry, including in Indonesia. Flight and hotel booking services are the two posts hardest hit by the disease.

The Central Statistics Agency (BPS) noted that as of December 2019, the highest number of foreign tourists came from Malaysia, Singapore, and China. China alone accounted for about 2 million tourists last year or ranked second with 12,8 percent of total tourists. Meanwhile, Malaysia, Singapore and foreign tourists from other Southeast Asian countries totaled 6,1 million.

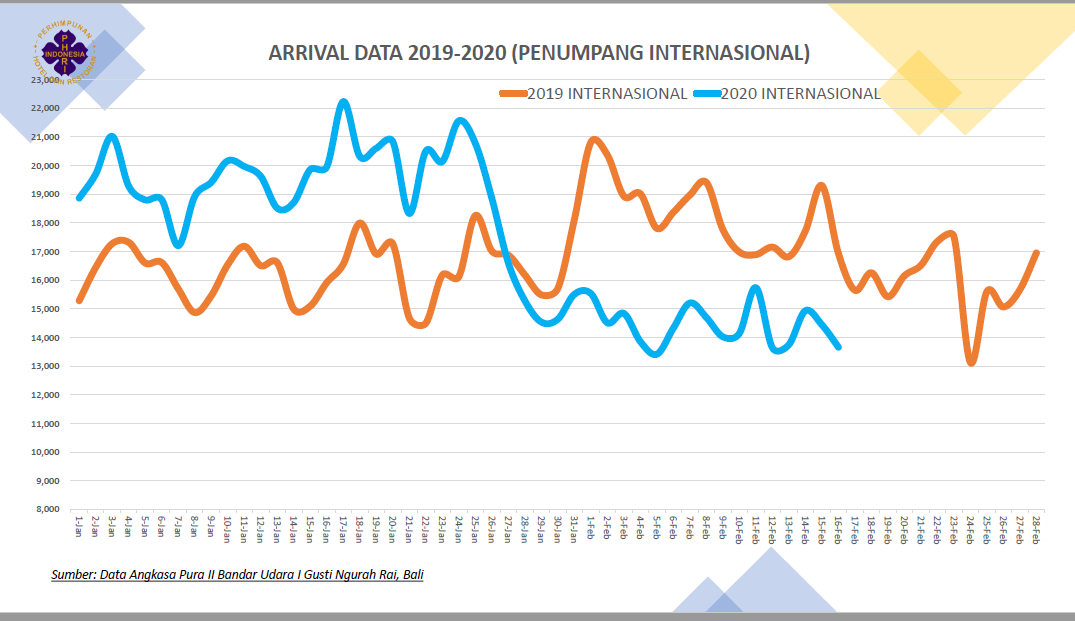

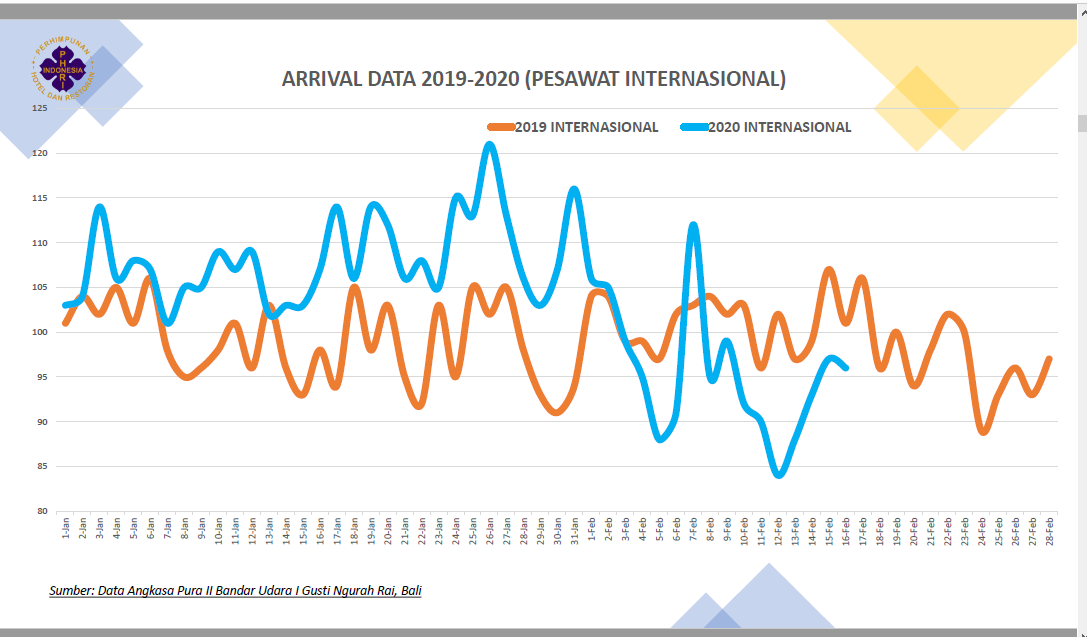

The report from the Indonesian Hotel and Restaurant Association (PHRI) explains in more detail the weakening of tourism in a number of regions. PHRI said Bali experienced a drastic decline. At some favorite tourist spots for Chinese citizens, such as Nusa Dua, Tuban, and Legian, the occupancy fell by 60-80 percent. International passenger arrivals at Ngurah Rai Airport have been stagnant at below 15.000 to below 14.000 from late January to mid-February. The number of international planes to Bali had dropped to the 80's. Even though throughout January the number was still constant above 100 flights.

Overall, the hotel occupancy rate in Bali is only around 30-40 percent. The same thing happened in Manado which was dominated by Chinese tourists. PHRI said hotel occupancy there fell 30-40 percent to only 30 percent.

Impact on OTA

The online travel agency (OTA) is automatically affected by this situation. Pegipegi through its written statement emphasized the reduction of domestic travel bookings. This happened especially when the government announced the first COVID-19 case on Monday (2/3).

"Currently, we can see that the demand for travel bookings for domestic destinations has decreased, considering that information on the Corona case in Indonesia was just announced earlier this week," Pegipegi Corporate Communications Manager Busyra Oryza told reporters. Dailysocial.

OTA's contribution to the country's tourism economy cannot be underestimated. Databox Katadata shows online ticket transaction was at US$8,6 billion or Rp125 trillion in 2018. This figure is predicted to grow to US$25 billion or Rp355 trillion in 2025. This nominal is the largest in Southeast Asia.

The tourism sector contributed 5,25% of Indonesia's Gross Domestic Product (GDP) in 2018 which was Rp. 14.837 trillion. This means that out of around Rp. 779 trillion contributed by the tourism sector, about 16 percent of it comes from online transactions.

Economist from the Center of Reform on Economics (CORE) Yusuf Rendy Manilet believes that OTA players in Indonesia will definitely be hit hard by COVID-19. However, Yusuf saw that they were not hopeless in this precarious situation.

Yusuf believes that OTA services can patch up the existing situation with their side services and tighten promotions for the domestic market. Well-known OTA services, such as Traveloka and Tiket.com, already have a number of services that are not related to booking accommodation or airline tickets, such as ordering food or booking recreation center tickets.

"I think they can take advantage of the potential of domestic tourists but those that are more local in nature, such as culinary tourism," said Yusuf.

Bhima Yudhistira, an economist at Indef, said that the impact of the epidemic on OTAs, especially those that have been operating overseas such as Traveloka is quite large. Almost in line with Yusuf's statement, according to Bhima, the hope lies in the domestic tourist enclave, which is only a few months away from welcoming the Lebaran season.

"At least this can keep the situation from going down too much. Moreover, in the next few months of Eid, there will definitely be an increase. Even though there is the Corona virus, domestic tourists will be able to return home, so I think it will still be strong enough [domestic]," continued Bhima.

A Traveloka representative, who was contacted separately, said he was concerned about the situation. However, they refused to explain the extent of the impact they received from the COVID-19 case. "Currently our focus is on prioritizing the safety and comfort of users in planning their trips," said Head of Marketing, Transport, Traveloka Andhini Putri.

Pegipegi's response was not much different. They are still busy accommodating the needs of travelers who use their services, including in canceling reservations. "Currently, for customers who want to cancel their order, it can be done easily through the Pegipegi application by using the Online Refund feature," added Busyra.

Government incentives

The contribution of tourism is still not as big as the manufacturing or trade sector, but the sub-sector it covers and its always positive growth is enough reason for the government to issue a number of incentives.

Multiple incentives for example, Rp72 billion fund for influencers (later suspended); IDR 860 billion in the form of a 50% discount on flight tickets for 10 leading tourist destinations such as Lake Toba, Yogyakarta, Bali, to Labuan Bajo; and several other incentives. These amounts are special additional incentives for sectors related to tourism with a total nominal value of IDR 298,5 billion. Previously, the government had made sure to disburse IDR 10,3 trillion for various sectors in anticipation of the economic slowdown.

Yusuf assessed that the incentives should be appreciated, although there are some things that still need to be criticized. He considers the government has not been too detailed regarding the implementation of the incentives. An example is flight ticket discounts that are not clearly applicable to leading tourist destinations or to all of Indonesia.

This point is also a criticism of PHRI. Chairman of PHRI Hariyadi Sukamdani assessed that the focus is not too much on the five super priority destinations, but also on areas that have well-established tourism businesses.

"The relaxation of tax incentives should not only be aimed at the 5 Priority Destinations and destinations that have foreign tourists from China, but also for destinations that have international direct flights from other countries where foreign tourist visits have also decreased, such as Singapore, Vietnam, South Korea and Malaysia," said Hariyadi in his presentation.

As of this writing, six people have tested positive for the COVID-19 virus without any casualties. Total worldwide, this virus has caused nearly 99 thousand cases, with a death toll of 3.390, and a recovering victim of about 56. China, South Korea, Italy and Iran are the four countries that are currently suffering the most from this outbreak.

Sign up for our

newsletter