How to Use the Toko Netzme Application, a Digital Payment Solution for Businesses

Complete Guide to Using the Netzme Store Application

Along with the pattern of changes in consumer shopping behavior from shopping habits in offline stores to shopping in online stores, it also changes the way merchant transaction acceptance works.

Now, more and more consumers prefer cashless payments to cash payments. Therefore, it is not surprising that many merchants are starting to explore non-cash payment systems to widen the choice of payment methods for their consumers.

Many merchants are trying to provide more payment method options so that consumers are more comfortable and flexible in making transactions. One application that can be used for this is the Netzme Store.

This article will help you understand the Netzme Store Application, especially the use of its features and services and how to register for the application. If you're curious, read the full article below, OK!

Get to know the Netzme Store Application

Unlike Netzme, the Netzme store is an application specifically designed for merchants to make it easier to complete their non-cash transactions.

Through Toko Netzme, merchants can provide non-cash payment options to customers for transactions both online and offline. That way, traders can transact without limits and monitor transaction reports each period for making the right business decisions in the future.

How to Register a Netzme Store for traders/business people

Before using the features and services of the Netzme Store, you must first register. To complete the process Netzme Store registration, make sure you prepare your KTP, NPWP (optional), bank account, and the products or services offered. After that, see the steps as follows:

- Download the Netzme Store application first on the PlayStore

- Open the downloaded application, then click Login / Register to register

- Enter your mobile number, then click Make sure the mobile number you registered is active so that you can receive the OTP code sent by the Netzme Store via SMS.

- Enter the OTP code you received to continue the registration process

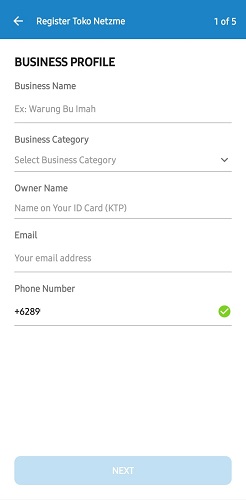

- Complete business profile You

Enter your business name, business category, owner's name, email, and double check the mobile number you registered, then click Next.

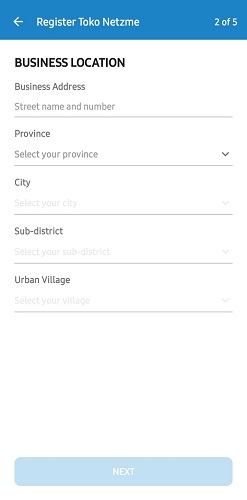

- Complete business location You

Enter the complete business address, starting from province, city, district, to postal code and click Next to proceed to the next registration stage

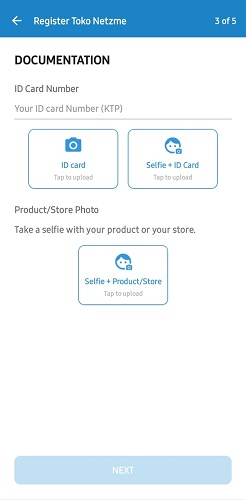

- Fulfill documentation required

Enter the ID Card number (KTP), enter a photo of your KTP, take your selfie holding your KTP, and take your selfie holding a product or being in a store. Then click Next.

- Complete the bank account information, then click Next

- Select a bank name, enter the account number and name of the account owner

- Review all the data that you have entered, if it is complete and correct then click Submit

- Verify your email by opening the email sent by the Netzme Store to the email you registered. Click Verification and registration is complete. You only need to wait until the verification process is approved by Netzme.

Use of Netzme Store Features and Services

The Netzme store has several features and services that its users can take advantage of, such as:

- PPOB (online bank payment points)

The Netzme store offers sales of data packages, pulses and electricity tokens at lower prices so that they can be used as additional business activities for users who wish to resell them.

- Invoice creation

This feature is used to make bills for customers or consumers, both on-time-payments and multiple payments. Invoices will be sent to customers via Email, SMS, social media, or the Netzme Chat feature.

- QR products

Merchants can easily create their own QR product or QRIS. That way, merchants can accept payments from consumers via the QR code.

- Transaction report

As with other business applications, Toko Netzme also provides transaction reports from all customers that merchants can easily access. These transaction records will assist traders in charting and making further business decisions.

- Cash withdrawal

With the convenience of making your own QR product, the nominal transaction that will be received by merchants via the QR code can be withdrawn to the merchant's account that was previously registered.

How to Make Cash Withdrawals via BNI ATMs

- Open the Netzme Application and make sure your Netzme account is premium

- Pilih Withdraw

- Click Withdraw Cash at a BNI ATM

- Select the amount of money you want to withdraw, then click Next

Withdrawals can be made with a minimum nominal value of Rp. 50.000 up to Rp. 1.250.000

- Double check the nominal you want to withdraw, if it is appropriate then click Generate VA Number and enter your Netzme PIN

The VA number is only valid for 1 hour. If it's been more than 1 hour and you haven't continued the withdrawal process at a BNI ATM, then you have to create a new VA number.

- After getting the VA number, immediately go to the nearest BNI ATM. Make sure the BNI ATM has a cash tap sign

- Select the transaction menu, click VA Debt Accounts

- Enter the 16-digit VA number that you previously received, then you will receive an OTP code to the mobile number that you registered

- Enter the 6 digit OTP code you received

- Select or enter the desired withdrawal amount. The transaction is complete and please take money at the ATM

Sign up for our

newsletter