Rumah.com's parent company will soon be listed on the New York Stock Exchange

It is planned to go public on March 18, 2022; is in the midst of completing the smelting process with Bridgetown 2 Holdings

Startups proptech from Singapore, PropertyGuru or known by its product Rumah.com in Indonesia, is preparing to go public on the New York Stock Exchange (NYSE) on March 18, 2022. This corporate action will be realized after the company completes the merger process with Bridgetown 2 Holdings, aka the blank check company (SPAC). ).

As reported by The Straits Times, PropertyGuru will also hold a GMS on Tuesday, March 15, 2022 to seek approval from the shareholders. Meanwhile, its merger with SPAC is expected to boost its valuation to $1,78 billion. Currently, Bridgetown 2 Holdings is backed by conglomerates Peter Thiel and Richard Li.

PropertyGuru is a platform listing property with service coverage in the Southeast Asia region. Based on financial performance, PropertyGuru's growth last year was contributed by three main markets, namely Singapore, Vietnam and Malaysia.

The company recorded revenues of $100,7 million, up 22,7% from $82,1 million in the previous year. This achievement exceeded the company's target of $97,5 million. This year, PropertyGuru projects a 44% increase in revenue to $145,1 million.

It was also reported that PropertyGuru had increased the subscription fee (subscription agent) by 15% in the Singapore market in November 2021. PropertyGuru CEO Hari Krishnan has a hand in assessing the increase based on a number of factors, such as property prices, consumer interest, solid property agents, and PropertyGuru's strong position in the market. proptech.

For your information, SPAC is also known as a shell company that raises funds through public offerings to acquire specified companies. This type of company has no independent business model other than financial transactions.

Usually, companies that want to go public, aiming at the stock exchanges in the United States. However, recently the stock exchange in Singapore introduced rules regarding IPOs via SPAC last September.

In Indonesia, a number of technology startups want to "go public" by using a SPAC vehicle instead of conducting a conventional IPO. Several startups that are preparing for an IPO with SPAC are GoTo, Kredivo, and Traveloka.

Proptech market momentum

In general, the property market has been sluggish due to the Covid-19 pandemic since 2020. However, a number of parties project that there is momentum for a revival in this sector, albeit slowly. According to a survey conducted Indonesian Knight Frank, there are three sectors that are estimated to have good growth performance, namely residential, industrial & logistics, and retail.

In addition, the momentum of the property sector has also been strengthened by the growing awareness of the millennial generation to start buying property, such as houses, for both essential and investment needs. Based on data from the Ministry of Public Works and Public Housing in 2019, as many as 81 million millennials don't have a house yet.

Apart from this projection, it is not yet known whether the action on the stock exchange will affect PropertyGuru's growth in Indonesia or not, considering that currently PropertyGuru's main markets are contributed by Singapore, Malaysia, and Vietnam.

More Coverage:

In Indonesia, PropertyGuru operates through Rumah.com which is a joint venture with EMTEK Group. In addition, EMTEK is also a PropertyGuru investor in the series D funding round.

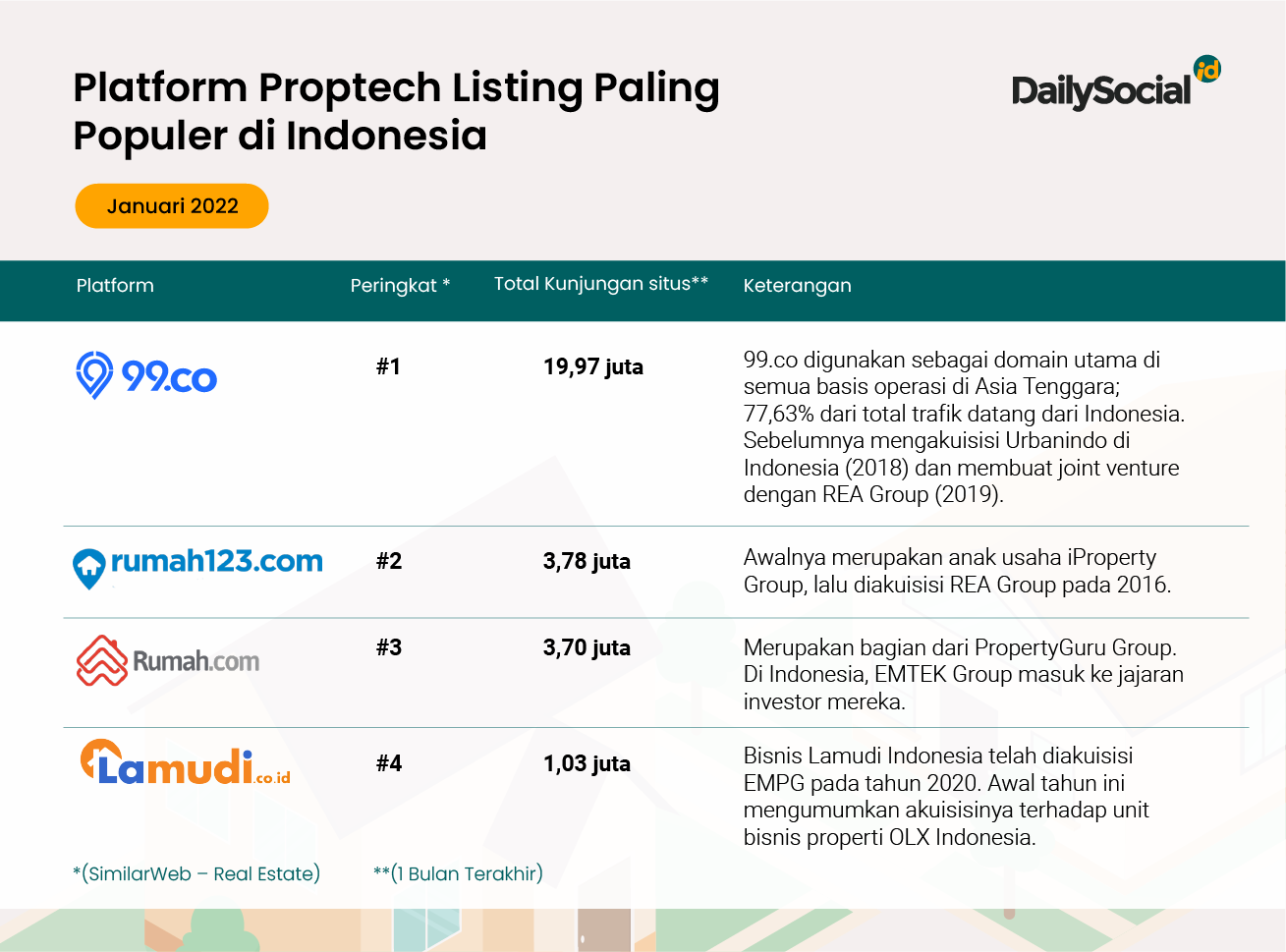

Competition in the realm proptech also gets stronger when big players start to do M&A to diversify and strengthen their position in the market. Among them, PropertyGuru through Rumah.com acquired the property platform RumahDijual.com. Later, the 99co platform annexed Urbanindo, and the Emerging Markets Property Group also acquired Lamudi Global for Lamudi Indonesia, the Philippines, and Mexico.

Sign up for our

newsletter