Hit by a Pandemic, Fintech Application Adoption in Indonesia Still Grows

AppsFlyer's report says that there was a decline in fintech use during the first lockdown, but now it's gradually increasing again

Service use fintech and digital banking experienced rapid growth throughout 2020 to date. One of them is proven in research conducted by AppsFlyer. In the report entitled "The State of Finance App Marketing 2021" As mentioned, these applications play a key role in developing countries like Indonesia. One of them is suspected that there are still many people who fall into this category unbanked or underbanked.

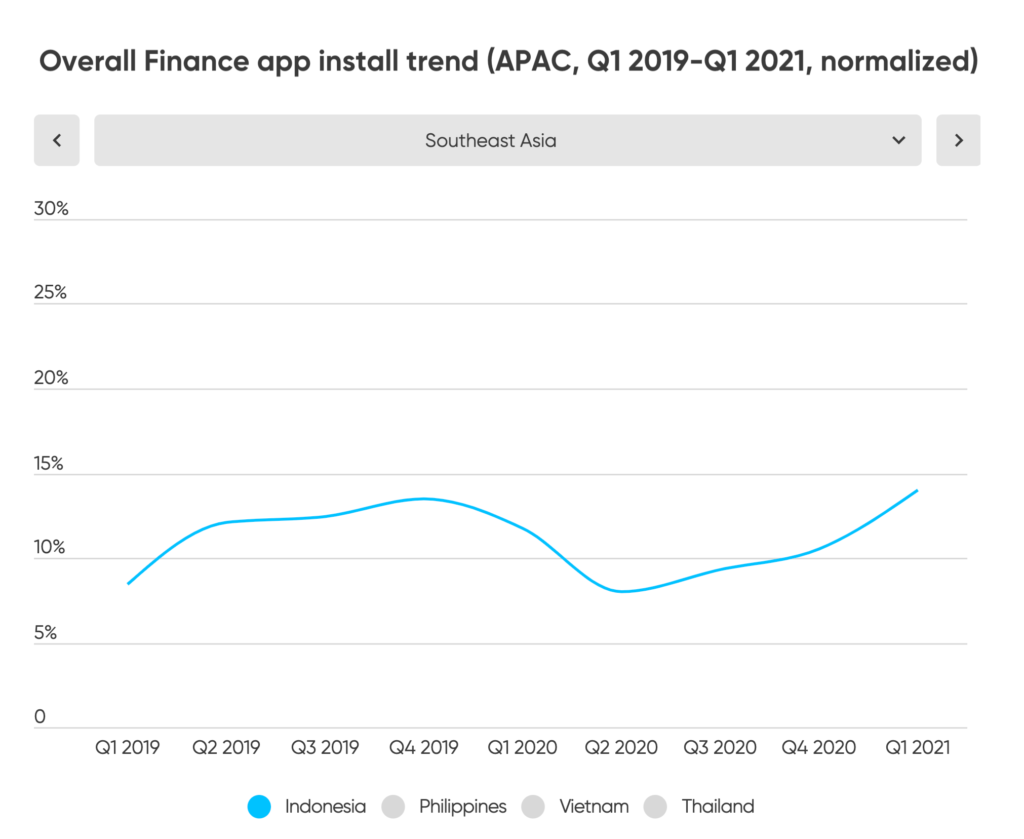

Even though global demand has declined over time, lockdown First, due to declining financial activity and increasing uncertainty, the use of financial applications continued to grow in Q2 2020. In Q1 2021, increasing digital acceleration has accelerated the adoption of payment, investment, and banking applications.

Other categories of financial services that are highlighted by AppsFlyer are digital banking applications, traditional banks, financial services, loans, and investments; including trading, crypto, stock market and other instruments. Overall there were 2,7 billion financial app downloads in the Asia Pacific region between Q1 2019 and Q2 2021.

The report also reveals that many financial companies are then stepping up efforts to drive more traffic to apps, using a combination of user acquisition activity and remarketing.

Meanwhile, globally, digital banking application installations increased by almost 45% between Q1 2020 and Q1 2021, and continued to increase during the pandemic. Meanwhile, the installation of traditional banking and financial services applications only increased by 15% in the same period. However, traditional banks picked up speed with a 22% increase in app installs in Q1 2021.

Indonesia and the popularity of financial apps

There are 3 countries experiencing the fastest growth in terms of the use of financial applications. Among them are India as the first ranked country, followed by Brazil and Indonesia which are in the second and third ranks.

From the data collected, the activity of using financial applications had decreased in the Q2 2020 period in Indonesia. It is suspected that there are obstacles in the economic climate due to the pandemic. YoY down by 40%. However, it gradually increased from time to time as market conditions and the economy began to improve.

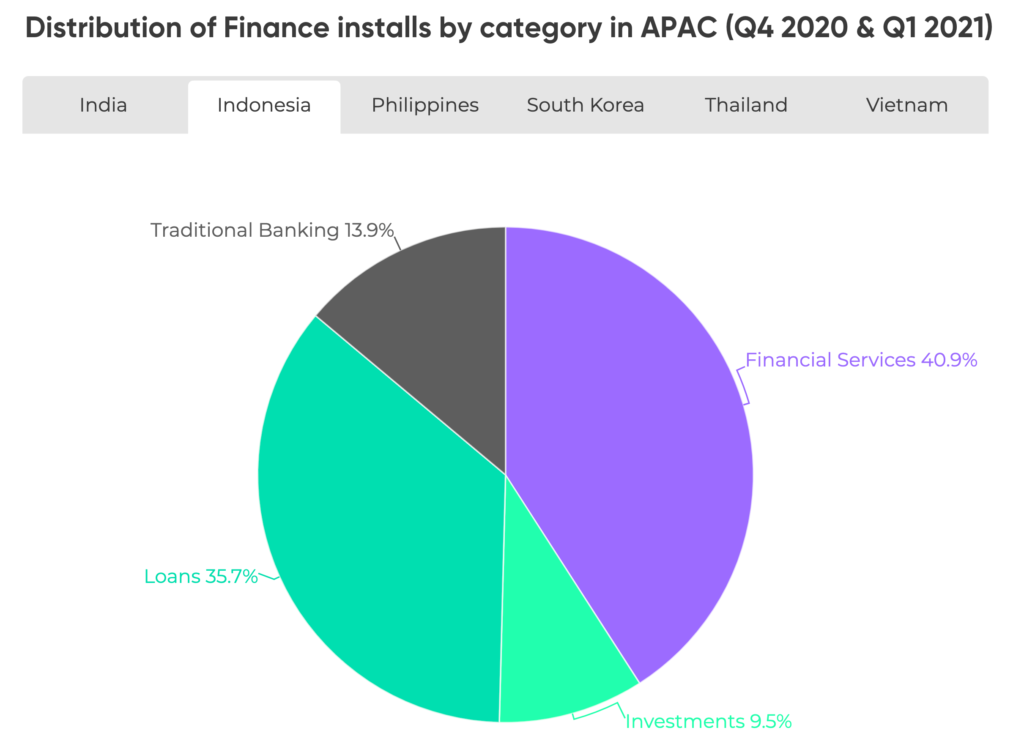

Users generally download the app mobile payment and loan applications. These two broad categories contribute greatly to the total number of downloads.

But overall, the AppsFlyer report divides several categories of financial applications that are downloaded by many users in the country, including applications from traditional banks (13,9%), then financial services (40,9%), loans (35,7%) , and investment (9,5%).

The pandemic is also driving the growth in the number of new users. In Indonesia, growth reaches 20% if you look at conditions in Q1 2020 and Q1 2021.

More Coverage:

"Sector fintech has drastically adapted to various environmental changes and accelerated digital transformation, especially in developing countries, where there are so many people who do not have a bank account and do not have access to banking,” said AppsFlyer's APAC Senior Customer Success Manager Luthfi Anshari.

-

Header Image: Depositphotos.com

Sign up for our

newsletter