Crowdlending Startup Joins Hands to Release Application, Aims for Distribution of 130 Billion Rupiah

Soon to follow applications for GT-Trust borrowers and field partners

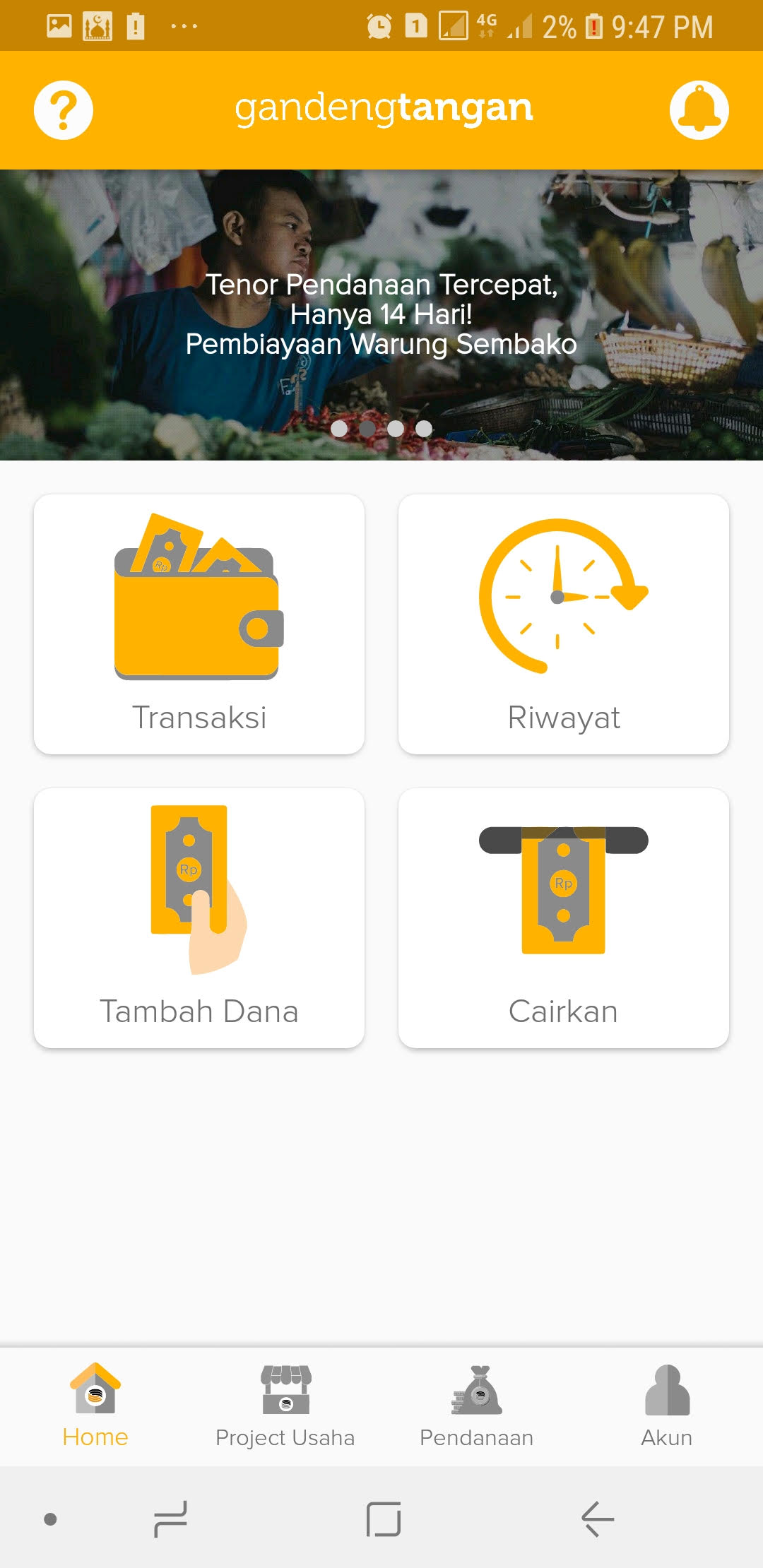

Hand in hand, fintech startup crowdlending, released an app for Android users to celebrate its 4th anniversary. This launch is expected to boost GandengTangan's performance, targeted distribution to reach Rp130 billion from last year's Rp8 billion.

Need to know, crowdlending this is a bit different from p2p loans and through crowdfunding. Crowdlending is the collection of loan funds, while through crowdfunding also fundraising but for donations.

Compared p2p loans, the difference is in the number of funders. If in p2p loans can be a joint venture or alone, while crowdlending always joint.

"After 4 years of relying on the site and hearing a lot of input from users, we created an application to facilitate the wishes of users. We want to offer convenience in investing while creating social impact for micro-entrepreneurs," explained the CEO. HoldHand Jezzie Setiawan to DailySocial.

This application will continue to be strengthened with features that are ready to be developed by the company. One of which is auto-lending to make it easier for investors to invest automatically, and income reports to make it easier for investors to report taxes. Not only that, the company is also preparing applications for GT-Trust field partners and micro-enterprise borrowers.

Jezzie explained that this application will be one of the supporting factors that are ready to boost the distribution target of Rp130 billion. Another strategy is to collaborate with strategic partners, such as traditional distributors, cooperatives, conventional microfinance institutions, and cooperation with regional banks.

Handheld Performance

Cumulatively, the company has disbursed more than Rp8 billion since it first appeared in 2016. If it is elaborated further, for last year alone, the total disbursement was Rp5 billion. That number increased 10 times compared to the previous year. The number of lenders in the company reached 13 thousand people with the majority locations in Jakarta and spread across 12 provinces.

For the number of businesses that have been financed, there are 1.859 businesses, the types of business vary from basic food stalls, street transporters, food traders, farmers, and clothing traders. Jezzie said that his party would widen its reach beyond Java so that the impact on micro-enterprises could be more evenly distributed throughout Indonesia.

In finding and screening borrowers, GandengTangan recruits a field partner called GT-Trust. They are also tasked with providing monthly assistance to borrowers in accounting matters, as well as being "sharing friends" for micro entrepreneurs.

The requirements are that the business must be in the micro category, loan for business (productive), the business has been running for six months, have a bank account, and be willing to participate in the mentoring process with GT-Trust. The nominal financing that can be submitted is a maximum of IDR 10 million, a maximum tenor of 24 weeks (6 months), and interest ranging from 2%-2,5% per month.

Meanwhile, to become a lender, the minimum amount of funds that can be disbursed starts from Rp. 50 thousand and there is no maximum limit. The yield that can be received by lenders is around 12% per year.

The company has been officially registered and supervised by OJK as of early February 2019. Jezzie said the company is currently in the process of discussing external funding. Finally, GandengTangan received a grant from the accelerator program Remake City Jakarta Batch 2 of US$25 thousand.

Sign up for our

newsletter