Grab Complete Fintech Services and Subscription Features "GrabClub"

Most of them are only available in Singapore, other countries will follow

Grab, past Grab Financial Group, further deepen the service fintech as a continuation with various strategic partnership which was announced last year. However, most of these services are only available in Singapore and will continue to other countries where Grab operating, including Indonesia.

Services fintech The latest released is summarized in The roadmap titled "Grow with Grab". Inside is the latest online payment method with "Pay with GrabPay" which is for online store owners. Online sites that have accepted this method are Qoo10 and 11Street, both of which are players E-commerce largest in Singapore and Malaysia.

Next is the integration of "Pay with GrabPay" with the cash register (POS). merchant offline, without having to replace their old device. Coffee Bean & Tea Leaf and Paris Baguette outlets will be premiere.

From the side fintechlending, the result of forming a JV with Credit Saison, Grab now provides "Pay Later" with two functions. First, these services allow consumers to pay for services Grab at the end of the month, at no additional cost. Second, as a virtual credit card that allows consumers to repay goods with a certain tenor and 0% interest.

"These two products will only be provided to users Grab deserving of historical credit. Grab The Financial Group determines credit risk based on a strict set of criteria, including how long it lasts Grab, the frequency of use, and spending patterns," explained the Senior Managing Director Grab Financial Group Reuben Lai in official statement.

Other than that, Grab also serves marketplace microinsurance, JV results with Zhong An. Medical insurance is available for driver-partners and personal accident insurance if partners wish to get more coverage. This service can be accessed directly through the application Grab.

In the future, there will be automotive insurance products with the premium payment concept "Pay-as-you-Drive". Allows driver-partners to only pay for insurance as they drive, as well as micro-life insurance, and critical illness insurance.

Regarding when service fintech This is present in Indonesia, no official statement has been given by the party Grab.

In Indonesia, service fintech Grab still related to the payment system. Application Grab new provide payment option with QR code scanner for Ovo payment in merchantoffline.

Ovo balance connected with Grab, can to pay for all services Grab starting from transportation, food courier, package delivery, and Grocery. Also used for purchasing and paying electricity bills, postpaid, and credit.

Not yet off GrabClub version beta

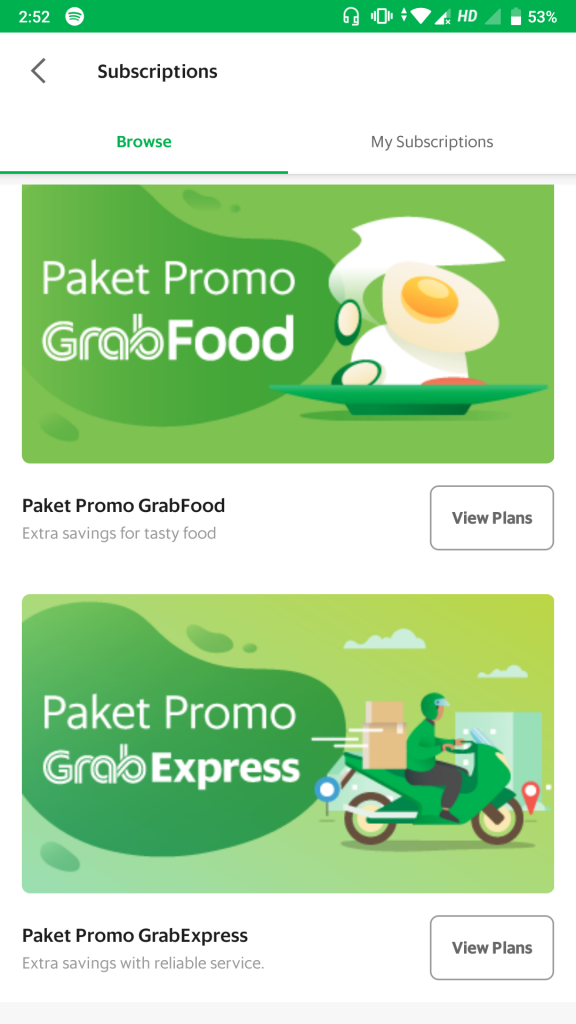

On the one hand, until now Grab have not released the subscription package (previously named "GrabClub") from version beta. In December 2018, DailySocial had reported about the presence of this feature in Indonesia. Then it disappeared and finally reappeared since mid-March 2019.

Spokesman Grab Indonesia said the subscription feature was still in the trial stage. So it is very likely that whentake out only temporary for service improvement.

"The availability of this feature will later be allocated to all users Grab, for that further details will be announced," he explained to DailySocial.

Current subscription features can be found in GrabRewards. Users can choose promo packages GrabFood starts from IDR 75 thousand and IDR 125 thousand to subscribe for a month.

It is explained that this package contains voucher a shopping discount of IDR 35 applies to purchases GrabFood and shipping costs IDR 5. If you choose a package worth IDR 75, users will get discount vouchers for five transactions and 10 times the shipping fee discount.

Then, there is the promo package GrabExpress starting from IDR 40 thousand valid for two weeks. In this package, users get a discount of up to 50% of fees and can be used for up to 20 transactions.

Previous party Grab mention This subscription feature is the company's weapon in fighting price wars with Gojek. This long-term strategy is believed to have a good retention rate in maintaining user loyalty.

Sign up for our

newsletter