Golden Gate Ventures Report on Startup Ecosystem Trends in the Next 10 Years

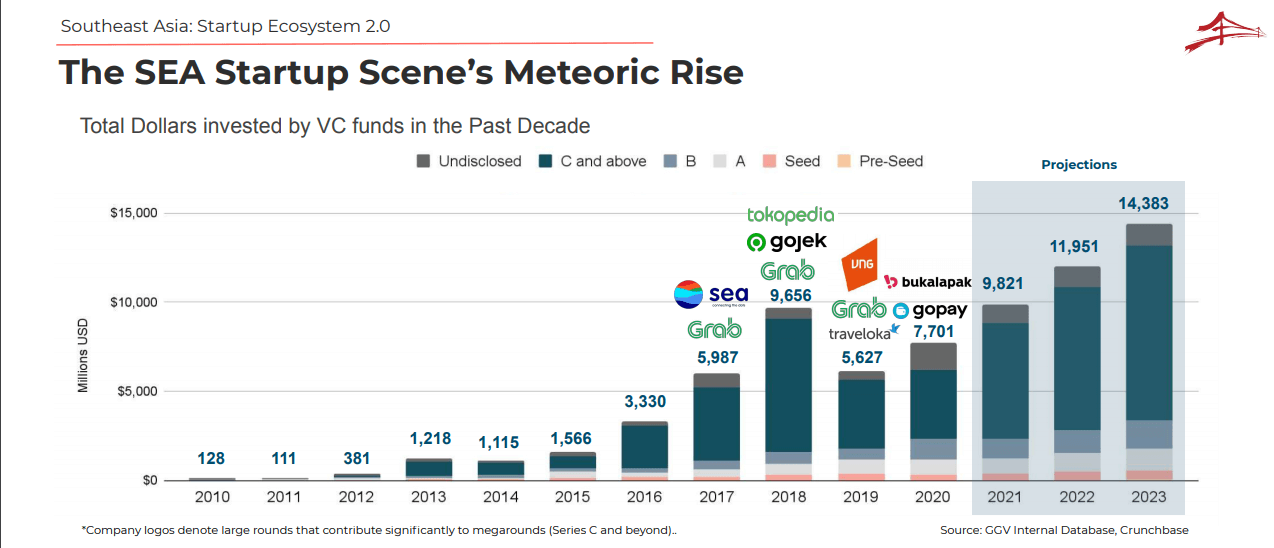

Over the past decade, investment growth in the Southeast Asia region has increased by up to 50 times

Celebrating their 10th Anniversary, Golden Gate Ventures (GGV) launched a report on the startup ecosystem in Southeast Asia. It describes important points about the trend of the startup ecosystem in the last 10 years and their predictions in the next 10 years.

Founded in 2011, GGV has now invested in around 60 startups and launched four initiatives fund. The investment thesis focuses on the growing presence of the consumer class in Southeast Asia. In Indonesia their portfolio includes Alodokter, BukuWarung, Side, Alami, and GoPlay.

Trends in the startup ecosystem of the last 10 years

In the last decade, startups in the Southeast Asia region have experienced very fast growth. Especially in terms of capital inflows, it is estimated to have increased by 50x from $130 million in 2010 to $6,5 billion in 2020.

In its report, GGV sees more and more capital coming from the United States. These include Kleiner Perkins, Accel, KKR, Tiger Global and Warburg Pincus. It was also noted that funding came from countries such as China and Japan. Not only are these countries leading large-scale funding, but these countries have also invested heavily in large companies in Southeast Asia.

The venture capitalists who later became leaders include Sequoia, Softbank, Tencent, and Alibaba. The business verticals that have received the most funding over the past 10 years are e-commerce, fintech, to entertainment. Meanwhile, GGV also noted that the fastest growing business verticals were food and logistics.

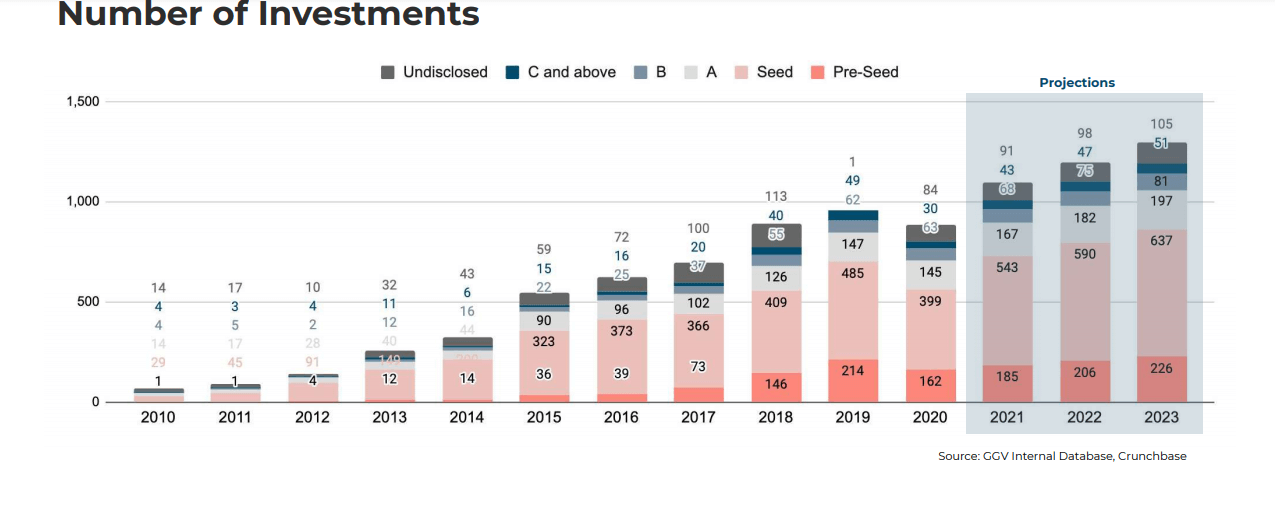

The interesting thing that was also explained by GGV is that expansion in various stages of funding is getting more and more mature in line with the growing interest of regional and global investors for SEA. The series A funding round became the funding stage that experienced the fastest growth. Meanwhile for funding later stages (series C and above) experienced the highest jump (worth 100x) given the absence of such a spin in the previous decade. For funding early stage and the initial funding round has grown in number by 30x.

Another interesting point that GGV also presented in its report is the increasing number of attendance Corporate Venture Capital (CVC) in South East Asia. There were only a handful of CVCs recorded in 2010, which are usually branches of businesses established in family businesses, telecommunications companies, or great app. Currently, there are more than 50 CVCs recorded.

In 2020, several CVCs were involved in approximately 8,7% of all VC transactions and had led a number of funding rounds, particularly in the seed and series A. In Indonesia, several CVCs that are quite active in investing include MDI Ventures and Prasetia Dwidharma.

Indonesia has also surpassed Singapore to become the country with the highest concentration of startups with the best capital. On average, Indonesian startups have closed relatively larger funding rounds. Singapore recorded the largest share of VC capital in 2010 (90%) but their share shrank to 40% in 2020.

Another interesting report presented by GGV is that Indonesia has become a market need for around 75% unicorn in Southeast Asia, and is claimed to be the most successful market for investing in the Southeast Asian region.

Trends in the startup ecosystem for the next 10 years

In its report, GGV also conveys a number of trends in the startup ecosystem in the next 10 years. Among them is the increasing presence of social commerce. Its GMV is predicted to exceed $5 billion by 2025 and $25 billion by 2030 as it continues to increase in adoption E-commerce, mixed with GDP per capita growth over the next decade.

In addition, other sectors that are also predicted to experience growth are: healthtech. In this case it is a platform that provides access to healthcare for a larger demographic, and improves infrastructure in Southeast Asia, especially after the pandemic.

Another prediction that was later presented by GGV was the increasing number of IPO activities in Southeast Asia, which is expected to exceed 300 IPOs by 2030, as more local startups seek potential exit in the domestic public market.

Meanwhile, for Indonesia and Malaysia, it is estimated that there will be more market growth for platforms that target Muslims. The market size of Indonesia and Malaysia will grow about 8x from its current size by 2030, including the Muslim lifestyle/halal economy in various industries such as fashion, food and finance.

Another trend that was also discussed was that startups targeting media and entertainment will gain a stronger following and funding, as the industry begins to shift its focus to digital solutions, including TV/film, live streaming, and Esports. Funding in this area is predicted to exceed $700 million by 2030.

The large number of unbanked population in Southeast Asia creates huge opportunities that can trigger the growth of unicorn startups specifically for fintech. Potential services that can then be disrupted by fintech platforms include digital wallets, Neobanks, BNPL, and other forms of financing.

More Coverage:

Mergers and acquisitions (M&A) activities are also predicted to increase in number in the next 10 years. As companies continue to compete for the top positions in their verticals, there will be more mega-mergers in Southeast Asia.

After Indonesia, which became the most targeted market by venture capitalists in the last 10 years, GGV predicts that within the next 10 years, Vietnam will become the country of choice for investors in Southeast Asia. Vietnam will emerge in 2022 as the premier startup ecosystem in Southeast Asia. This can be seen with the increasing number of venture capitalists who then allocate their funds to invest in startups from Vietnam to date.

Meanwhile, for venture capitalists, it is predicted that within the next 10 years, the Assets Under Management (AUM) will be doubled. AUM has been increasing on a steady track over the last decade and it is estimated that it will exceed $300 billion by 2030.

-

Header Image: Depositphotos.com

Sign up for our

newsletter