Financial Record Application Business Opportunity for Warung

Its long-term mission is to be a fintech service or its supporters

According to data published by BPS, as of 2018 there are around 64,2 million MSME units throughout Indonesia. This large amount becomes a potential market share to work on.

According to investors, from several the interview we did to venture capital in Indonesia, one of their targets is startups that develop solutions to empower MSMEs – usually in the form of SaaS.

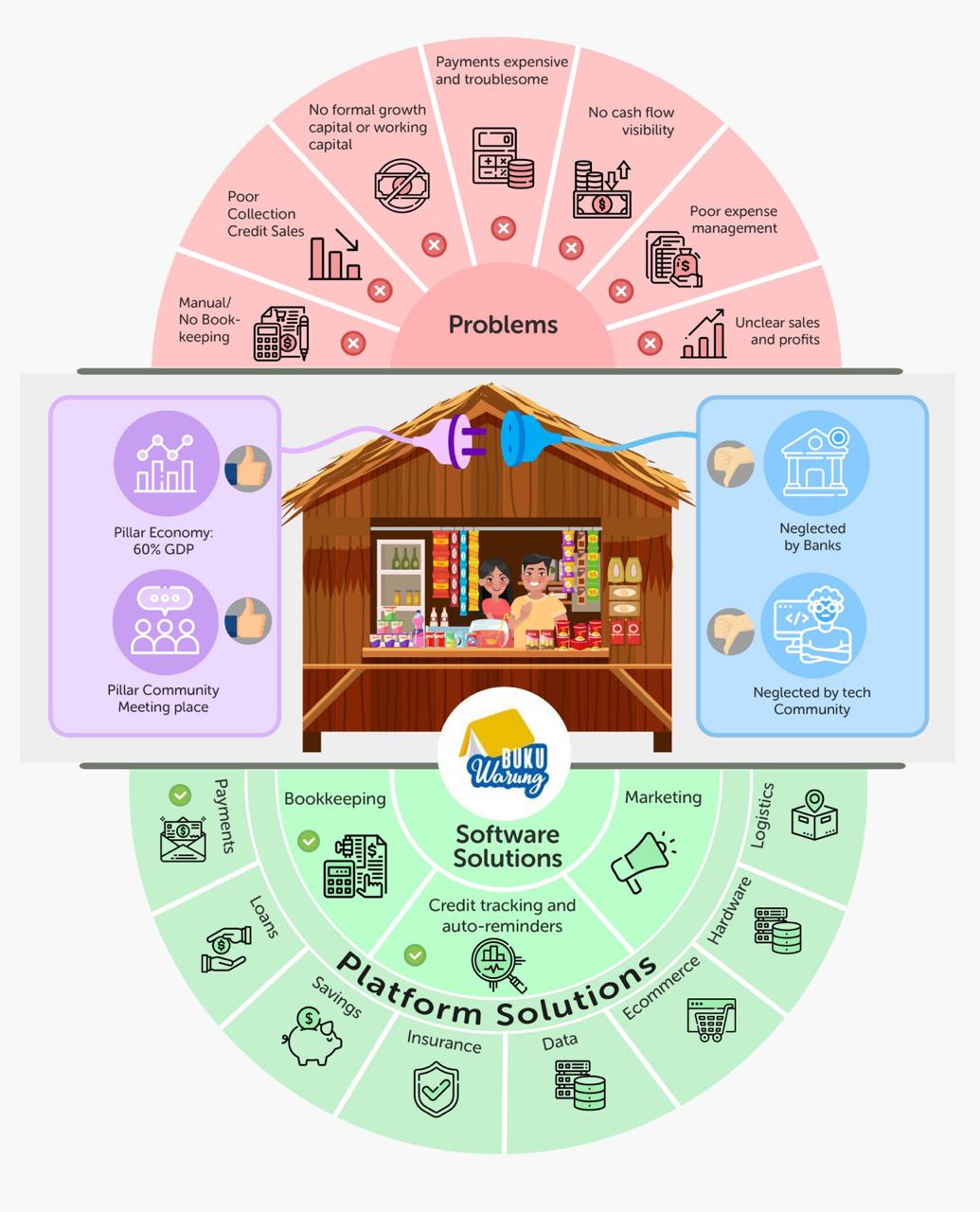

Among the variants of the developed application or service for SMEs, one that is on the rise is a business financial recording solution. The goal is to help small entrepreneurs record incoming and outgoing money. The developers deliberately target micro-small businesses, such as shop owners or grocery stores, under the pretext that most of them still use the manual recording model with books – some don't even do it.

Almost all of these applications are released for free. From our monitoring on Google Play and combined application statistics from App Brain as of 18 November 2020, there are several popular applications in this sector, namely:

| Application | Rating (business category) | Number of Downloads |

| Cash book | 3 | 1 million+ |

| BookStore | 6 | 1 million+ |

| Creditbook | 46 | 100 thousand+ |

| SME Accounting | 84 | 100 thousand+ |

| mood | 121 | 10 thousand+ |

| Labbook | 184 | 1 thousand+ |

| Business friends | 254 | 100 thousand+ |

| my accounting | 309 | 1 thousand+ |

In general, these applications offer almost similar features. Recording cash flow, sales, accounts receivable, and reporting. Some products have an automatic debt collection feature via SMS or WhatsApp.

Market leader

Referring to the table above, there are two applications that have the largest download statistics, namely BukuKas and BookStore. Both were founded in 2019 and this year they are actively raising new funding to accelerate their business.

Based on the latest data, the latest funding for both was in the Pre-Series A round. BukuKas recorded an investment worth 134 billion Rupiah, while BukuWarung only said "eight digit dollars".

| Cash book | BookStore | |

| Seed Investors | Surge, 500 Startups, Credit Saison, and angel investors | East Ventures, AC Ventures, Golden Gate Ventures, Tanglin Venture Partners, and angel investors |

| Pre-Series A Investor | Surge, Credit Saison, Speedinvest, S7V, January Capital, and Cambium Grove Capital, Prasetia Dwidharma | Quona Capital, East Ventures, AC Ventures, Golden Gate Ventures, Tanglin Venture Partners, Partners of DST Global, GMO Venture Partners, Soma Capital, HOF Capital, VentureSouq, and angel investors |

| accelerator | Surge (Sequoia) | And Combinator |

When we contacted him asking about his business model, Founder & CEO Cash book Krishnan Menon said BukuKas' goal was to build a simple software solution to help MSMEs digitalize and bring them into the formal financial ecosystem. They position themselves as an MSME digitalization software company that will develop into a player fintech.

"Right now we have interesting initial experiments on monetization, but it's still too early. It can be done in many ways, some obvious ones like SaaS, financial solutions, and there are some other interesting ones that we can't get into at the moment," he said Krishnan.

He further said, "Traders have realized that go digital very important to their business. Traders save 2-4 hours a day, 20% of costs, and minimize manual calculation errors. We also enable traders to recovering cash is 3x faster because the process is automatic. It also has features for sending invoices, inventory management, etc., making them more organized in running their business."

Meanwhile, BukuWarung Co-Founder Chinmay Chauhan gave a more detailed answer. Both are focusing their business future on fintech. He explained that BukuWarung's business model will revolve around payments, lending, digital savings/banking, insurance and other financial services.

Currently, they are getting initial income from the digital payment feature which was launched 2 months ago. However, because it is still in the initial phase, BukuWarung wants to focus more on building the best payment experience. "We've seen $200 million in annual total payment volume (TPV)."

Chinmay continued, "BukuWarung's vision is to build digital infrastructure for 60 million MSMEs in Indonesia, we have started with bookkeeping and payments. The BukuWarung application is as simple as WhatsApp and merchants can track all their cash and credit transactions, manage cash flow, and see their profits. They can also send free SMS/WA reminders and generate/print invoices serving nearly 2 million merchants so far in just a year since we started.”

Path to fintech

These services have a long-term mission to become players fintech. This goal is quite reasonable. According to data from the Ministry of Cooperatives and SMEs, currently there are approximately 20 million MSMEs that still exist unbankable. The basic factor that makes it difficult for them to access banking services is proof of credit scoring. There is no guarantee that can be analyzed, even though banks generally carry out assessments of income or assets, through proof of bank statements and so on.

BukuKas or BukuWarung at the beginning of its debut focused on helping micro entrepreneurs to record incoming and outgoing money. This data is an important asset to bring business actors closer to financial services, especially credit. Cash flow data can be good analysis material for credit scoring requirements. From existing historical data, analysts can see income-expenditure trends to determine feasibility.

It is not surprising that many investors dare to invest billions of Rupiah in this segment. They see this long-term mission for broader monetization.

Industrial development

The era of BukaKas and BukuWarung could be said to have only emerged around the middle of this year. Free distribution of applications has good implications for the growth of users of related applications. This can be seen from the statistics submitted by each of them founder.

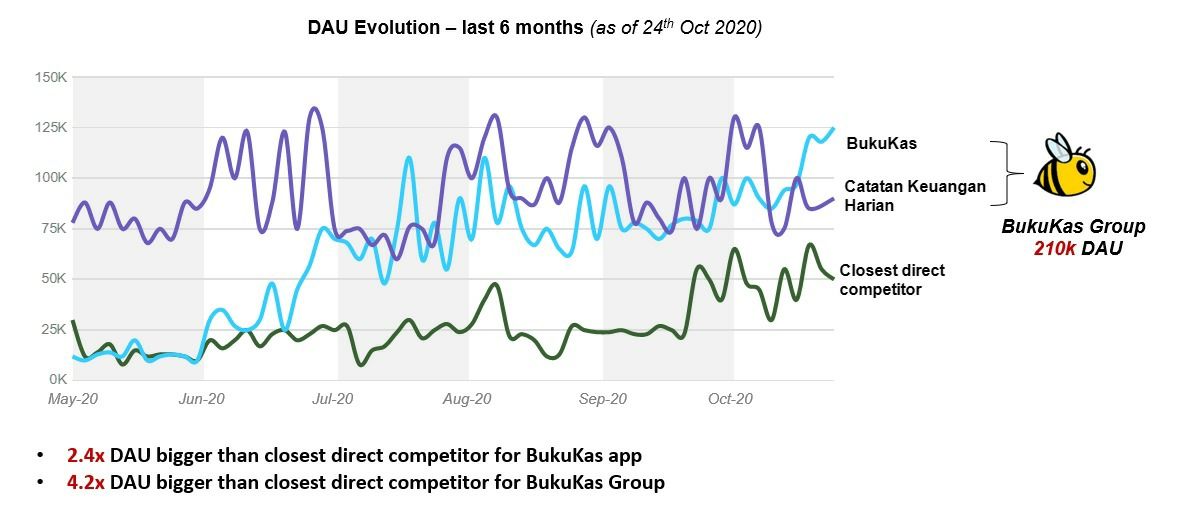

Using matrices daily active users (DAU), calculated from the number of active users who carry out activities on the application every day, the following statistics were conveyed by Krishnan via his personal LinkedIn page:

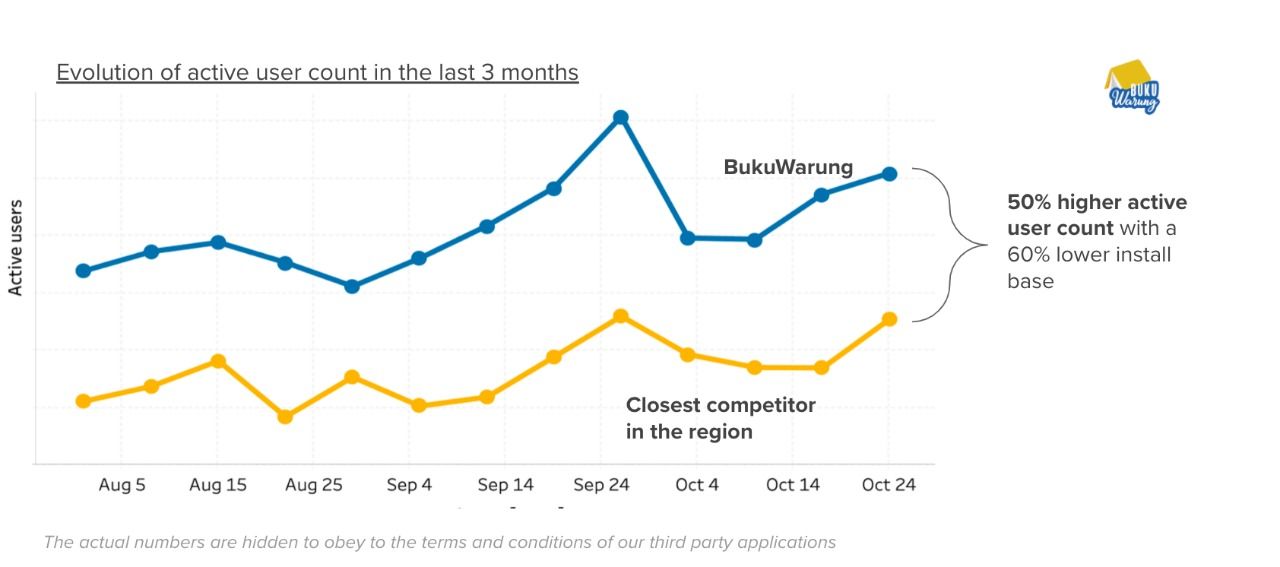

Chinmay also released its app usage statistics for the last few months, with the same matrix. Following are BukuWarung's achievements:

Not all players can target this shop segment. Previously, most MSME financial recording services offered premium features (or freemium) with certain capabilities. In its development, some have shifted their target market to upper-middle businesses and corporations. Model freemium it is still not suitable to be applied to target lower-middle businesses.

Apart from being a platform standalone, financial recording services are often an additional feature on other platforms, such as point-of-sales. Incoming and outgoing money is automatically recorded. The conditions must be-input via the related application.

There are still many aspects that can be presented to micro entrepreneurs in Indonesia. It is believed that in the future there will still be other models appearing.

| Sector | Services |

| SaaS | Finata, Jurnal, Zahir, Paper, Accurate, and others |

| point of sales | Moka, Cashlez, Qasir, iSeller, YouTap, Pawoon, and others |

| Fintech | Warung Tools (Payfazz), GrabKiosk by Kudo |

| Supply Chain | Wahyoo, Ula, Warung Pintar |

| E-commerce | Bukalapak Partners, Tokopedia Partners, Shopee Partners, Blibli Partners, and others |

- Header Image: Depositphotos.com

Sign up for our

newsletter

Premium

Premium