Australian Proptech Digital Classifieds Group Acquires Lamudi Indonesia and the Philippines

Lamudi Indonesia has a network of 30 thousand agents, is trusted by more than 400 developers, and partners with 10 national banks

Digital Classifieds Group (DCG), platform developer classifieds marketplace based in Melbourne, Australia announced its acquisition of assets belonging to Dubizzle (formerly EMPG - Emerging Markets Property Group) in Indonesia and the Philippines, namely Lamudi.co.id and Lamudi.com.ph. This corporate action was allegedly carried out as an effort to aggressively expand the company ahead of its plans go public on the ASX.

Lamudi was founded in 2013. Then Lamudi acquired Dubizzle in 2020, at that time the takeover included platforms operating in Indonesia, the Philippines and Mexico.

The acquisition of the Dubizzle business by DCG actually started at the beginning of this year. Last January, the Bproperty business was first acquired by DCG to take the Bangladesh market seriously.

"Lamudi has created the dominant classification and property transaction platform in two of Asia's most attractive markets: Indonesia and the Philippines. Our vision is to build a group classifieds leading in Southeast Asia, a region with tremendous opportunity, and this acquisition is the catalyst for realizing this vision. "I am very excited to enter these markets and welcome the Lamudi team to the DCG family," said DCG Group CEO Mathew Care.

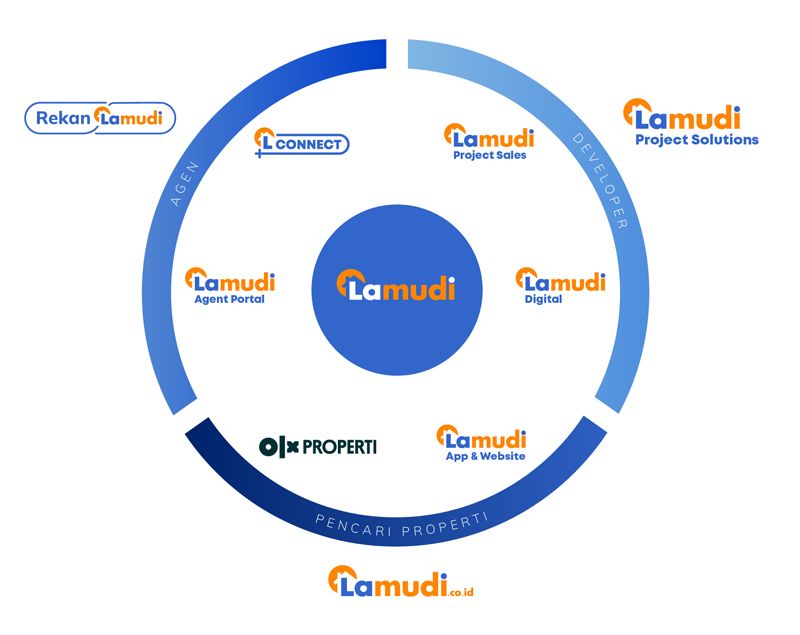

In the last two years, Lamudi Indonesia business claimed to grow from 200 to 900 employees. Lamudi also has a network of more than 30 thousand agents, is trusted by more than 400 developers, and partners with 10 national banks.

Previously, at the beginning of 2022, Lamudi.co.id announced OLX Indonesia property business acquisition. All assets in the OLX Indonesia property channel are fully managed by Lamudi.co.id, as a strategy to dominate the market proptech in the region.

Meanwhile, at the end of 2022, DCG just booked funding from Tanncam Investment Pte. Ltd., company private equity and venture capital from Singapore. In his official release, DCG Group CEO Mathew Care said that this investment comes at the right time, amidst the return of rapid business growth proptech after the pandemic.

Competition proptech in South East Asia

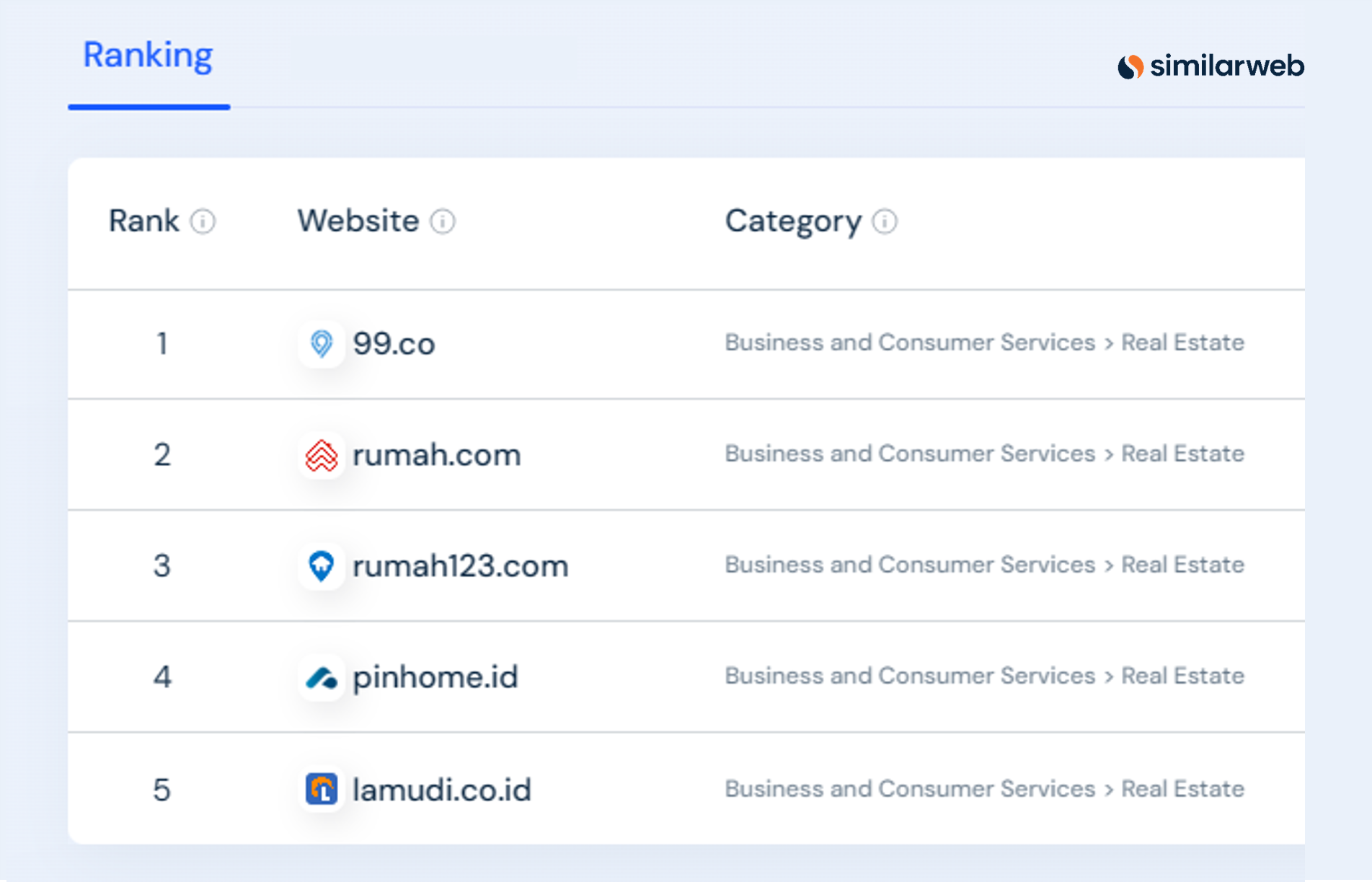

On the regional scene, a number of groups dominate the platform market share listing property. Competition also became more intense when PropertyGuru was acquired by REA Group in 2016. In 2019, REA Group even formed joint venture together with 99.co to jointly operate the iProperty business.

| Company group | Business unit | Investor |

| 99. co | · Singapore: 99.co, SRX.com.sg, iProperty.com.sg · Indonesia: 99.co/id, Rumah123.com | East Ventures, Sequoia, 500 Startups, Quest Ventures, Golden Gate Ventures, Mindowkrs, Allianz |

| Digital Classifieds Group | · Cambodia: realestate.com.kh, Fazwaz · Papua New Guinea: hausples.com.pg, marketmeri.com · Laos. : yula.la, lanloa.la · Fiji: property.com.fj · Bangladesh: Bproperty | Belt Road Capital Management, Tanncam Investment, and a number of investors not publicly disclosed |

| REA Group (PropertyGuru) | · Singapore: PropertyGuru, CommercialGuru, Sendhelper · Malaysia: PropertyGuru, iProperty · Vietnam : Datdongsan, Dothi · Thailand: DDProperty, Thinkofliving · Indonesia: Rumah.com (this year this unit will closed immediately) · REA Group also operates a number of platforms in Australia and North America | IPO with market capitalization: AUD20,91 billion |

On the other hand, Indonesian startups are playing proptech take a more approach hyperlocal, they try to present a more specific digital platform. Recently AMODA received seed funding from East Ventures and Living Lab Ventures, to develop a SaaS service to monitor the construction process. There is also Sumkas which provides digital services to facilitate residential credit (KPR).

Judging from service traffic, pinhome to be one of the local startups that is quite successful in this area. Besides listing curated, they also provide rental, mortgage, agency and business capital services for developer.

More Coverage:

Menurut report Mordor intelligence, The Indonesian property market is expected to grow from $61,22 billion in 2023 to $81,24 billion in 2028, with an average annual growth rate of 5,82% (2023-2028). Support for public housing projects supported by the government, foreign investors and institutions such as the World Bank is expected to increase the growth of the real estate market in Indonesia during this period.

Despite facing challenges such as the post-pandemic economic impact, the stable growing economy and programs such as 'One Million Homes' support the growth of the property sector in Indonesia. The high demand for property due to rapid population growth and high urbanization has made the Indonesian property market one of the strongest sectors in the region.

Sign up for our

newsletter