The Development of a Policy that Underlies Indonesia's Fintech Ecosystem

The fintech rules will be updated soon by adding some technical aspects

The third Financial Literacy National Survey conducted by the Financial Services Authority (OJK) in 2019 showed the financial literacy index reached 38,03% and the financial inclusion index 76,19%. Then when compared to the last three years, there was an 8,33% increase in literacy or public understanding of financial services; and an increase of 8,39% related to public access to financial products and services.

Tirta Segara, a member of the OJK Board of Commissioners for Consumer Education and Protection, admitted that the increase was the result of joint hard work between various parties, including the government, authorities, industry, and other components. Innovation is no exception, especially in the technology sector, the various financial applications that have been launched in the last few years have really had a very pronounced impact on people to carry out various transactions: save, send, and invest their money.

Regarding the digitization of financial services, the role of the authorities is clearly dominant. This industry is strictly regulated. As mandated by Law no. 21 of 2011, the government established the OJK with the aim of regulating and supervising various activities in the financial services sector. So far various types financial technology services(fintech) continue to be accommodated within the scope of OJK regulations.

Starting from

Financial Services Authority Regulation (POJK) no. 77 of 2016 is one of the spearheads of development fintech in Indonesia. This regulation regulates information technology-based money lending and borrowing services. Since its publication, up to now there have been 158 players recorded p2p loans registered with the authority, 33 other players have obtained licensed status. The large number of players entering this sector cannot be separated from the large public interest in obtaining credit alternatives from non-bank institutions.

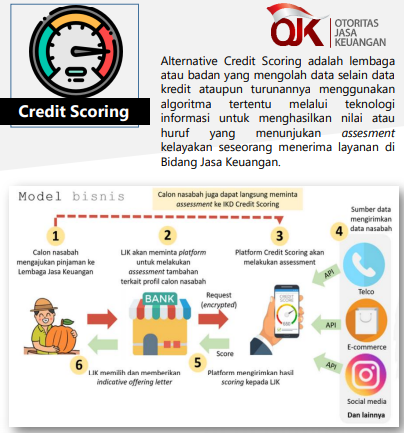

As is known, access to financial services from banking cannot be fully enjoyed by all elements of society. For example, regarding credit, in the banking environment the scoring variables used include aspects that only accommodate certain groups, for example regarding employment, net income, educational status, etc. Meanwhile microloans come from fintech the variables are simpler, for example using electricity bill records, shopping history at E-commerce etc.

Of the 158 players available, the shapes are different. There are those that provide loans to individuals such as UangTeman and KreditPintar, there are those that focus on providing capital loans to shop owners such as AwanTunai, there are those that provide business capital using a group system such as Amartha, there are those that provide loans for purchases at services E-commerce as Akulaku, and much more.

In the relevant POJK , things are clearly regulated. Including the form of business legal entity which implies it must be a limited liability company or cooperative. Then related to business capital, data exchange, data centers, etc. These technical specifications are very necessary, so that registered/licensed players have significant differentiation from illegal players. It cannot be denied that illegal platforms are one of the loopholes in the information technology-based financial system.

Regarding action against illegal players, OJK together with 13 ministries and other state institutions formed Investment Alert Task Force (SWI). From 2018 to October 2020, SWI has stopped 2923 illegal. So far this year 206 illegal players have been suspended. This step is important considering that many groups of people, including SMEs, have been affected by the pandemic. Borrow capital funds from fintech is the option that many choose. So the ecosystem needs to be maintained and monitored closely.

Rules update

Rules regarding the plan will be updated soon. OJK Fintech Licensing and Supervision Director Tris Yulianta said that the update would follow the draft Personal Data Protection Law currently being drafted by the DPR. If we examine it more deeply, the data protection and privacy aspects really deserve to be made urgent in the POJK, because business processes and service operations fintech It is closely related to data collection and management.

Another thing that might be included in the policy update is to encourage platform services to be more comprehensive, not just centralized in Java. Apart from that, several technical components will also be added, for example regarding the use of digital signatures. The OJK is still continuing to communicate with associations and ecosystem actors, in various discussions and opportunities, the regulation is still being finalized.

From a public perspective, it is quite feasible for the authorities to tighten the rules – at least adding requirements for players to obtain registered or licensed status. This is to limit the rate of addition of new players, the number of which is currently very large. Apart from that, strengthening technical aspects related to system security, loan/return/open processes, and service integration also need to be paid attention to to create a better perspective regarding services. fintech.

Open to digital innovation

OJK also released circular letter no. 21 of 2019, specifically accommodates various innovations fintech which keeps popping up (outside lending). It regulates several things, regarding digital financial innovation (IKD) and regulatory sandbox. Regulatory sandbox is a testing mechanism carried out by OJK to assess the reliability of business processes, business models, financial instruments and organizer governance. Meanwhile, IKD is an activity to update business processes, business models and financial instruments that provide new added value in the financial services sector by involving the digital ecosystem.

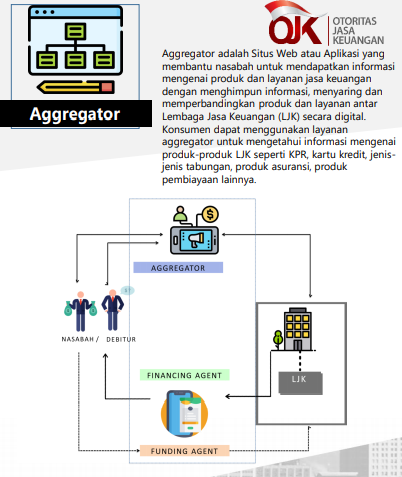

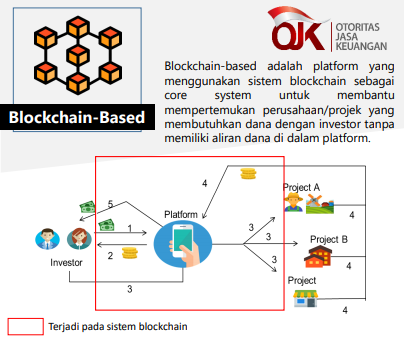

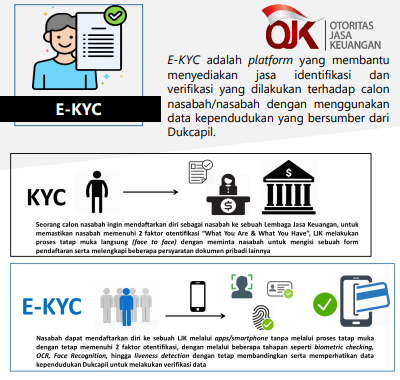

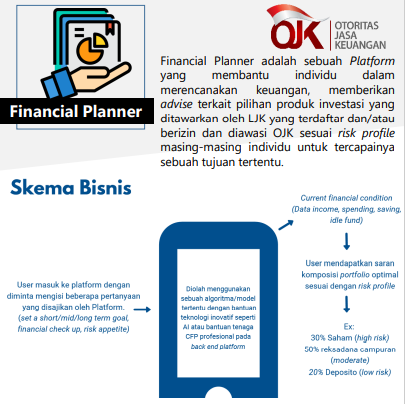

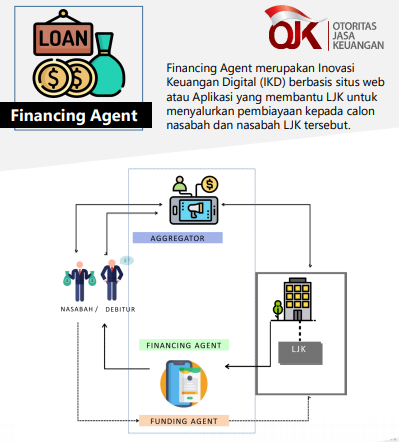

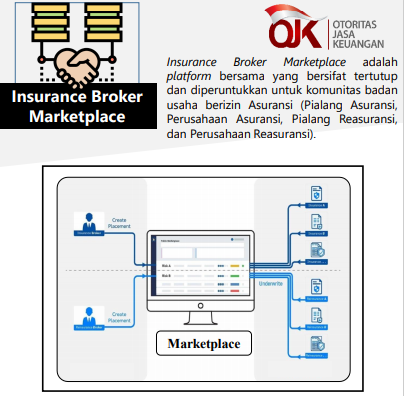

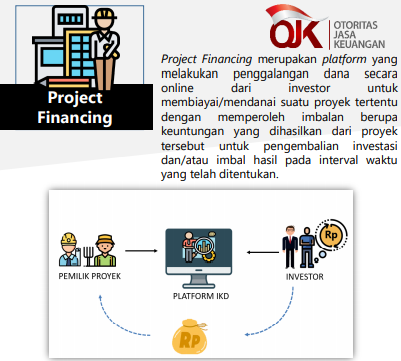

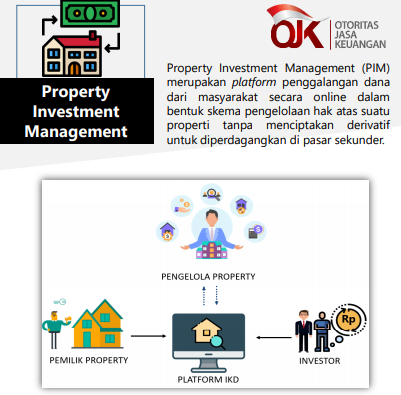

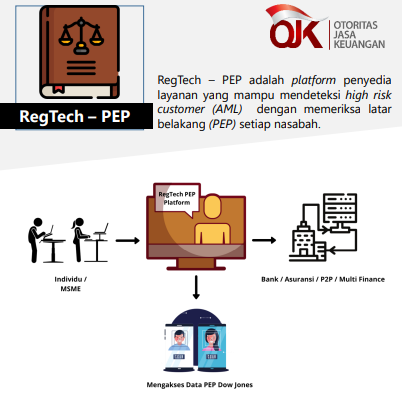

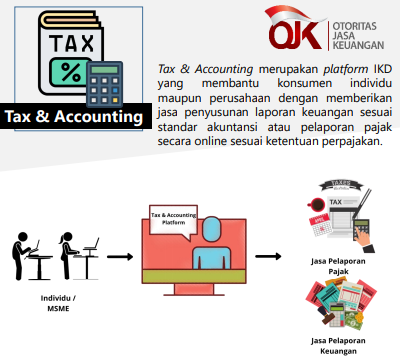

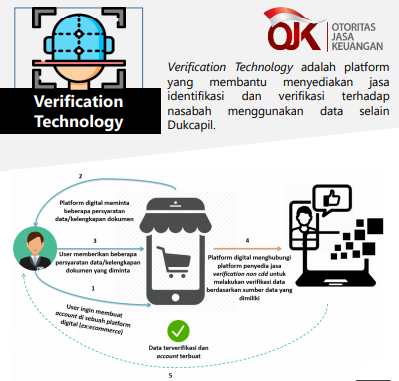

The process includes determining a prototype based on panel forum agreement, followed by evaluation and experimentation activities. The process takes a year at most, or can be added to six months if it is still not enough. So far these regulations have succeeded in embracing digital financial innovation in various clusters, including: aggregator (36 players), blockchain (1), claim service handling (1), credit scoring (13), e-KYC (4), financial planner (7), financing agent (7), funding agent (1), insurance marketplace broker (1), insurtech (2), online distress solution (1), project financing (5), property investment management (2), regtech (1), tax & accounting (3), and non-CDD verification (4).

The birth of new business models is actually also driven by improved services from legacy players. Take e-KYC for example, their platform enables digital players like to easily verify personal data. Or credit scoring which presents a decision-making system algorithm to help ensuring credit worthiness is based on certain data obtained from the user's device. So it is possible that every year IKD's position will continue to increase with other new innovations.

Other players that OJK is starting to embrace are equity crowdfunding. Based on POJK No. 37 of 2018 concerning Crowdfunding Services Through Information Technology-Based Share Offerings. Until this year, only three players have received permits, namely Santara, Bizhare and Crowddana.

Suggestions and input

Despite growing, financial literacy in Indonesia cannot yet be said to be high. There is still a lot of homework that needs to be done together. Actually in POJK fintech, aspects of user education and protection have been touched on in chapter 7. However, there is still a need for emphasis and clear instructions regarding what kind of education organizers must convey to their potential customers. A rule update could be an opportunity to strengthen this aspect.

More Coverage:

Just doubt the convenience provided fintech can be right on target – in the sense of providing real benefits to customers. Without a good understanding of financial services, it is possible for customers to fail fintech will be "stuck" because they don't understand how the system works. Maybe several times we heard about users fintech which borrows from many services to “dig-cover holes”. The educational model is appropriate to minimize this.

The next point is related to collaboration between players – good fintech nor non-fintech. The still large market share, coupled with increasingly tight competition for the business cake, has made players think about synergy strategies. Rules need to be enforced to anticipate bad implications as a preventive measure, for example avoiding monopolies which are not healthy for the ecosystem.

Next is the opportunity to expand services. It is clear that the Indonesian market is still large enough to be exploited, so the intended expansion is still in the domestic arena. Java and other islands have very different conditions, both culturally and infrastructurally. Meanwhile, equality is important to expand financial access. Isn't their main target (unbankable) In fact, there are many outside Java.

From OJK data, currently 147 organizers are still based in Jabodetabek and only 3 players have bases outside Java. Until September 2020, accumulated loan disbursement , as much as IDR 110 trillion, still around Java, while outside Java it is only IDR 18 trillion.

Sign up for our

newsletter

Premium

Premium