CredoLab's "Credit Scoring" Service Takes Advantage of Mobile Metadata

Has obtained regulatory permission from OJK as IKD provider. Planning to complete a Series A fundraiser this year

In article DailySocial As previously mentioned, there are currently more and more banking institutions that rely on the method and quality of credit scores in fintech startups. Banks cannot be as dynamic as fintech startups, but they do not rule out collaborating while still adhering to the principles careful. This can be seen in various collaborations in distributing productive loans to micro-enterprises and being registered as fintech borrowers.

Seeing this potential, more and more fintech startups are offering technology credit scoring, one of which is a Singaporean fintech startup, CredoLab, which has begun to penetrate the Indonesian market. By leveraging mobile device metadata, CredoLab claims to be able to generate digital credit scorecard accurate and relevant.

To DailySocial, Chief Product Officer CredoLab Michele Tucci revealed, by utilizing alternative data sources, the company gives banks and non-banking financial institutions the power to guarantee requests from the public. unbanked and underbanked with high predictability, high accuracy, and full privacy protection real-time.

Founded in 2016 by Peter Barbak (CEO & Co-Founder), Greg Krasnov, and Adrian Chng, CredoLab now has 16 clients spread across 19 countries. In Indonesia CredoLab already has 7 clients.

"Since 2016, Credolab has generated nearly $1 billion in loans issued after analyzing approximately 1 trillion data points across 16 countries. Our clients have seen 20% higher approvals for new bank customers, 15% reduction in bad debts, and a decline of 22 % in fraud rates," said Michele.

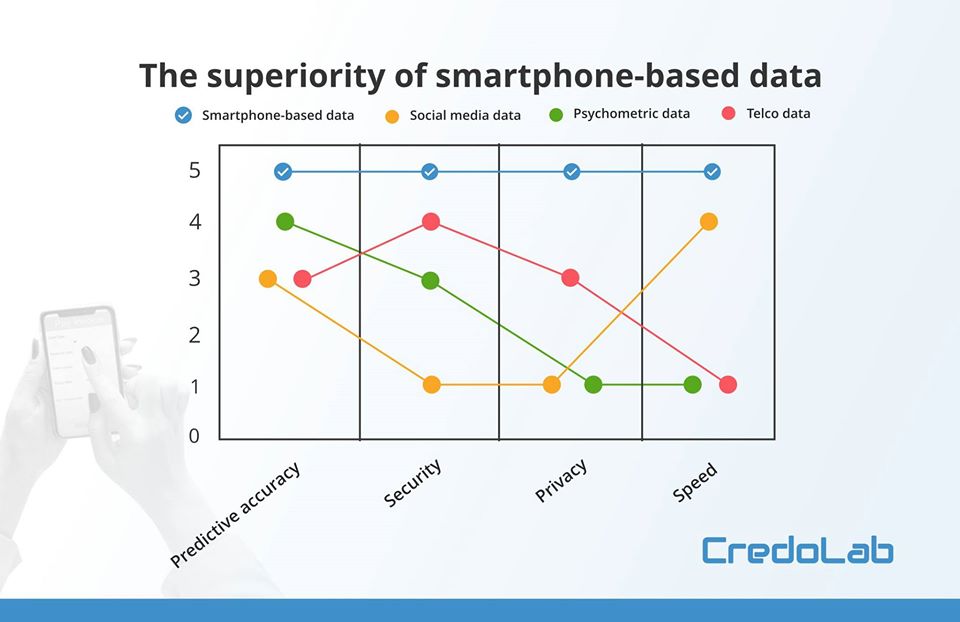

Smartphone-based data

True to its mission, CredoLab tries to help financial institutions make better credit decisions. The company also wants to redefine how banks view creditworthiness by giving them access to mobile device data.

For the business model, CredoLab applies pay per use or pay as you use. Financial institutions may pay a one-time setup fee and then a fee per score requested, depending on the volume generated. Platform setup fee is a one time fee covering SDK integration, development scorecard first digital and fine tuning for the next 12 months.

"CredoLab uses smartphone data to generate behavioral scores for customers that estimate the likelihood of default. By accessing device metadata directly, anonymous, embedded AI technology can power algorithms which are then sent to financial institutions the results in seconds," said Michele.

The CredoScore algorithm is claimed to be able to generate thousands of data points and turn them into more than 1 million features. The result is a score that can be used by banks, consumer finance companies, P2P lenders, auto lenders, insurance companies, and any Fintech or digital wallet player interested in offering unsecured loan products to their users.

Thus, the company not only opens up new customer segments for banks and financial institutions, but also reduces risk costs, processing time, and significantly increases the Gini Coefficient.

Plans after getting permission from OJK

Currently CredoLab has obtained regulatory permission from OJK and claims to be the only IKD provider authorized to access mobile data for credit scoring purposes. The permit obtained has become an achievement in itself for CredoLab in the last three years. In the future, the company will continue to invest in improving technology in accordance with OJK regulations and in line with the increasing demand for consumer loans.

The company also has plans to use a combination of first-party data it has collected from smartphone devices with approved and authorized privacy data from selected partners. The goal is to help financial institutions, insurance companies and retailers reach the right customers, at the right time, and with the right offer.

The company has raised $3,1 million in Pre-Series A funding and intends to close a $3 million Series A round in the first quarter of this year.

"By leveraging CredoLab technology, all Indonesian banking and non-banking financial institutions now have the confidence to include more people in financial services on fair terms, privacy of user data and controlling risk," concluded Michele.

Sign up for our

newsletter