Central Capital Venture Sees Big Opportunity in Embedded Finance

Until 2020 they have distributed around 157,7 billion Rupiah of investment funds to 17 startups; this year added 4 new portfolios

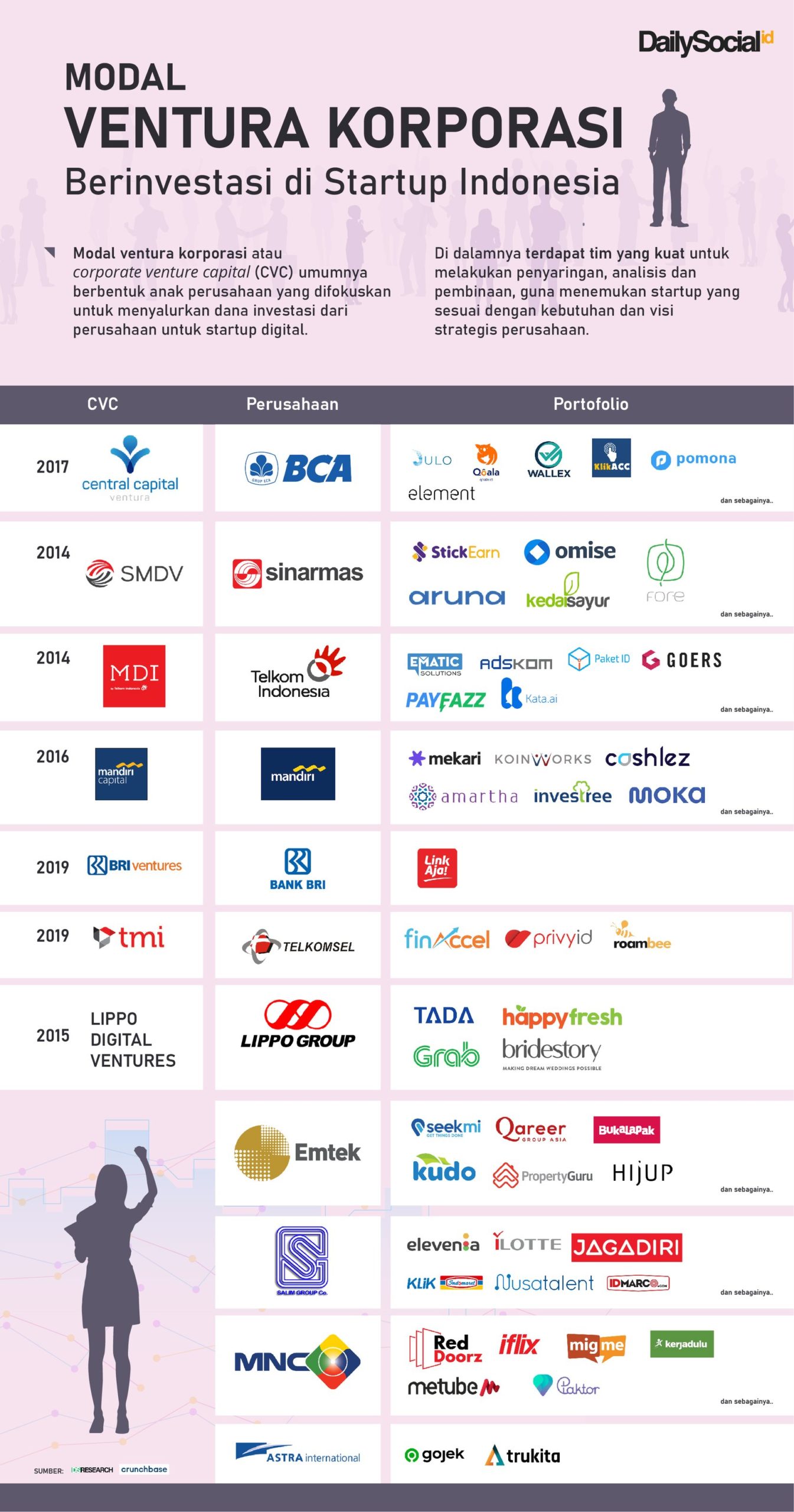

Corporate Venture Capital (CVC) is one of the company's strategies to remain relevant in the midst of today's digital technology developments; as well as being used as a vehicle so that they can synergize with the startup ecosystem that is growing rapidly in Indonesia. Of the several companies that have initiated CVC, Bank Central Asia (BCA) is one of them through PT Central Capital Ventura (CCV).

Since its establishment in 2017, CCV has focused on early-stage funding in business verticals fintech. They have a mission to create collaboration between BCA and its portfolio. "While building our portfolio, we saw opportunities in embedded finance, where you can embed financial services into logistics, healthcare, trade and more. Therefore embedded finance This is a new sector that we are exploring," said CCV Investment Associate Eric Hendrickus.

Developed by fintech, draft embedded finance enable various consumer services to have financial capabilities such as payments, loans, or insurance. They don't need to develop from scratch, they just need to integrate existing services into them backend application.

As is well known, the sector fintech strictly regulated by the authorities, in the process of developing a service it must have a license and meet certain criteria. Using a ready-made service can be a solution so that application developers focus on their main business model -- in addition to developing solutions fintech requires a large investment.

Investment hypothesis

It was also conveyed, until now the funds under management (funds) in CCV only comes from the parent company [99,9%+ shares owned by BCA, the rest is BCA Finance]. Based on the financial report as of 2020, which was submitted in April 2021, cumulatively they have invested Rp. 157,7 billion to 17 startups. Most recently, CCV participated in a developer startup funding round Verihubs e-KYC platform and transfer service Oy! Indonesia.

Then for the criteria set in deciding to invest, in addition to potential synergies with the parent company, CCV usually looks at several variables. "We are always careful whenever we make an investment. There are many variables to be aware of, but the main ones are: great founders, healthy & sustainable business model, growth, and a big market," added Eric.

If you look at the ranks of the CCV portfolio, not all of them are purely playing in the realm fintech. Call it developer game Agate, a B2B startup supply chain leaders Sinbad, the biometric platform Element, and several others. Eric also explained, "Even though the company you mentioned may not be a startup fintech purely, they can play a role in supporting financial services. For example biometrics for KYC, gamification for banking customers, and others. In addition, we like them as a business and see an opportunity to work with BCA."

During the pandemic, he said not much had changed from the CCV investment hypothesis. The difference is, now they are trying to find startups and which sectors will win the market after the pandemic. Throughout 2021, CCV has invested in 4 new startups and made several follow-up investments to its previous portfolio.

"Even before the pandemic, we have been very careful in investing [...] With the pandemic, we are sticking to the same criteria, emphasizing a sustainable business model," explained Eric.

A view of the startup ecosystem

The current Indonesian startup ecosystem is considered by CCV to be successful in proving its resilience. Since 2017 dabbling, they have seen an exponential growth trend. Many new business models emerge, solving specific problems in society. In the next 5 to 10 years, CCV is quite optimistic that the existing growth will not slow down. Due to the fact, the pandemic actually accelerates digitization and encourages the emergence of new startups.

"We've seen a lot of second-generation founders and former employees unicorn start their own company. From an investor perspective, we also see that global investors are increasingly interested in Indonesian startups. Moreover, as the ecosystem matures, there is a way 'exit' through M&A and IPO," explained Eric.

"This growth trend is definitely a good sign for the Indonesian startup ecosystem as we aspire to become a global technology hub," he concluded.

More Coverage:

In addition to investing, CCV is also active in helping its parent company carry out educational programs and startup acceleration through: SYNRGY. Verihubs itself, which was recently invested by CCV, is also a graduate of the program. Beyond that, they also continue to improve their value proposition as a CVC, by opening up networks, connecting and accessing BCA's ecosystem for its portfolios.

Currently, apart from CCV, in Indonesia there are also several other CVCs. Here's the list:

Sign up for our

newsletter