Calculating Startup Valuation and Relation to Traditional Companies

The opinion of Bukalapak's Co-Founder and CFO Fajrin Rasyid about the valuation calculation process in startups

This topic is something that is often asked by various parties. Many say that the valuation of startup companies is "magical". How is it possible for a startup with a huge loss to have such an insane valuation? In this paper I try to describe the things that are usually used in calculating startup valuations, and how they have the same basis as calculating company valuations in general.

What are startups?

Many people define a startup, but one definition that I quite like is a business that tries to solve a problem with a solution that has not been proven successful/scalable. Haven't succeeded or not scalable here it can mean that it has not been used by many parties (early/seed stage) or has started to be used by many parties but not yet sustainable on a business basis (growth stage).

Well early/seed nor growth stagesIn general, these startups have not made a profit. Some of them have earned income but have not yet made a profit.

So why do investors want to fund startups that are still losing money? The answer is future prospects, where investors analyze that the startup will grow in terms of size and revenue so that in the future the startup will become a big company — and profitable.

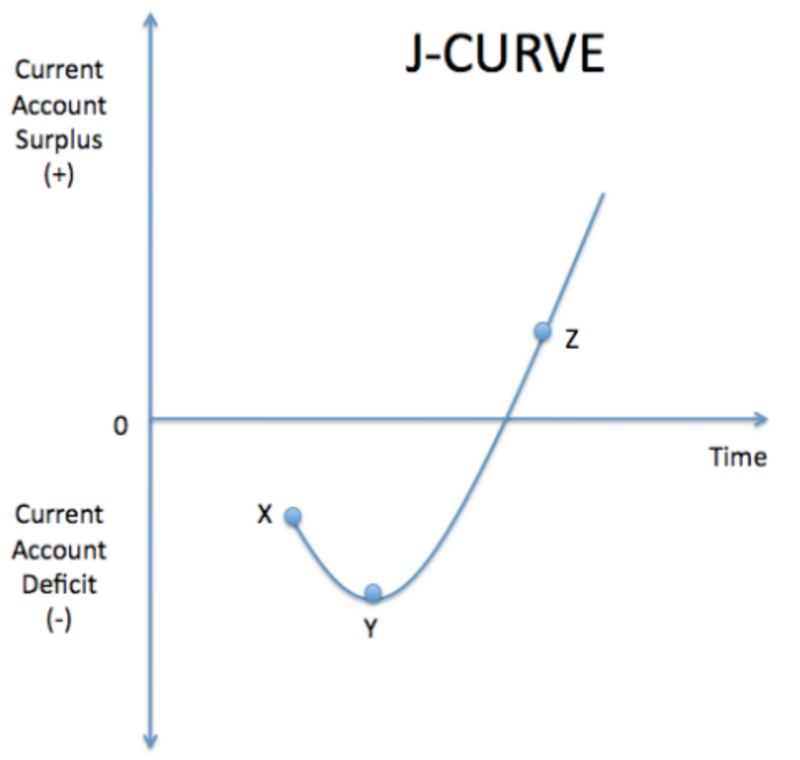

This is illustrated by a graph called a J curve which looks like the one below.

This curve depicts the relative financial/cash position of the company from the starting point before the company was founded. At the beginning (point X), the startup is below zero because the startup spends initial capital to build the company. Next (between point X and point Y), the startup starts running but has not yet generated revenue. Thus, the company's finances will continue to decrease.

In the end, the startup reaches BEP at point Y, so the company's finances don't go down anymore. If after that the startup achieves a profit, then the company's finances will rise from point Y. This point Y can be considered as the actual total investment required by the startup.

If this continues, the company's finances will continue to rise above zero (point Z), and after that, the company's finances will grow exponentially.

Of course, the curve above is an ideal picture. In reality, startup conditions vary. Some have succeeded in reaching the conditions as above, some have failed (unable to rise from point Y). The success of a startup lies in its ability to make a profit (up from point Y) but still grow rapidly in size.

Matrix for calculating startup valuation

Due to the loss condition, it is certainly difficult to measure the company's valuation based on profit/loss (referred to as price earnings ratio or PER). Therefore, Usually investors will judge from the startup's top line, namely Gross Merchandise Value (GMV) or the total value of the transaction.

For example, in an e-commerce startup, GMV indicates the number of transactions through the startup's payment system. Meanwhile, at online transportation startups, GMV signifies the total value of a ride (Laughs) through the startup.

What is the multiplier (multiple) used to calculate the GMV based valuation? This will vary widely based on several factors, including:

- Industry (the bigger the industrial potential, the bigger multiple)

- Growth (the faster the startup grows, the bigger multiple)

Links with traditional companies

So, what is the relationship between startup valuations based on GMV and company valuations in general? The answer lies in the IRR/ROI expected by investors. Even though the startup has not yet made a profit, investors hope that in the future the startup will profit so that it will generate profits return for investors.

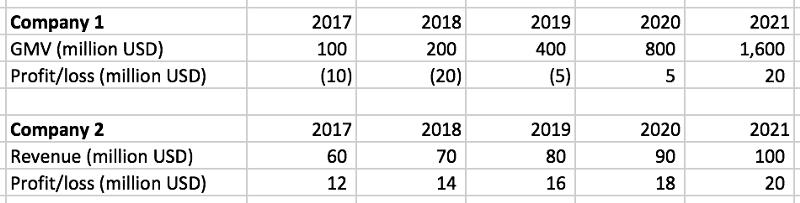

For example, let's look at the table below.

In general, startup growth has a pattern as shown in the table Companies 1. Of course, this is an oversimplification, but at its core, startups have rapid growth, and along with that growth, startups strengthen their business models so that they can ultimately make a profit.

Meanwhile, traditional companies experience a pattern as shown in the table Companies 2. You can see the characteristics of traditional companies that make profits from the start but have growth that is not as fast as startups.

Next, let's assume the two companies are in the same industry and market so we use the same PER, for example 10. Thus, in 2021 these two companies have the same valuation of 20 million * 10 = 200 million dollars.

So, if we use the 10% interest rate and calculate present value, then the valuation of company 1 in 2017 is 136.6 million dollars (calculated from 200/(1+10%)⁴). If we compare it with GMV company 1, then this is more or less equivalent to 1.4x GMV.

This is where we can see that valuing startups from GMV does have a financial basis, not something dreamy or magical, provided that the startup is projected to earn (large) profits in the future.

If the valuation of company 1 in 2017 turns out to be 1x GMV or 100 million dollars, then assuming this projection is achieved, this startup generates an average IRR of 19% (calculated from (200/100)^(1/4)-1) for investors.

Does a startup experiencing rapid growth mean that it will always make a profit in the end? Not necessarily! One of the most phenomenal examples to date is Uber, which is still debated by many whether it will ever make a profit. Until this article was written, Uber was still making a loss, to be precise, it was a loss 645 million dollars. Does this mean Uber failed? Not necessarily, because it is possible that he will benefit in the near future.

The key, as I have stated several times before, is that startups must grow in terms of size and revenue. Startups must be able to show faster revenue growth compared to the startup's top line growth. For example, Facebook was at a loss from its inception until 2008 before finally making a profit since 2009 until now.

Shift of the top line matrix to income or profit

The fact that investors use GMV as a benchmark in making many startups try to pursue GMV in any way, including in a way that seems unreasonable. This includes, for example, subsidizing transactions (so that instead of making a profit from each transaction, the startup actually gains a loss from each transaction). In fact, there are startups that are trying to make fake transactions to increase GMV.

The things mentioned above currently tend to be seen as less sustainable by investors so that apart from looking at GMV, investors also usually ask for other data, such as:

- GMV breakdown (to see the potential for the above fake transactions)

- Income and profit

- Number of new and repeat customers

Although in the end, GMV is usually still used as a measure, but the things above will be taken into consideration for multiples. Two startups with similar GMV, but one with a healthy GMV is more likely to have a higher multiple than another startup with a GMV driven in part by fraudulent transactions.

Eventually, Business valuation is an agreement between the buyer/investor and the seller/business owner, which means that as long as there is an agreement, that is the business valuation concerned..

This is the same as calculating land/house prices — is there a formula to calculate it? There isn't any. The price of the land/house is estimated based on the market price of the land/house in the surrounding location, the condition of the building, and the like. In the end, if there is a transaction, then that is the price of the house/land. This also applies to startup.

- Disclosure: This article was written by the Co-Founder and CFO of Bukalapak, Fajrin Rasyid, and has been republished with the permission of the author. The original article can be seen HERE.

Fajrin can be contacted through the account LinkedIn or Twitter-New.

Sign up for our

newsletter