BRImo's "Digital Banking" Application, How BRI Gets Millennial Customers

Immediately replace the BRI Mobile application. Can register as a new customer via the application

BRI releases application digital banking BRImo to attract new customers from the millennial circle. This product is targeted to deliver the company as a consumer banking at the forefront of Indonesia.

Director of Information Technology and Operations BRI Indra Utoyo explained that so far the company is known as a bank that focuses on the SME segment. However, along with the rapid development of technology, the company must continue to innovate to serve consumers better.

"This year BRI focuses on becoming a the leading consumer banking in Indonesia. BRImo is one of the important strategies in it," Indra told reporters DailySocial.

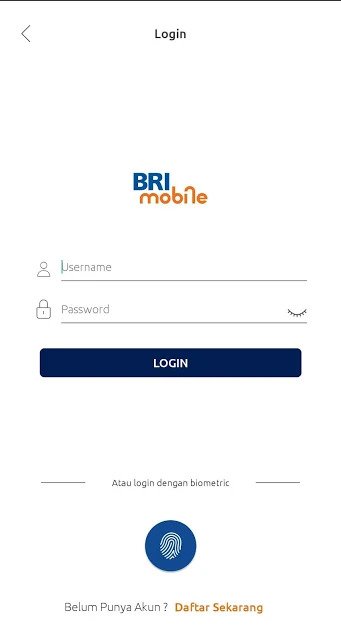

He continued, BRImo was prepared to target the millennial market by providing convenience in digital transactions. This includes the convenience of opening a BRI Britama Muda account, logging in with fingerprint/face recognition, and access promo info.

"Customers can experience banking services that are getting faster, better, and also prioritize banking services user experience customer focused."

BRImo is the latest development of the existing BRI Mobile application. It was stated that there were more than 11 million BRI Mobile users with the number of transactions reaching 575 million last year.

This application combines functions mobile banking, internet banking, and electronic money (Tbank) in one application with a more complete and attractive transaction menu.

Indra said that the company will slowly shift all digital banking transactions from BRI Mobile to BRImo. At the same time, the company will continue to add BRImo features to make it an one-stop mobile banking solution in Indonesia.

"Currently we are still opening access for the old BRI Mobile because there are still many customers who transact there. But, slowly, we will move it to BRImo."

BRImo features

Indra explained that BRImo has various advantages compared to the previous BRI Mobile application. Among them are the convenience of opening a savings account online, logging in to the application using finger print or face ID recognition, use of account aliases and access to bank promos.

To use this product, BRI customers do not need to come to a BRI branch office. Enough login using user ID and password internet banking customer. For non-customers, you can register through the application to get a user ID and password with a Tbank source of funds so that they can transact with BRImo.

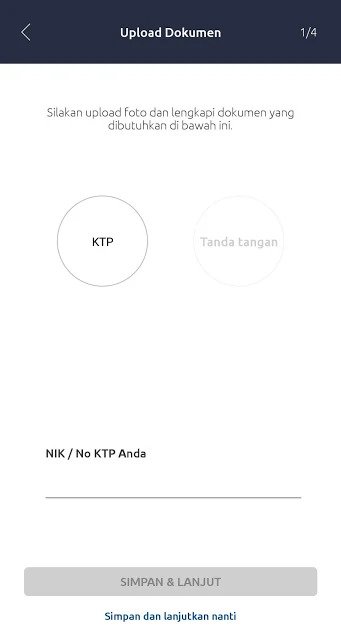

If you want to become a BRI customer, BRImo can accommodate it without the customer having to go to a BRI branch office. The KYC process can be done online, customers need to upload a photo of their ID card, NPWP, digital signature. Then, the customer is asked to record a video of the front, left, and right faces for three seconds.

BRI will verify it within five hours after all data is received. After completion, the customer will be given a virtual number to make an initial deposit to a savings account. If you have made a deposit, the savings account number will automatically be used.

In order to get a physical card, customers simply need to choose the design available in the application and choose the nearest BRI branch office for card collection.

BRImo also accommodates customers who want to withdraw cash at an ATM without a card. Customers simply select the source of the account and the amount they want to withdraw, then enter the BRImo password. Later in the application will be listed a unique code that must be entered into the ATM.

Indra added, for now Tbank is still available at BRImo. When later LinkAja integration When finished, Tbank will soon be disintegrated from BRImo.

Quoted from Cash, BRI has prepared capital expenditures for IT development of IDR 3,7 trillion and digital banking 500 billion this year. The funds are used for infrastructure modernization, cloud, big data, core banking, and related development digital banking.

The presence of BRImo, is the answer to the bank's response to the rapid development of technology. Previously, BTPN was able to come up with Jenius solutions, DBS with Digibank for digital banking solutions. Other banks, assessed by OJK are not yet fully digital, meaning that customers still need to come to the branch office.

In encouraging digital banking innovation, OJK released a regulation regarding this matter contained in POJK No. 12 of 2018. The POJK regulates several services digital banking as video banking and home loan application services to customers.

He also explained that banks can open account opening services independently through ATMs or applications on smartphones. Also added features are fingerprint scanner, identity card scanner, and video banking.

Sign up for our

newsletter