7 Best Online Loan Applications Supervised by OJK

Several loan applications with their respective advantages are safe and reliable because they have been registered with the OJK.

You must have often heard complaints from netizens for being entangled in online loans (pinjol) on social media, right? Borrowing money is not a bad thing because these options each provide benefits, both for the customer and for the lender.

However, in this sophisticated era, you must be careful and careful in conducting financial transactions online. In the midst of booming developments fintech today, we recommend choosing a trusted platform, bank, or application to borrow money.

One of the parameters is that it has been registered and supervised by the Financial Services Authority (OJK). Well, we have summarized the 10 best online loan applications in the form of cash for loans smartphone Android.

Of course, all of these applications have been registered with the OJK. Checkidot!

Akulaku

Akulaku is a digital banking and finance platform that wants to strengthen the financial ecosystem in one application. You can use a money loan service through a cash loan service with two options. The first is a cash loan consisting of Installment Funds and Assetku KTA.

You must have a history of using the app Akulaku good first to use the Cicil Fund service. Meanwhile, for KTA Asetku, you can borrow money with a fast disbursement process. You can adjust the repayment period from credit from 1 to 12 months.

The condition is, you must deposit an account number and personal data such as no. handphone and email for verification. Second, you can use a credit service for purchasing goods such as cellphones, laptops, and the like. In addition to these two services, you can also take advantage Akulaku Paylater.

Akulaku Paylater himself has been registered with OJK under PT Akulaku Finance Indonesia. Akulaku Paylater is a member of the Association of Indonesian Financing Companies (APPI). For the first account registration, you can immediately get a credit balance of IDR 25 million!

Download application Akulaku HERE.

Kredivo

The next application is Kredivo which has also been registered with the OJK. Kredivo is here to provide online loan services with a maximum limit of Rp. 30 million and can be repaid at any time. In fact, you can get 0% interest if you repay the loan within 3 months.

In addition, you can also take advantage of “Buy Now Pay Later” to do online shopping in various merchant who works with Kredivo, such as Tokopedia, Bukalapak, Lazada, Erafone, Tiket.com, Electronic City, IKEA, McDonald's, and many more.

The requirements for applying for a loan are also quite easy, namely a minimum income of IDR 3 million per month, include an ID card and photo of yourself, and a TIN for premium accounts.

Download application Kredivo HERE.

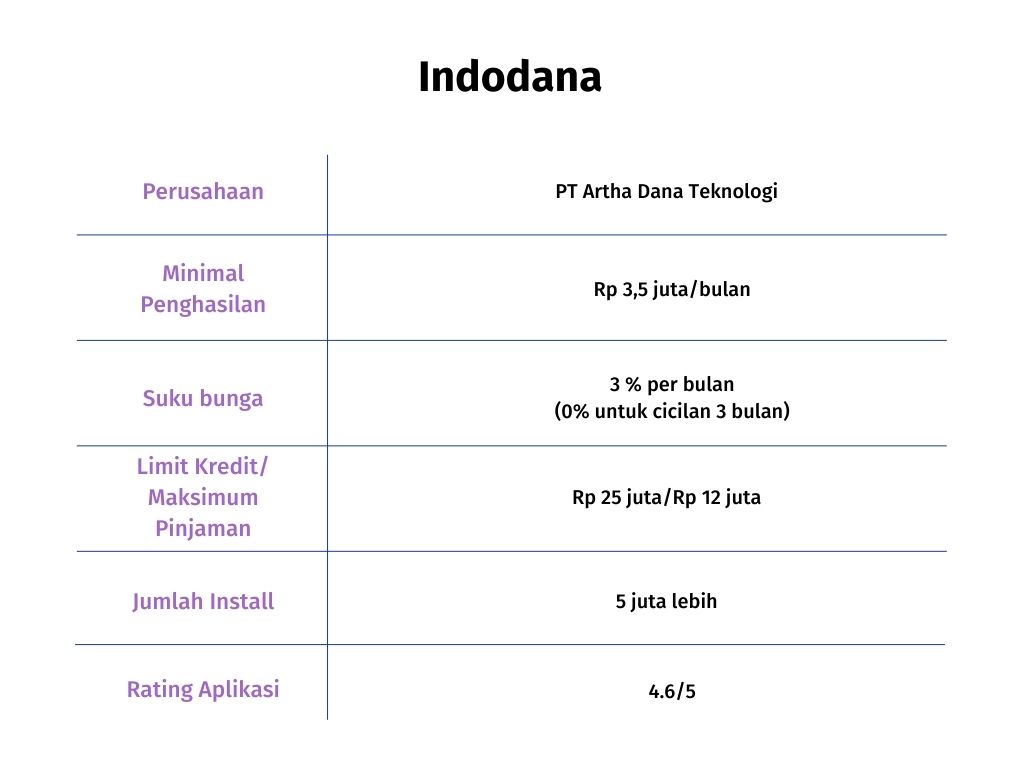

indodan

Established in 2017, Indodana provides cash loan services, installments without a credit card, and paylater. A year later, or to be precise 2018, Indodana was officially registered with the OJK and is currently a member of the Indonesian Joint Funding Fintech Association (AFPI).

Look like Kredivo, Indodana provides installments with 0% interest if you choose a 3-month installment period. Indodana itself also provides freedom of installments of up to 12 months. In addition, you can also make cash loans ranging from Rp. 1 million to Rp. 12 million.

The terms of transaction at Indodana are also easy, a minimum age of 20 years and a maximum of 55 years at the time of payment and domiciled in the Indodana service area. You are also asked to include an ID card, a photo of yourself, have a bank account (especially for cash loans) and go through the income validation process of at least IDR 3,5 million per month.

Download Indodana app HERE.

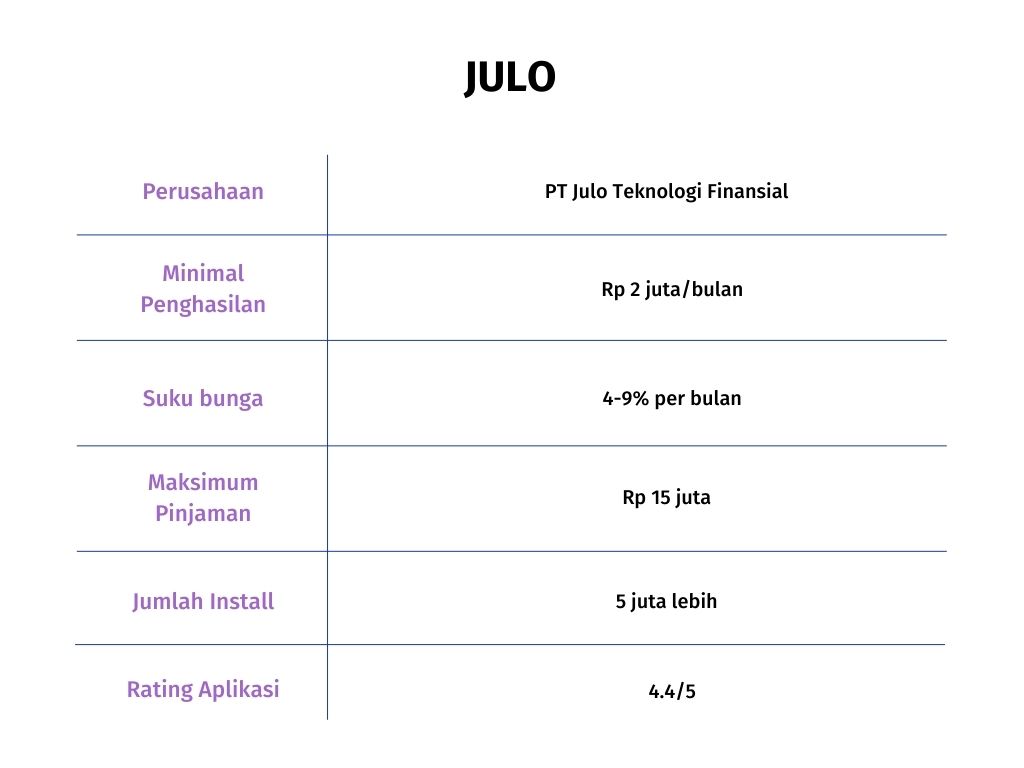

JULO

The JULO application was established one year earlier than Indodana, namely in 2016. JULO offers online loans with an installment period of up to 9 months and a maximum loan fund of Rp. 15 million and a minimum of Rp. 500 thousand.

In addition, JULO has other attractive offers, namely cashback when paying installments to lucky draws every month. Apart from being an online loan application, JULO also provides wallet and digital payment features.

The requirements for applying for an online loan at JULO are 21-60 years old, domiciled in Indonesia, earn a minimum of IDR 2 million per month, and use an Android phone during the transaction.

Download JULO app HERE.

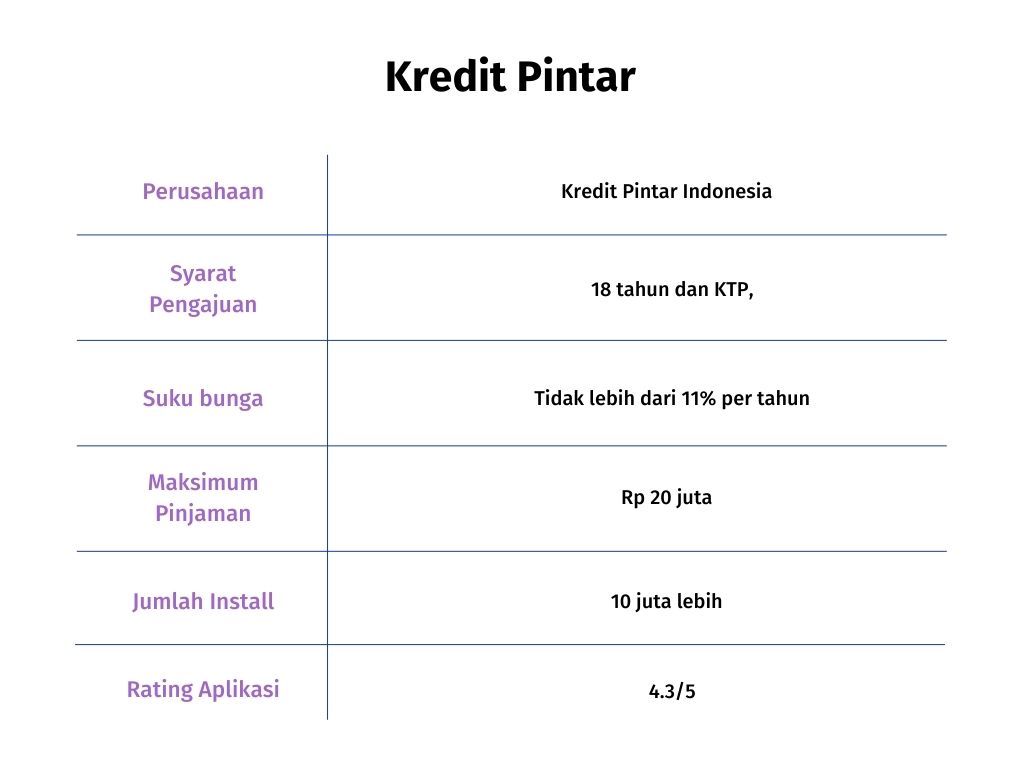

Smart Credit

Similar to Indodana, Kredit Pintar also appeared for the first time in 2017. Kredit Pintar offers online loans with a fairly low annual interest rate, which is no more than 11%. You can borrow cash up to IDR 20 million and pay in installments starting from 91 days to 360 days.

By meeting the minimum requirements of 18 years and over, including an ID card, and entering personal data correctly, you can get loan money in less than 24 hours if you have received approval. Suitable for those of you who need emergency funds with a fast process.

Download Smart Credit app HERE.

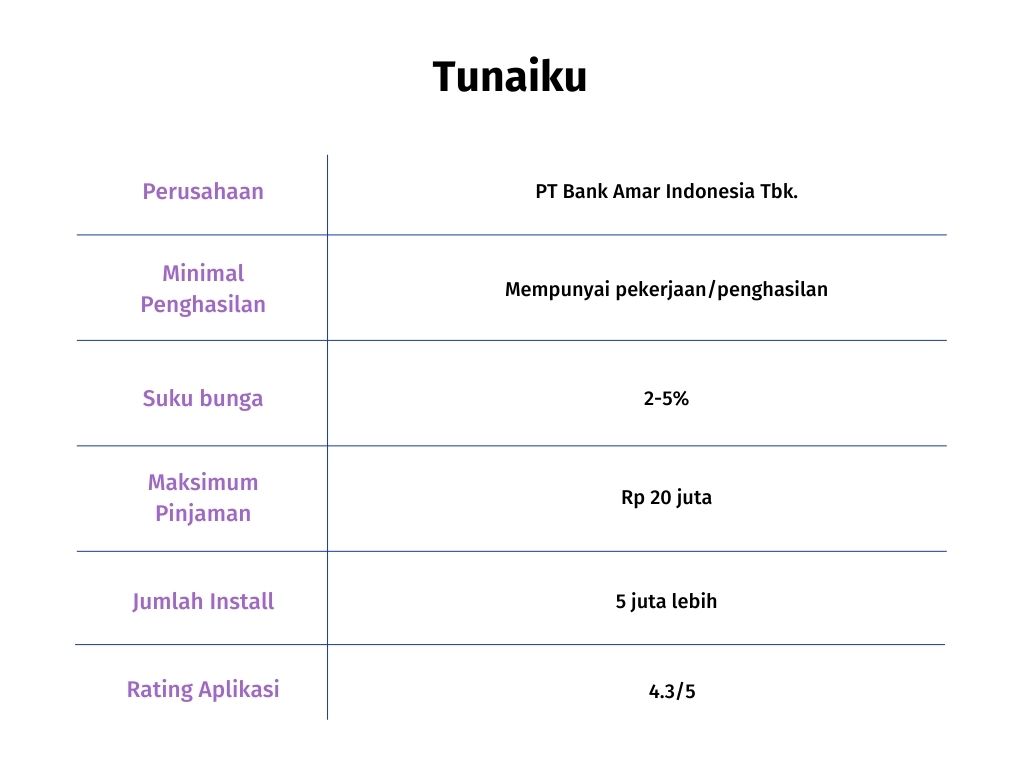

my cash

Founded in 2014, Tunaiku provides online money loan services with installment periods that tend to be longer than its competitors, starting from 6-20 months. You can borrow from IDR 2 million to IDR 20 million with this application.

Disbursement of money loans is fast, namely waiting for approval for up to 24 hours. Then, you just signed a loan contract 1-3 days later. However, if you are late paying the installments, you will be charged a late fee of IDR 150 per month.

To be able to use the Tunaiku service, you must be at least 21-55 years old, an Indonesian citizen, have a bank account, have income, and an ID card address and domicile according to the Tunaiku service.

Download My Cash App HERE.

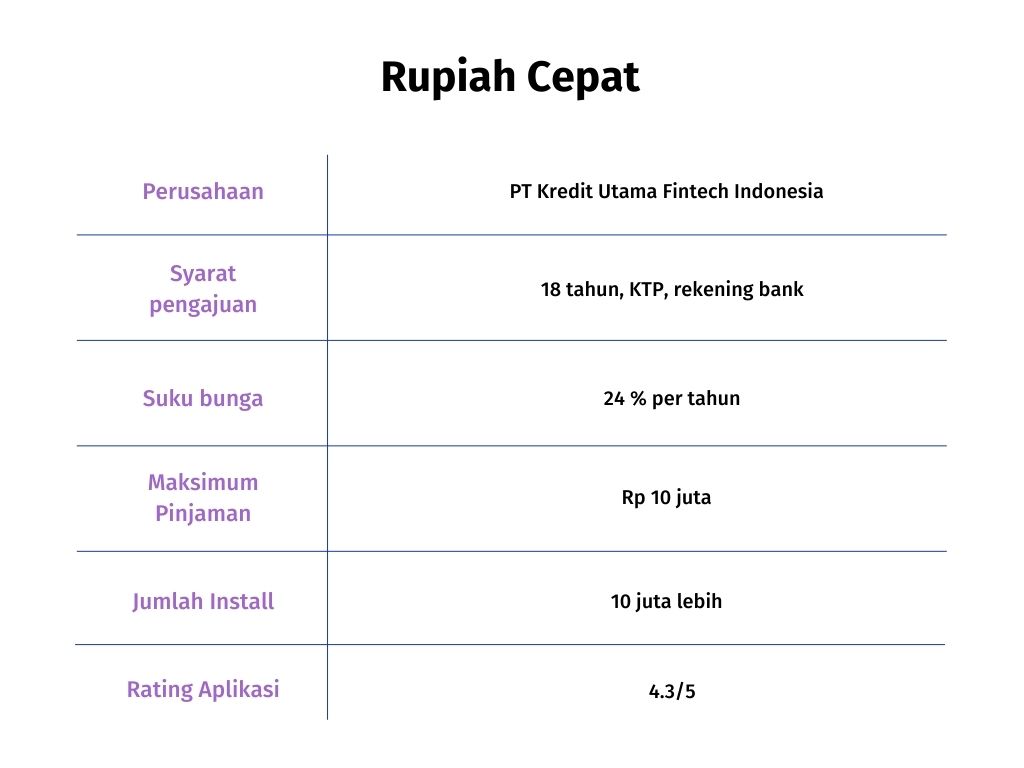

Fast Rupiah

We come to the last application, Rupiah Fast. Besides being registered with the OJK, Rupiah Fast is also a member of the AFPI like Indodana. Rupiah Fast offers installment periods from 91-365 days.

You could say, this application has the easiest money loan application requirements. You only need to meet a minimum age of 18 years, have an ID card and a bank account. However, the amount of money offered tends to be lower than the others, starting from IDR 400 thousand to IDR 10 million.

Download Fast Rupiah app HERE.

Thus 7 applications for online money lenders on smartphone The best Android and supervised by OJK. Remember, be wise in borrowing money! Apply for a loan if there is an important or urgent need that must be met immediately.

Don't borrow money just for fun and prestige because in the end, you also have to return the money you've borrowed. You don't want to end up being chased debt collectors?

Image source headers: iStockPhoto.

Sign up for our

newsletter